Regulatory | Infrastructure | LNG | LNG Insight | NGI All News Access | NGI The Weekly Gas Market Report

National Grid’s NYC Long-Term NatGas Supply Constraint Solutions Heavy on LNG

In an effort to meet current and future New York City natural gas supply constraints, National Grid is planning to deploy a series of measures to maintain near-term system reliability while mulling over a host of longer-term solutions, a number of which prominently feature liquefied natural gas (LNG).

National Grid’s 115-page Long-Term Natural Gas Capacity Report, which was released this week, fulfills the utility’s November 2019 agreement with New York State, under which it committed to research and publish a report that offers potential long-term solutions to address downstate New York’s natural gas constraints. The company serves 1.9 million customers throughout Brooklyn, Queens, Staten Island and Long Island.

Over the past 10 years, National Grid said demand for gas in the region has increased by 2.4% per year, driven by annual economic growth of 1.9%, the addition of 32 million square feet per year of housing and non-residential building space, around 12,400 conversions to gas heat per year and a favorable cost profile versus available alternatives for heating, cooking and many industrial uses. As a result, this demand growth has placed constraints on the utility’s existing gas network.

“Quite simply, we are at risk of not having enough gas to meet the needs of our customers during periods of peak demand on cold winter days,” National Grid said in the report. “In the near term — to ensure sufficient supply for the winter of 2019/2020 and the winter of 2020/2021 we are taking a series of measures…”

The report comes amid uncertain times for the fuel in New York City. In early February, Mayor Bill de Blasio didn’t mince words on his government’s position on oil and natural gas in a 2020 State of the City speech, proclaiming that the metropolis must “say goodbye to fossil fuels.” Under a plan laid out by the de Blasio administration, the Big Apple would stop using all fossil fuels, including natural gas, in its “large building systems” by 2040, with government buildings the first to undergo the proposed overhaul.

A lack of natural gas infrastructure serving the city and surrounding suburbs also has led to moratoriums on new service, including one by National Grid that came to an end late last year.

Measures to be taken include the installation of additional compressed natural gas (CNG) capacity, which allows up to 42 trucks per day in the winter of 2019/2020 to bring CNG from upstream of National Grid’s system. The CNG would be injected into its gas system as needed during periods of peak demand. The utility plans to expand to 108 trucks for the winter of 2020/2021.

National Grid also plans to fund $8 million of incremental investment in energy efficiency, demand response and other gas conservation measures designed to reduce peak-day gas usage among current customers to enable certain new customer connections

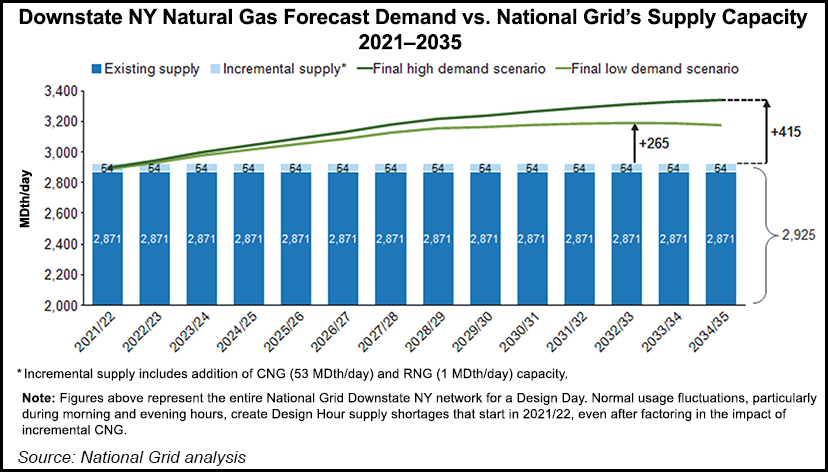

Looking beyond winter 2020-2021 at years two through 15, continued growth in gas demand — even after factoring in incremental energy efficiency and electrification under recently proposed and agreed to programs — “creates a supply versus demand gap which must be anticipated and resolved,” National Grid said. The company’s modeling indicates a gap between customer demand and available supply that starts in 2021/2022 and grows to 265-415 MDth by 2032-2035.

The utility offered a number of longer-term solutions to address the forecasted supply-demand gap, noting it is a complex challenge with multiple potential solutions that must consider size, safety, reliability, cost, environmental and community impact, and permitting, policy, regulatory and implementation requirements. The report looked at solutions that would require additional infrastructure, and some that would require no further buildout.

Potential infrastructure solutions proposed by National Grid include:

As for non-infrastructure solutions, National Grid also researched a number of solutions incorporating energy efficiency, demand response and electrification.

National Grid said its intention is not to make a specific recommendation on the best solution or solutions, but rather to provide the facts on each option and combination of options that could “comprehensively resolve” a supply versus demand gap that starts by the winter of 2021/2022 and continues to grow until at least 2032/2033.

The company plans to host a number of information sessions through the month of March in order to inform the public of all the options on the table. They also will be collecting feedback at the sessions and through an online survey.

“The dialogue with the public on the long-term options is an important first step in addressing the natural gas capacity constraints in downstate New York,” said Badar Khan, National Grid’s interim U.S. president.

“Ultimately, at the end of this process, we want to offer customers a balanced energy solution that considers reliability, cost, and environmental and community impacts,” he added.

After all the sessions have been held, National Grid said it would submit a supplemental report that summarizes and includes public input and provides agreed on long-term solutions with New York State by June 2020, which would enable the solutions to be in place and in operation by the winter of 2021/2022.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |