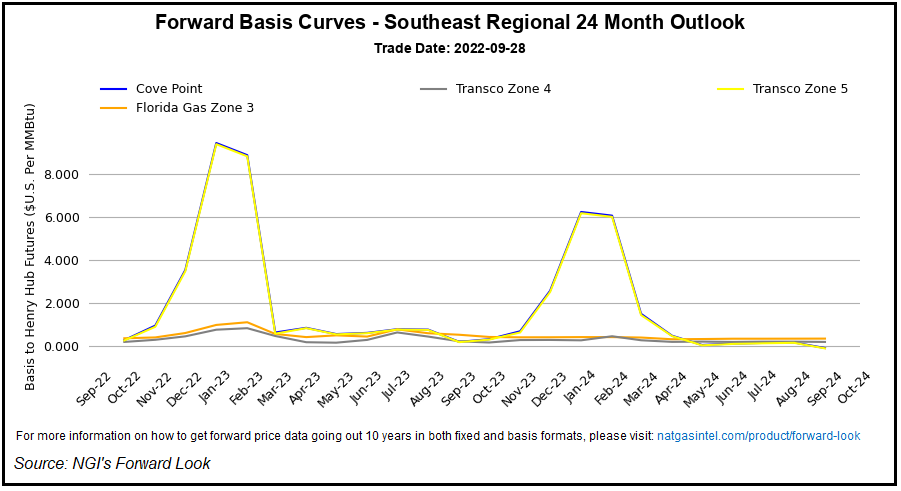

With natural gas production remaining stout – even amid temporary shut-ins ahead of Hurricane Ian – and cooler weather leaving its mark on storage inventories, natural gas forward prices continued to fall during the Sept. 22-28 week, according to NGI’s Forward Look.

In the latter part of the period, all attention was on Florida, where Ian – downgraded to a tropical storm by early Thursday, packed maximum sustained winds around 150 mph when it made landfall on the southwest coast near Cayo Costa Wednesday afternoon.

More than 2.6 million Florida utility customers were without power as of midday Thursday, with more outages possible as the storm continues to move inland.

The National Hurricane Center (NHC) said on the forecast track, Ian would approach the coast of South...