NGI The Weekly Gas Market Report

NGI The Weekly Gas Market Report | Forward Look | Markets | NGI All News Access

NatGas Shoulder-Season Volatility Continues on Erratic Weather, Supply Concerns

Natural gas forward prices for November were all over the board during the Oct. 18-25 period as volatile weather models and disappointing news on the Canadian import front pushed November prices up an average 8 cents, according to NGI’s Forward Look.

Interestingly, however, the Nymex prompt month fell 3 cents during that time to settle Wednesday at $3.166, while December slipped 2 cents to $3.227 and the winter strip (November-March) dropped 4 cents to $3.174.

In fact, the majority of pricing hubs across the country followed that trend, including the normally more volatile Northeast markets, where back-to-back cold snaps have lifted cash prices for much of the week.

For a market that counts on weather as its main source of demand, forecasts of late have been playing games as model runs have changed daily for at least the last week. The latest models remained mixed on Thursday morning, but generally resulted in little change to overall heating degree day (HDD) projections. Bespoke Weather Services said it expects that into Week 3, a ridge builds from the Midwest into the East and keeps heating demand solidly below average thanks to tropical forcing cycling into phases more favorable for warmth.

“Before then, we are still tracking one solid shot of cold air across the center of the country in the first week of November that should pull gas-weighted degree days up close to historic averages, and there are questions surrounding how far into the East that cold can get,” Bespoke chief meteorologist Jacob Meisel said.

A slightly further east push could prove more bullish, but overall the cold shot appears transient as Bespoke does not see the forcing needed to sustain it past Days 12-13, at which point warmer weather should prevail.

Indeed, Weather Decision Technologies’ Week 4 preview featured a continuation of Week 3’s pattern, with warm anomalies blanketing both coasts and near-normal weather across the rest of the country. Current forecasts, however, also suggested heating demand could increase 15 gas-HDDs from Week 3 to Week 4, potentially bolstering weather-driven gas consumption by 3.5 Bcf/d week/week, according to EBW Analytics.

From a meteorological perspective, the current upper level pattern was expected to shift westward and flatten by Week 3, reducing the intensity of cold air flow from Canada. “Although confidence in the Week 4 forecast is low, the current outlook aligns with market expectations for warmer-than-normal November weather, likely weakening support for Nymex natural gas amid easing tight marketing conditions,” EBW CEO Andy Weissman said.

Indeed, recent storage data has indicated an increasingly loose market, according to Bespoke. The Energy Information Administration on Thursday reported a 58 Bcf build to storage inventories for the week ending Oct. 19. Implied flows, however, were actually reported to be 63 Bcf due to a 5 Bcf reclassification that decreased working gas in South Central non-salt gas stocks.

“Though stockpiles were decreased by 5 Bcf in the revision, the net implied flow of 63 Bcf is incredibly loose and indicates a market far looser than even we had expected,” Meisel said.

With increasing warm risks later in Week 2 into Week 3 and production hitting new highs, as well as indications that the market has only marginally tightened this week, “it would appear that the front of the natural gas strip is poised to test the $3.10 level into the weekend with continued risk lower with any further long-range warm risks,” he said.

Still, traders appeared to view the report as somewhat supportive. The Nymex November contract, which briefly dipped into the red earlier in the day, went on to settle Thursday at $3.202, up 3.6 cents. December rose 2.9 cents to $3.256, and the winter strip (November-March) climbed 2.3 cents to $3.198.

Wood Mackenzie analyst Gabe Harris said that any storage build that is below the five-year injection with a 600 Bcf storage deficit heading into November “is pretty supportive.” Last year, 63 Bcf was injected into storage, while the five-year average injection is 77 Bcf.

“I get excited about the low numbers and possibility of shortages in February as anyone”, but the last 10 days of big weather-adjusted injections “makes me very skittish. Production seems bigly,” Harris said Thursday on the Enelyst chat room hosted by The Desk.

Indeed, production soared to new heights last weekend as Genscape Inc.’s daily pipe production estimate pegged Saturday’s output at 84.43 Bcf/d. Further strong gains are likely as producers in Appalachia continue to fill newly available pipeline takeaway capacity, according to EBW.

“Many producers, particularly in the Northeast, have also exhibited a penchant for ramping up output ahead of the winter heating season, when demand and prices reach an annual high,” Weissman said.

At the same time, earnings season during the next two weeks will provide a platform for producers to highlight accomplishments and ability to grow output at very low costs, according to EBW. “Production may easily come in at or above guidance, management may guide toward lower breakeven costs and the forward outlook may feature the ability to grow production using lower capital expenditures,” Weissman said.

While surprises are possible, these announcements are likely to firm up the production growth trajectory heading into 2019 — “and may convince the market lower prices may be warranted to accommodate low gas prices ahead,” he said.

For now, the purchases of salt cavern storage operators should keep some support for prices, while any sustained cold could drive a sizeable rally, market observers said.

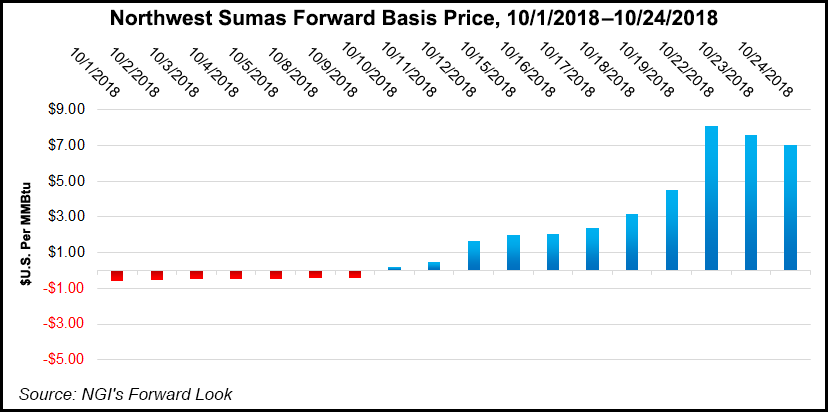

Enbridge Pipeline Update Sends Sumas Rocketing Higher

In the two weeks since a 36-inch line on Enbridge Inc.’s Westcoast Transmission ruptured, volatility in western United States markets has been prevalent. No more has that been the case than at Northwest Sumas, where both cash and forward markets have surged due to the cut in imports from British Columbia.

Even though Enbridge returned a second, unharmed line to service the day following the explosion, the smaller 30-inch line operated only at 80% of its design capacity. On Oct. 18, the company said it would return the 36-inch line to service by mid-November, but also at the reduced operating cap. In fact, the pipeline noted that capacity on its T-South system was expected to range between 0.9 and 1.3 Bcf/d throughout the winter as a result of these reduced operating pressures.

By comparison, average southbound flows last winter at Station 4B were roughly 1.8 Bcf/d, “so this would still represent a cut of 0.5-0.9 Bcf/d of flows year over year,” Genscape natural gas analyst Joe Bernardi said.

Mobius Risk Group’s Zane Curry told NGI that the outage on Westcoast and the corresponding lack of import capacity at Sumas “is certainly still the headline and driving strength in both the spot market and winter forwards.”

In conjunction, NOVA/AECO forwards remained weak, and arguably could see further downside if the outage is extended. As a result, the price signal for Western Canada producers is anything but strong, he said.

Indeed, NOVA/AECO November sat Wednesday at $1.516, while the winter strip sat at $1.75, according to Forward Look. That’s actually a stark improvement compared with cash prices, which averaged just C$34 cents on Wednesday.

Also of importance are the relatively low storage levels in Western Canada, Curry said. “The lack of import capacity, potentially sluggish Western Canadian production and a year/year storage deficit of significant magnitude likely have participants in western U.S. gas markets concerned.”

Meanwhile, forecasts for a winter El Nino are also weighing in on pricing dynamics. “While the statistical significance is certainly debatable, the probability of a colder-than-normal and wet Pacific Northwest in such a weather pattern is meaningful,” Curry said.

The impact of the explosion on prices aside, “the recent events should serve as a wake-up to consumers in the I-5 corridor,” Solomon Associates director of Strategic Energy Advisory Services Cameron Gingrich said.

The de-bottlenecking currently underway on TransCanada Corp.’s NGTL pipeline west leg “will compete for Northeast BC supplies in the near-term and liquefied natural gas in the longer term — supplies which currently rely on Westcoast T-South markets in the Lower Mainland and I-5 corridors,” he said.

Jordan Cove LNG and the expansion of the Southern Crossing Pipeline were two potential solutions Gingrich offered to the supply security concerns. Already, utility FortisBC said it was working with TransCanada to maximize output of the Southern Crossing pipeline that feeds into the Interior from Alberta. In addition, the utility was working with industrial customers to optimize their energy use, keeping them running while minimizing system impacts.

“We are also working on securing additional natural gas in the open marketplace to best support the province’s gas supply,” FortisBC said.

The utility has told customers that the wake of Enbridge’s pipeline update, “the natural gas system will be challenged in times of high demand throughout the winter.” As such, FortisBC asked customers to be conscious of their natural gas use and “conserve energy wherever possible.”

While the explosion has led to lower prices at NOVA/AECO, Northwest Sumas prices have rocketed higher. November shot up $3.87 from Oct. 18-25 to reach $10.212, December rose $4.07 to $9.608 and the winter jumped $3.20 to $7.80, Forward Look data show.

California prices also strengthened. PG&E Citygate November was up 28 cents to $4.016, December was up 18 cents to $3.957 and the winter strip was up 13 cents to $3.74.

Permian Basin pricing had also benefited from the rupture north of the border as downstream markets were forced to look elsewhere for supply. That changed this week, however, as a wider regional retreat took place due to planned maintenance on Transwestern Pipeline that cut already constrained Permian outflows by roughly 275 MMcf/d.

The pipeline has several more maintenance events lined up for the rest of the month. Transwestern also indicated that it would perform a station valve replacement at its Station 9 Compressor Station in Roswell, NM, from Oct. 26-29, reducing westbound flows through the station to approximately 450,000 MMBtu/d from 750,000 MMBtu/d.

It was also scheduled to install a pig Launcher and pig receiver on the Oasis lateral from Oct. 30-31, reducing flows through the lateral to zero from 340,000 MMBtu/d.

Given the increasing constraints, El Paso-Permian November prices plunged 24 cents from Oct. 18-25 to $1.57. December slipped just a nickel to $2.058 and the winter strip fell 10 cents to $1.80, according to Forward Look. Waha tracked similar declines.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |