Markets | NGI All News Access | NGI The Weekly Gas Market Report

Natural Gas Forward Prices Fueled by Heat, Improving Export Outlook and Lower Production Trajectory

Natural gas traders couldn’t bear the scorching temperatures any longer, as heat indexes surged above 100 degrees across the United States and boosted forward prices for the July 23-29 period, according to NGI’s Forward Look. With the prospect of improving export demand and lower gas production in the months ahead, prices for the winter and beyond netted even stronger gains.

Prices for the August contract, which rolled off the board Wednesday, rose an average 4.0 cents for the six-day period, while the incoming prompt September contract climbed 8.0 cents on average. Winter prices jumped an average 15.0 cents, and the summer 2021 strip tacked on 12.0 cents on average, Forward Look data show.

It was status quo for the majority of U.S. markets, which followed the lead of rather volatile Nymex Henry Hub futures. Faced with an increasingly cooler outlook for early August, futures managed to eke out notable gains for the July 23-29 period as the intense heat currently suffocating much of the country drove power burns to higher-than-expected levels.

The August Nymex contract expired Wednesday at $1.854, up about 7.0 cents on the week and 3.5 cents higher than the July contract’s expiration. However, August still rolled off the board 29.0 cents below year-ago levels.

September stood at $1.930 on Wednesday, while winter 2020-2021 prices were up 15.0 cents on the week to average $2.860. Summer 2021 was up 12.0 cents to $2.64.

The “principal bullish thesis” appears to be a seasonal tightening of spreads as the storage trajectory may not justify the tremendous discount for 2020 contracts, particularly with liquefied natural gas (LNG) anticipated to begin rebounding in the fall, according to EBW Analytics Group. While the odds are in favor of this thesis proving accurate in the medium- to longer term, “it is by no means new,” the firm said.

“Outside of potential producer comments during earnings calls or a sharp rise in Mexican exports, there do not appear to be any bullish catalysts on the horizon for the next several weeks,” said EBW.

[Want to take the pulse of the industry? NGI covers earnings calls every quarter for 120 key companies. Find a list of the companies with links to their earnings reports and NGI’s coverage here.]

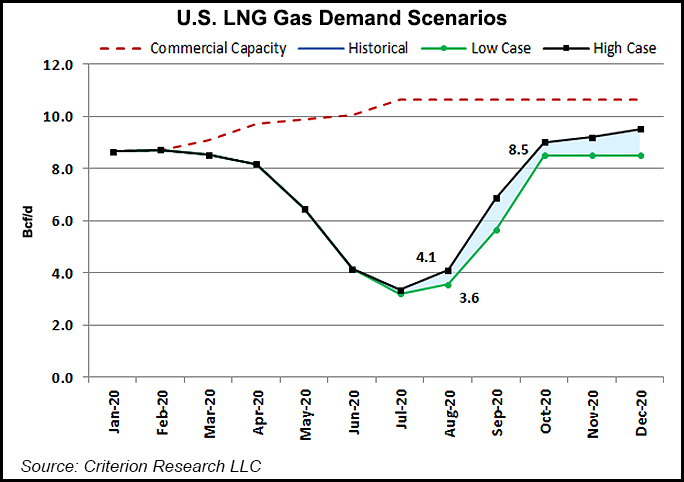

The earliest confirmation of rising LNG is unlikely until at least late August or, more likely, mid-September, according to the firm. However, some indications have pointed to a decline in U.S. LNG cargo cancellations for September, which may signal the worst of LNG demand destruction is in the rearview mirror.

On The Desk’s energy chat room, Enelyst, Criterion Research analyst James Bevan said rumored cargo cancellations were down to less than 30 for September, which compares to more than 50 in July and around 45 in August. Criterion’s low-case LNG demand scenario shows feed gas volumes nearing 6.0 Bcf/d in September and then moving above 8.0 Bcf/d by October, a level at which demand is expected to remain for the rest of 2020. On Thursday, NGI’s LNG Export Tracker showed feed gas volumes at around 3.5 Bcf/d.

In the interim, however, EBW said weakening physical dynamics may propel spot prices downward and tow Nymex futures down along with them. That’s largely because the sweltering conditions currently baking the Lower 48 are set to subside beginning in the next few days. Weather models have grown increasingly cooler since last week, with the latest model runs showing a return to more seasonal levels in the days ahead.

“We do still envision above-normal heat toward the middle of August, but nothing extreme, as the focus of above-normal temperatures looks to be more north versus south,” said Bespoke Weather Services.

The track of newly formed Tropical Storm Isaias also is key, as there could be some impact in the Southeast in a few days. With the storm’s trajectory toward Florida, away from core Gulf of Mexico production, the weather system would likely result in more demand destruction for the region.

“Each storm’s different and requires close monitoring,” said NatGasWeather.

Nevertheless, after an uninspiring storage injection and stable outlooks for cooler weather on the horizon, the September Nymex contract plunged 10.1 cents Thursday to $1.829. October dropped 8.8 cents to $1.991.

Where To Next?

Where prices go from here is still difficult to predict. A rise in Covid-19 cases and a pullback in reopening plans for a number of large cities across the United States threaten gas demand recovery for the rest of the year, and possibly beyond. Meanwhile, increasing cases abroad cloud the outlook for domestic LNG in the coming months, as swelling storage inventories and continued demand weakness would crush any meaningful rebound in U.S. demand for super-chilled fuel.

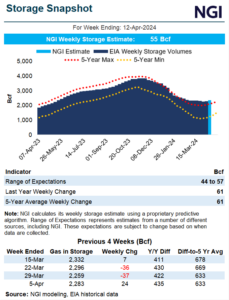

That leaves the storage trajectory on a slippery slope between now and the end of October, with U.S. stocks already trending well ahead of year-ago and five-year average levels. On Thursday, the Energy Information Administration (EIA) said inventories grew by 26 Bcf for the week ending July 24.

The EIA figure, the lowest injection of the summer so far, lifted inventories to 3,241 Bcf, which is 626 Bcf above year-ago levels and 429 Bcf above the five-year average, according to EIA.

Bespoke said the 26 Bcf injection is slightly weaker week/week, “but by no means a ‘game-changer.’”

While the build does point Bespoke’s models over 4.0 Tcf for end-of-season storage levels, the firm would not consider that alone as a bearish force. “We likely continue to see choppy price action, staying inside our prompt-month trading range for the foreseeable future,” Bespoke said.

However, there could be increased volatility once the market nears October, according to EBW. The analysts pointed to storage capacity risks and vast contango spreads as signals for potentially volatile trading. EBW sees the potential for both extreme weakness and extreme strength, with natural gas price moves of potentially 50 cents or more by the fall on the table.

That theory isn’t so far fetched. Mobius Risk Group said after Wednesday’s close, the fourth quarter 2020 strip was up 7.4 cents day/day to $2.504. For reference, the 4Q2020 strip bottomed at $2.164 in late June, and as recently as May 4, topped $2.70.

Weakening Permian

Although the path forward for U.S. gas production generally is expected to decline in the coming months, steady levels of associated gas out of West Texas the past week kept the pressure on regional forward prices.

RBN Energy LLC analyst Jason Ferguson said Permian Basin associated gas is continuing to average around 11.4 Bcf/d, which is comparable to levels seen last week but down around 0.4 Bcf/d from earlier in the month.

Although Ferguson sees Permian production declining to around 11.0 Bcf/d by the end of the year, the current level of output, combined with the lack of strong demand in some downstream markets, sent Waha August prices down 12.0 cents from July 23-29 to reach $1.331, Forward Look data showed.

Meanwhile, a fire at the Lone Star natural gas liquids (NGL) fractionation facility at Mont Belvieu, TX, late Wednesday may leave Permian prices at lower levels for the time being. The facility sources most of its NGLs from the Permian.

At around 4:45 p.m. CT, a contractor at the Mont Belvieu facility east of Houston struck an underground pipeline, according to operator Energy Transfer LP. There were no injuries, and all employees and contractors were safe, said spokesperson Lisa Coleman. No evacuations were needed, and responders from the local fire department and Energy Transfer’s fire team contained the fire.

“There will be an investigation into the cause of this incident,” said Coleman. “Updates will be provided as information becomes available.”

Strong SoCal Demand

There is some upside risk for Permian gas prices, though. Southern California demand has been on the rise, soaring above 2.7 Bcf/d on the Southern California Gas (SoCalGas) system this week for only the fourth time since April.

The National Weather Service is forecasting highs reaching into the 90s through Saturday, and SoCalGas is projecting demand to remain in the 2.5-2.6 Bcf/d range over that time. SoCalGas is currently conducting some maintenance reducing import capacity through its Southern Zone, but this work should remain unimpactful relative to recent flows, said Genscape Inc. analyst Joseph Bernardi.

Meanwhile, average U.S. piped gas exports to Mexico neared 6.4 Bcf/d during the July 20-24 period, yielding the strongest five-day period ever seen in the market, according to Genscape. This stage includes three of the five highest, single-day values so far recorded, with July 21 setting a new maximum of almost 6.6 Bcf/d. As a result, summer-to-date (STD) U.S.-Mexico net border flows are hovering above 5.3 Bcf/d on average, right at the level registered last summer.

“The overall surge in U.S. exports to Mexico indicates that the latter’s demand for gas continues to recover from the disruptions caused in April-May by the Covid-19 pandemic,” said Genscape analyst Ricardo Falcon. “This rekindling coincides with the seasonal drive that typically leads to Mexican gas consumption peaks between June and August every year, especially from power burns.”

Barring downside risks, especially those associated with Mexico’s still uncertain economic growth outlook, power burns still have some room for growth in the coming few weeks, according to Genscape. Both industrial gas consumption and state-owned Pemex utilization also seem to be picking up from the April-May slowdown, with respective summer-to-date averages of 2.5 Bcf/d and 1.7 Bcf/d, Falcon said.

Also weighing on California’s natural gas demand outlook, and therefore the trajectory of Permian gas, is the future of the Aliso Canyon storage facility. The deadline for a critical Aliso Canyon study would likely be extended by an additional 18 months, according to a filing from the California Public Utility Commission (CPUC).

The CPUC issued a proposed decision for its proceeding to determine the feasibility of minimizing or eliminating the use of the SoCalGas storage facility. The proceeding started in February 2017 and initially was expected to end by February 2019. However, the deadline was then pushed back to next month. This proposed decision would extend it again out to February 2022. The CPUC still has to vote to approve this change before it becomes official.

Aliso Canyon is currently limited to a maximum working inventory of 34 Bcf, compared to 86 Bcf before a leak was detected in October 2015, and it can only be used for withdrawals under certain conditions.The potential for lower associated gas production and stronger demand nearing the winter months boded well for the rest of the Waha forward curve. September prices were up 6.0 cents from July 23-29 to reach $1.527, while winter prices jumped 15.0 cents to $2.460, according to Forward Look. The summer 2021 strip was up 11.0 cents to $2.20.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |