NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Bears Send Futures Down Again With No Heat in Sight; Cash Mostly Higher

Not even stronger power burns were enough to stop the renewed downside momentum in natural gas futures prices, which slipped a few cents at the front of the Nymex curve as weather models chopped even more demand from outlooks. Spot gas prices were mostly higher given pockets of localized heat. The NGI Spot Gas National Avg. climbed 12 cents to $2.055.

While the hottest temperatures of the summer typically arrive in July or August, June so far has been rather disappointing on the weather front as no truly intimidating heat is expected until the final third of the month at the earliest. In the meantime, a weather system with heavy showers was expected to track across Texas and the South the next several days, cooling daytime temperatures by five to 10 degrees and the primary reason national demand was forecast to ease, according to NatGasWeather.

The July Nymex gas futures contract traded in a tight range of only a couple of cents before intense selling near the end of the session pushed prices down to $2.378, a loss of 3.8 cents on the day. Similar declines were seen through November, with smaller losses in contracts further out the curve.

A hot ridge was expected to spring back beginning late this week and into Monday over Texas and the Southwest, returning highs to the mid-90s for a minor bump in national demand, although even that pattern has trended less impressive over time, according to NatGasWeather. The southern United States was forecast to cool in the middle of next week as a strong weather system tracks across the country’s midsection, decreasing coverage of 90-degree temperatures while keeping northern temperatures comfortable in the 60s to 80s.

“There will continue to be bouts of hot conditions across the southern United States through mid-June, especially the Southwest, but where the data isn’t hot enough is across the South and Southeast as weather systems prevent the upper ridge from getting too strong,” NatGasWeather said.

While the weather side continues to be a hindrance toward any rally attempt, the fundamentals side continues to look better, according to Bespoke Weather Services. Production was revised higher on Wednesday, although more than 2 Bcf/d remains off highs. Canadian imports are also up, adding a bit to the supply side.

“The burns are still where the strength is, as they were revised tighter Tuesday, pushing us to the tightest levels we have seen in daily balances since the cold blast in the first third of March,” Bespoke chief meteorologist Brian Lovern said. “Given this notable improvement in balances, we feel confident we would at least be a few cents higher if not for the bearish weather pattern.”

If heat does return in the final third of June, it should be enough to propel the market higher, as long as balances can hold firm as the market transitions to the cool period next week. “We wouldn’t rule out a dip back to lows, but we should find support there,” Lovern said.

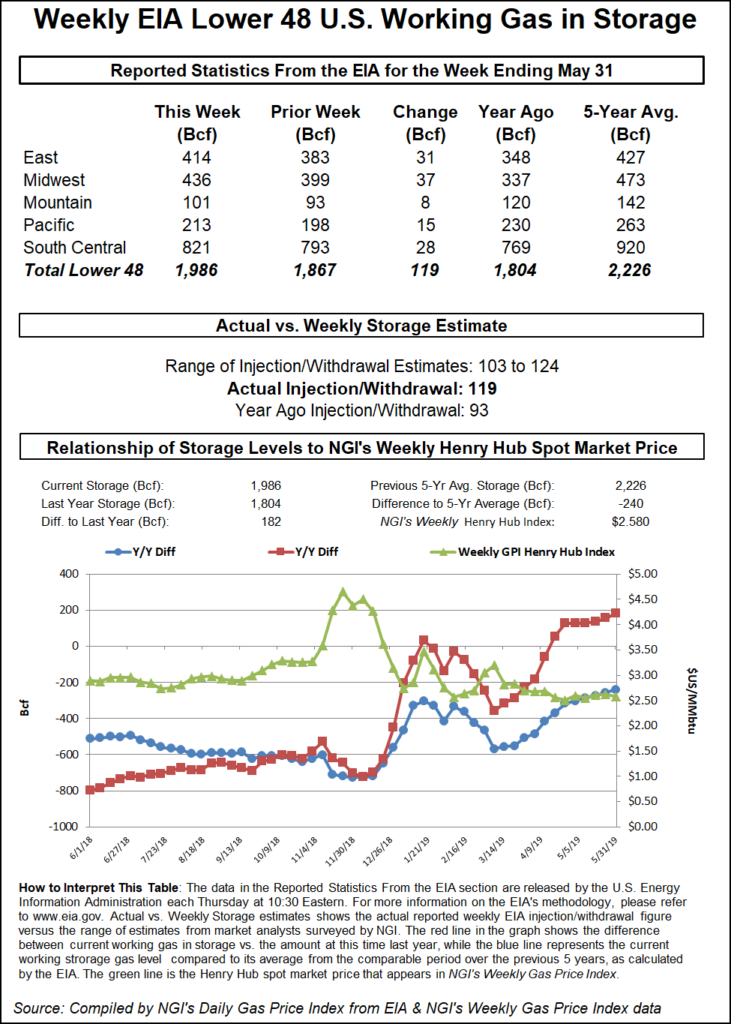

However, price action on Thursdays is always a wildcard as the market receives the latest storage inventory data from the Energy Information Administration (EIA). Last week, the EIA shocked with a storage injection that was at least 10 Bcf above even the highest projection.

For this week, a Bloomberg survey of 16 analysts showed injections ranging from 103 Bcf to 121 Bcf, with a median of 109 Bcf. A Reuters poll of 19 analysts had a range reflecting a build between 104 Bcf and 124 Bcf, with a median of 109 Bcf. Intercontinental Exchange settled Wednesday at a 110 Bcf injection. NGI projected a 111 Bcf build.

Last year, the EIA reported a 93 Bcf injection for the similar week, while the five-year average stands at 102 Bcf.

Given the “monster” injection expected Thursday, and mild weather expected for most of June, there’s little reason for futures to rally strongly in the near term, according to EBW Analytics. However, “at this early stage in the air conditioning season, when a hot summer scenario is still possible, the market has little appetite for pushing the price of the summer-month contracts lower,” EBW said.

Spot gas prices across the country were mostly higher Wednesday even as numerous weather systems were forecast to track across the country with showers and thunderstorms over the coming week. One system was tracking across Texas and the South on Wednesday with modest cooling.

Away from this system across the southern United States, it was expected to be very warm to hot, with highs in the upper 80s to 100s, hottest over the Southwest, according to NatGasWeather. In the northern half of the country, including Chicago to New York City, high temperatures were forecast to be comfortable in the 70s and 80s, although with showers and cooling into the Northwest with highs of 60s mid-week, the firm said.

With much of the heat on tap for this week out West, cash prices were strongest there. Gains were seen ranging from 20-30 cents, with Northwest S. of Green River soaring 30.5 cents to $1.675.

On the pipeline front, Kern River Gas Transmission declared a force majeure that will cut operational capacity through the Goodsprings compressor to around 1.8 Bcf/d. While this does not present an immediate risk to flows, which have averaged 1.5 Bcf/d so far this month, it does present moderate risk should downstream demand spike, according to Genscape Inc.

Effective June 4-12, the pipeline operator cited mechanical damage to a turbine at the Goodsprings compressor, Southwest of Las Vegas, NV. Kern River does not anticipate any restrictions to firm or secondary nominations at this time.

“However, it is worth noting that June flows through Goodsprings can swing by as much as 250 MMcf/d on a daily basis, and above-normal temperatures are forecast for downstream demand markets in Southern California and the Desert Southwest next week,” Genscape analyst Matthew McDowell said.

To be sure, SoCal Border Avg. cash prices rose considerably more than other pricing locations in California, climbing 34.5 cents to $1.985. Most other cash markets were up 20-25 cents.

Meanwhile, Southern California Gas (SoCalGas) has postponed the return-to-service of its import line L235-2 again by nearly a month, citing additional small leaks discovered during progressive restoration, according to Genscape. This change could keep SoCalGas’ system tighter through the summer and into the fall, which could put upward pressure on futures prices.

“This cycle of attempting to restore limited pressure to the line but finding additional leaks has happened numerous times over the last several months,” Genscape analyst Joe Bernardi said. The most recent postponement pushes the return-to-service to July 5 from June 8, a 27-day delay. This is the biggest modification to this schedule since April 24, when the return to service changed to June 4 from May 8, according to Genscape.

In the three trade dates following that postponement, 3Q2019 basis futures for SoCal Citygate rose by more than 60 cents, up to $3.40 from the month-to-date average of $2.76.

“At that time, SoCal storage inventories were essentially even with the two-year post-Aliso Canyon leak average, whereas now those inventories are comparatively higher, which could reduce the magnitude of the change in futures,” Bernardi said.

NGI will monitor any potential price impact from the most recent postponement in Forward Look.

The various pipeline restrictions and stronger-than-normal demand also lent support to Permian Basin pricing, which had already begun to recover Tuesday following the conclusion of a six-month maintenance event on El Paso Natural Gas. On Wednesday, Permian prices strengthened a bit more, with major pricing points in the region moving in on the $1 mark. Waha jumped more than 50 cents to average 86 cents.

Elsewhere across the country, ongoing maintenance on Columbia Gas Transmission (TCO) continued to pressure prices at Columbia Gas, which slipped 1.5 cents to $2.12 even though the rest of Appalachian cash prices strengthened day/day.

TCO provided an update Tuesday to the forces majeure at “LXPSEG” and “MXPSEG”, with the pipeline operator stating that it expects them to remain in effect through at least June 6. The pressure reduction, downstream of the Summerfield Compressor Station which led to the restrictions at LXPSEG and MXPSEG, was necessary due to results obtained from pigging on “Line LEX,” Genscape analyst Anthony Ferrara said.

TCO has indicated it is still evaluating next steps and will provide further updates as additional information becomes available.

Meanwhile, Northeast spot gas prices picked up a few cents on average, although Algonquin Citygate rose a more pronounced 6 cents to $2.295.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |