Sponsoring U.S. natural gas projects will be a solid bet for years to come as overseas demand grows, and as the fuel supports the energy transition, according to private equity (PE) investors.

At the Enverus Evolve conference held in mid-May, a panel of PE executives said upstream investments overall are in the money.

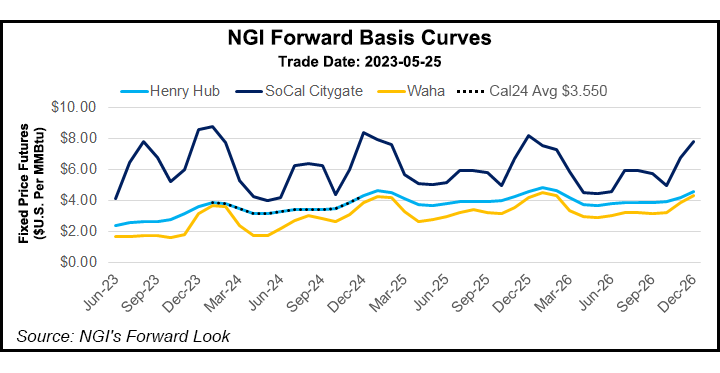

“On the traditional energy economy, I think the natural gas markets are pretty interesting,” Hartree Partners LP’s Anne Cameron, co-head of U.S. Equities, said. “I think in the public arena, people are hesitant to step in because we all know that gas is oversupplied. We all know more rigs need to drop. More spreads need to come off.

“But if you think about the long term, the gas prices you need to fill the LNG exports, the additions, it gets pretty...