Markets | NGI All News Access | NGI Data

Natural Gas Bulls Fail to Gain Momentum as Outlooks Trend Colder; Spot Gas Mixed

The stars were aligned for natural gas bulls hoping to ride the wave of Tuesday’s gains as weather models continued to trend colder for the late February/early March period. But after hitting an intraday high of $2.689, the Nymex March gas futures contract slid from there, eventually settling Wednesday at $2.636, down 2.6 cents. April fell 2.8 cents to $2.669.

Spot gas prices were mixed as the latest blast of chilly air was set to give way to high pressure that was forecast to rapidly build across the South and East through the weekend, and where conditions are expected to become unseasonably mild over the Ohio Valley and Northeast and even warmer across the Southeast and Mid-Atlantic coast. The NGI Spot Gas National Avg. fell a penny to $3.53.

It was the expected span of mild weather that proved to be too much for futures traders to ignore, especially as overnight forecasts trended slightly colder. The European model had been milder compared to the Global Forecast System (GFS) with the overall pattern in recent days, but it gained four heating degree days (HDD) overnight compared to Tuesday’s data, according to NatGasWeather.

The midday GFS model also trended a little colder with the pattern Feb. 28-March 6, with the ensemble data adding three to four HDDs versus Tuesday night and 10 HDDs compared to midday Tuesday.

“All weather models continue to advertise a mild to warm pattern across the South and East late this week into early next week, then plenty cold/bullish enough Feb. 28-March 6,” NatGasWeather said.

Still, there are signs the coming weeks of cold will soon be coming to an end as the current weather pattern is at risk of breaking down into mid-March, according to Bespoke Weather Services. “…We see trends that are a bit less favorable in the Pacific even with Nino forcing returning, but before any moderation, we will have a solid period of colder weather overall.”

Meanwhile, power burns remain quite tight, production appeared to be off just a touch and Canadian imports were stable as well, according to the firm. While balances are not as tight as last week, Thursday’s Energy Information Administration (EIA) storage report print should be supportive, “and with very significant cold likely Week 2, that is enough to get the front of the strip rallying,” Bespoke chief meteorologist Jacob Meisel said.

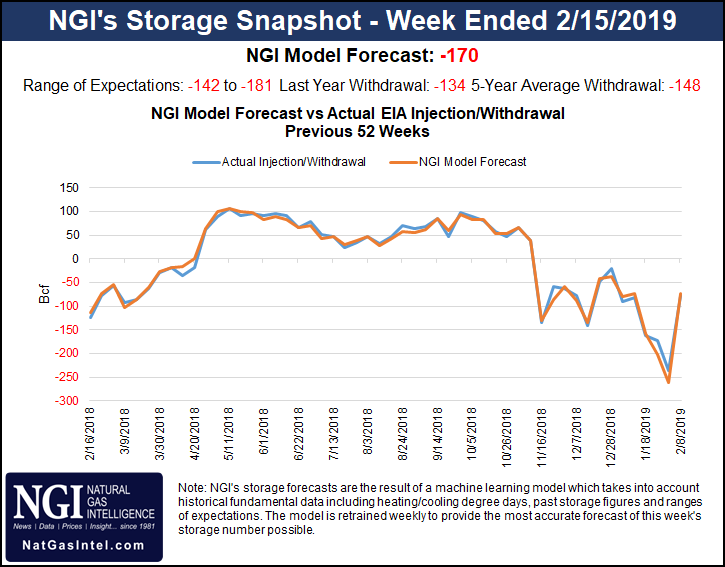

Estimates for this week’s storage report are clustered around a withdrawal near 170 Bcf. Bespoke projected a draw of 172 Bcf, EBW Analytics projected a 166 Bcf pull, and Intercontinental Exchange settled Tuesday at a pull of 170 Bcf. NGI also projected a 170 Bcf draw.

Meanwhile, a Bloomberg survey of 13 market participants had a withdrawal range of 142 Bcf to 181 Bcf, and a median of 169 Bcf.

The estimates compare to last year’s 134 Bcf withdrawal for the similar week and the five-year average pull of 148 Bcf, according to EIA. Last week, the EIA’s reported 78 Bcf draw left inventories at 1,882 Bcf, 30 Bcf below last year and 333 Bcf below the five-year average.

Deficits are expected to increase to more than 400 Bcf off the next two EIA weekly reports, and could increase further if the colder-than-normal U.S. pattern holds Feb. 28-March 6, according to NatGasWeather.

Meanwhile, technical support in the low $2.50s — a critical inflection point — has been reinforced by recent trading behavior and, coupled with bullish forecast shifts, could lead to higher prices during the next week as the March contract is set to roll off the board Feb. 26, EBW said.

The potential continuation of cold into mid-March could further support prices, according to the firm. As important, the Climate Forecast System model suggests the possibility for another 50 gas-heating degree days (80 Bcf) of bullish risk, highlighting the potential for significant revisions and upside price risks.

“Late-winter cold reduces the storage trajectory and increases storage refill demand later in the injection season, sapping expected downward pressure on Nymex futures this April. Our expected end-of-March storage figure has fallen to 1,285 Bcf, and further bullish weather shifts for early March could reduce projected storage further,” EBW CEO Andy Weissman said.

Furthermore, with gas-focused producers largely scaling back output expansion efforts, production growth in 2019 appears less likely to match 2018’s record pace and could maintain a floor under prices. Concho Resources Inc., which focuses on Permian oil prospects, on Wednesday indicated it was slashing spending for 2019 to $2.8-3.0 billion, the midpoint of which is 17% below preliminary capital expenditures of $3.5 billion unveiled in October.

Many other Lower 48 exploration companies focused on oil rather than gas have reduced spending for the year but still expect to see higher production. Despite the pullback in spending by the producers, higher oil production would mean more associated gas.

West Cash Still Volatile

Spot gas prices were mixed Wednesday, although most gains that were seen across the country were rather modest as mild high pressure was set to move into the eastern half of the country. The exception was in the Rockies and California, where market demand is rising again at the same time that the Southern California Gas Co. (SoCalGas) storage and import restrictions continue to strain its system.

After jumping more than $8 Tuesday, SoCal Citygate next-day gas shot up another $3.835 to $22.285 as SoCalGas system-wide sendout has exceeded 3.7 Bcf/d for three days in a row, more than 1 Bcf/d above the winter-to-date average, according to Genscape Inc.

Daytime highs in the Los Angeles basin are running more than 10 degrees below normal, and the chilly weather is expected to last another week. The strong demand prompted SoCalGas to issue another mandatory electric generation curtailment for Wednesday’s gas day — the second in three weeks — that is to continue until further notice.

At the same time, demand across the West Coast remained elevated with below-normal temperatures stretching from Vancouver to Phoenix. This has contributed to market versus market competition with notable basis price gains across the Desert Southwest, and sustained elevated prices in the Pacific Northwest, according to Genscape.

Indeed, Kern Delivery spot gas rose more than 60 cents to $12.36, a more than $9.60 premium to benchmark Henry Hub. Kingsgate climbed more than 80 cents to $8.315, some $5.60 above Henry.

Those same elevated demand levels in neighboring markets have also led to a reduction in California power imports, according to Genscape. “With in-state renewables generation holding relatively steady in recent days, the lower imports have had to be made up for by increased burn among in-state gas-fired power plants,” Genscape natural gas analyst Joe Bernardi said.

Further compounding the price volatility at SoCal Citygate are ongoing restrictions on Aliso Canyon withdrawals and additional constraints on pipeline import capacity. Late Tuesday, El Paso Natural Gas (EPNG) declared a force majeure on its Mojave Pipeline, restricting 220 MMcf/d of Arizona-to-California imports at the Topock Unit 3 compressor station.

The most recent in a series of forces majeure is because of an equipment failure at the beleaguered compressor station. No end date has been provided.

Flows in the month before the failure averaged 390 MMcf/d with Wednesday’s evening cycle nominations of 170 MMcf/d falling far below the 340 MMcf/d restricted operational capacity stated in Mojave’s notice.

“With elevated SoCal Citygate basis above $15 and storage withdrawals being hamstrung by restrictions, this additional constraint could further agitate a volatile SoCal market as cold weather lingers,’ Genscape natural gas analyst Matthew McDowell said.

Interestingly, though, it was also the Rockies and California that saw some of the steepest declines in Wednesday trading. Kern River plunged $1.22 to $8.52, while PG&E Citygate dropped $1.125 to $8.435.

Elsewhere in the country, Northeast prices were down as much as 65.5 cents in New England, while Appalachia losses were capped at less than 30 cents. Most other declines were limited to about a dime or so, as were most gains that were seen.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |