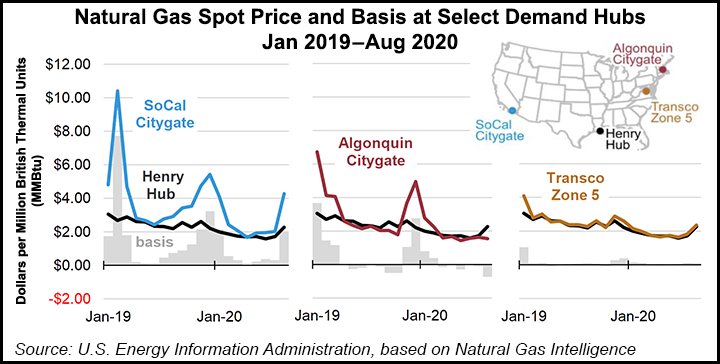

The average spot basis at many natural gas trading hubs in the United States narrowed during the first half of 2020 (1H2020) versus the same period last year, the Energy Information Administration (EIA) said Tuesday, citing NGI data.

Basis refers to the difference between the natural gas price at a given hub and the Henry Hub benchmark.

Warmer-than-normal temperatures during the 2019-2020 heating season helped drive narrower basis prices at key demand hubs such as SoCal Citygate in Southern California, Algonquin Citygate near Boston and Transco Zone 5 in Virginia, said EIA researchers led by Stephen York and Katie Dyl.

At some supply hubs, meanwhile, the basis was narrowed because of decreases in natural gas production.

“Declines in economic activity related to the...