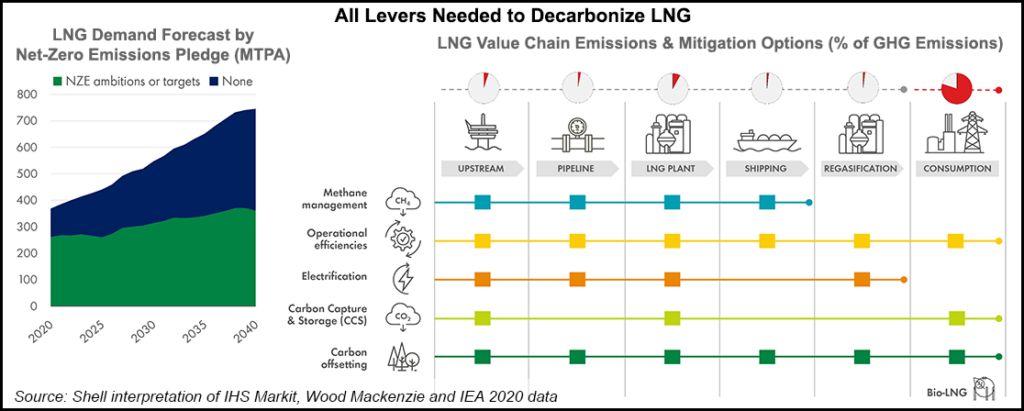

The nascent carbon-neutral liquefied natural gas (LNG) market is set to gain momentum this year as global buyers are increasingly concerned about their emissions footprints.

The market is on track to quadruple this year, according to a recent report from FTI Consulting. The firm has tracked six carbon-neutral cargoes through April, compared to only five during all of 2020.

However, the growth in popularity of carbon-neutral LNG has also brought to light questions about how environmentally friendly the super-chilled fuel could become. Standards vary, making it difficult to determine how much carbon has been mitigated, emitted or offset through trading.

“It’s totally the Wild West out there in terms of verification systems and standards,” FTI’s Madeline Jowdy, senior...