North American natural gas buyers are ready to embrace low-carbon options for their customers, but executives said they are wary about the dearth of regulatory mandates, which could determine which direction to take.

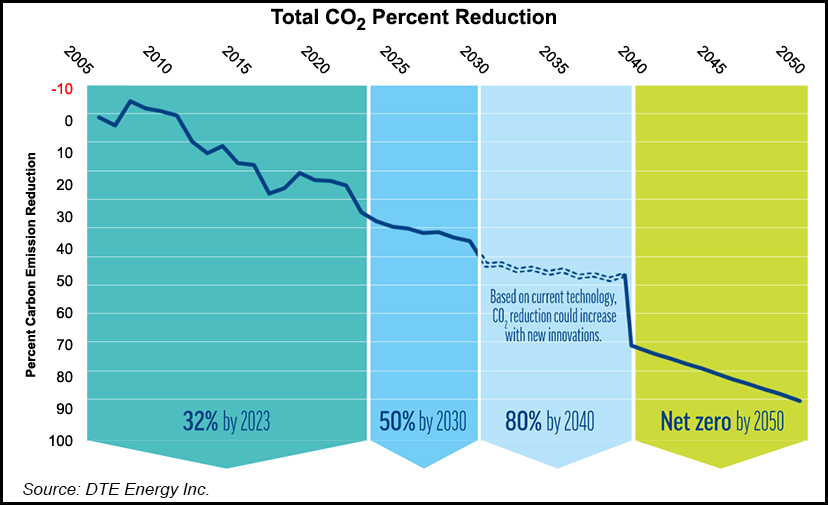

Reducing the carbon footprint is a worthy goal, said DTE Gas Co.’s Eric Schiffer, principal marketing specialist for the DTE Energy Co. unit.

“We want to be net zero by 2050,” he said. “We’re just not sure how to get there…We’re trying to figure that out…”

Schiffer spoke as part of a panel discussion at the LDC Gas Forums Midcontinent conference in Chicago. The gas buyer panel was moderated by Direct Energy’s Drew Slater, regional manager of origination and producer services. Executives from Enbridge Inc., PBF Energy Inc. and Southern Company...