NGI Data | Markets | NGI All News Access

NatGas Futures Test Low End Amid Volatile Weather Outlook, Rare December Storage Build

Natural gas futures sold off sharply Thursday, with a rare December storage injection doing little to ease market concerns over volatility in the latest weather outlook. Outside of some strength in the Mid-Atlantic and New York, the bears controlled the spot market too, and the NGI National Spot Gas Average declined 12 cents to $2.86/MMBtu.

The January contract tumbled 15.9 cents Thursday to settle at $2.763, with a lot of the selling occurring before 10 a.m. EDT on some overnight warm risks showing up in the forecast guidance. February settled 14.2 cents lower at $2.782.

“We’re getting the cold weather now, finally…but the problem is the weather models are not holding onto it,” Commodity Weather Group President Matt Rogers told NGI. “There’s just so much volatility.”

In the back half of the six- to 10-day and first part of the 11-15 day, Rogers said the latest guidance showed a “temporary breakdown of the pattern’s structure that would allow more warmth to move across the country.

“…The models have gotten warmer in the past 24 hours, but they’re not committing to durability on that…it seems we’re in a very volatile pattern where neither side can lock in” to move temperatures above or below normal.

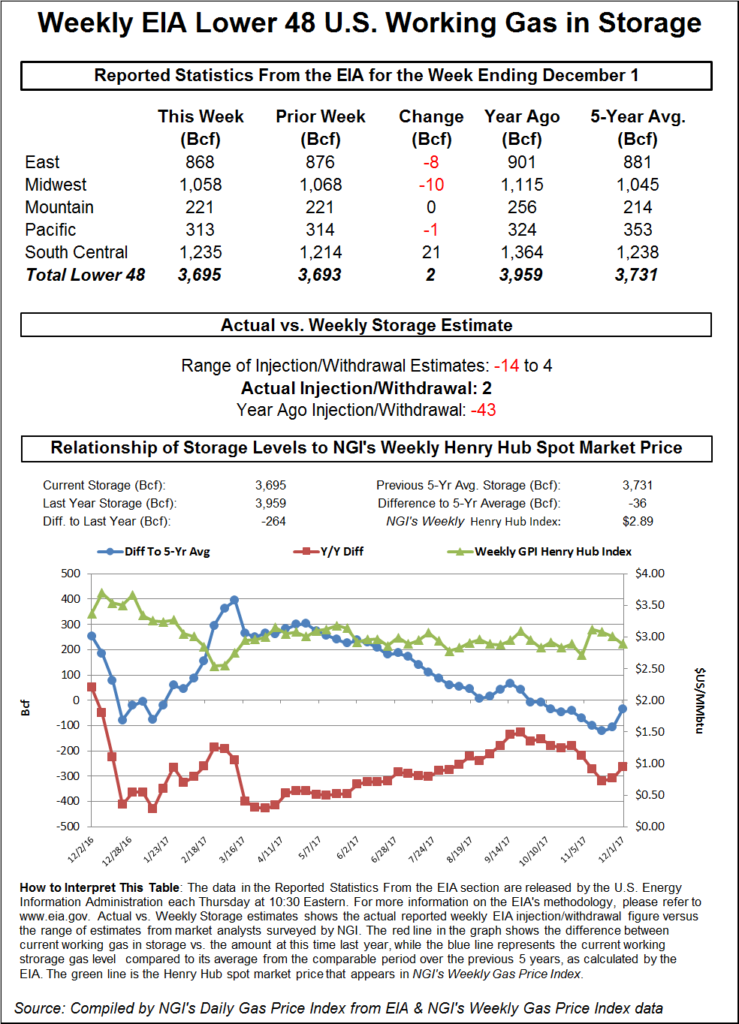

Meanwhile, the Energy Information Administration (EIA) reported a net injection into U.S. gas stocks for the week ended Dec. 1, a slight bearish miss on what was already a bearish consensus leading up to the report.

EIA said in its weekly report that U.S. working gas in underground storage showed an implied 2 Bcf build for the period, an unseasonable number that’s far looser than the 43 Bcf withdrawn a year ago and a five-year average 69 Bcf withdrawal.

The market would have to go back five years to find the last time EIA reported a net injection during the month of December — a 2 Bcf build recorded for the week ended Dec. 7, 2012.

Word of a potential injection had spread earlier in the week, and the futures market seemed to have baked in the news. January recorded a small bounce from pre-report levels in the minutes immediately following EIA’s 10:30 a.m. EDT release.

With some overnight warm changes in the weather outlook, January fell sharply from Wednesday’s $2.922 settle, pushing down into the $2.775-2.790 area in the lead-up to the report. By 11 a.m. EDT, January was trading around $2.790-2.800.

The market came into Thursday bracing for an unusually light withdrawal, though a net injection wasn’t out of the question, according to some analysts.

A weekly Reuters survey had revealed on average a 7 Bcf net withdrawal. Responses ranged from -66 Bcf to an injection of 3 Bcf. The -66 Bcf prediction was an outlier, with the next most-bullish survey response coming in at -25 Bcf. Responses to a Bloomberg survey ranged from -14 Bcf to +4 Bcf, with a median of -3 Bcf.

IAF Advisors analyst Kyle Cooper had been calling for a 1 Bcf build for the week, echoing Price Futures Group analyst Phil Flynn, who had also called for an injection. Stephen Smith Energy Associates had been looking for a 7 Bcf withdrawal, as had PointLogic Energy.

“The print missed slightly bearish to our estimates and confirms significant week-over-week loosening that the market has priced in recently,” said Bespoke Weather Services in a note issued shortly after the EIA release.

“Elevated production and very warm weather last week clearly allowed for such a print, which has moved us back far closer to the five-year average. However, it appears the surprise bearish print was not much of a surprise at all; prices moved little off the number, lending support to the idea that this may be a ”buy the rumor, sell the fact’ report. We still see $2.75 support as likely firm, though this print limits short-term upside too.”

The net injection for the week shrank the year-on-five-year deficit to -36 Bcf, versus -107 Bcf last week. Total U.S. gas stocks ended the week at 3,695 Bcf, versus a five-year average of 3,731 Bcf and year-ago stocks of 3,959 Bcf.

The East and Midwest regions recorded weekly withdrawals of 8 Bcf and 10 Bcf, respectively. The Pacific region saw a 1 Bcf withdrawal. The South Central region injected 21 Bcf for the week, according to EIA, including 12 Bcf injected into salt and 9 Bcf into nonsalt.

INTL FCStone Financial Inc.’s Tom Saal, senior vice president, said the market was “trading against some pretty significant numbers” in terms of technical support Thursday.

“In order for the market to go lower you need sellers, and it looks like based on the market profile that the sellers have been speculators liquidating their long positions, and the question is how much more can they liquidate?” Saal told NGI.

With the next likely support level at around $2.500, if speculators “get stuck in a short position” at current prices “and mother nature shows up with an arctic blast, you’re probably going to take it on the chin.”

A Houston-area trader speaking to NGI said, “The bears are definitely aggressive here…However, the weather forecasts are trending more normal to slightly above normal.” Until it’s clear “that weather models can return again to the cooler side. I think the bears are winning the short-term battle.”

As for the 2 Bcf build from EIA, “the one thing that’s noteworthy is the South Central injection was quite a bit higher than most were expecting,” the trader said. “That has implications to the near-term spreads. I think that was the bearish surprise.”

In the spot market Thursday, strong pricing on Transco through Zones 5 and 6 and another day/day jump at SoCal Citygate couldn’t offset double-digit declines across most regions.

Accuweather was calling for chilly temperatures Friday and a mix of wintry precipitation across parts of Georgia, South Carolina, North Carolina and Virginia. The forecaster expected Atlanta to see lows in the 20s and 30s heading into the weekend, with Washington, DC, along with Philadelphia and New York, also expected to see lows drop into the 20s and 30s over the next few days.

“Zone 5 demand rose sharply beginning Wednesday, and Zone 6 demand increased as of Thursday,” Genscape Inc. analyst Josh Garcia told NGI. “Zone 1-4 imports into Zone 5 rose day/day, while imports into Zone 5 from Zone 6 fell day/day as their demand also spiked.”

Transco Zone 6 New York gained 69 cents to average $3.95, while Transco Zone 5 surged 72 cents to $3.98.

Another big gainer Thursday was the recently volatile SoCal Citygate, which jumped $1.46 to $7.48, even as nearby points fell, such as the 25 cent drop at SoCal Border Average ($2.90).

Southern California Gas Co., which has been dealing with import and storage constraints in recent weeks, was forecasting system demand to exceed deliveries by about 100,000-150,000 Dth/d Friday and Saturday.

Most everywhere else, prices fell.

Unseasonably wintry weather in Texas — including calls for a mix of rain and snow overnight in places as far south as Corpus Christi — couldn’t lift prices. Katy dropped 13 cents to $2.76, while Texas Eastern South Texas fell 13 cents to $2.73. El Paso Permian gave up 20 cents to $2.45, and Waha fell 16 cents to $2.52.

The chilly temperatures raised the prospect of freeze-offs in producing regions. El Paso Natural Gas Co. LLC issued a notice to customers Thursday that it was “concerned about the winter weather that continues to move through the Permian Basin…through Friday morning and the potential for supply shortfalls.”

In New England, where MDA Weather Services was forecasting temperatures in the 30s and 40s in Boston over the next few days, prices pulled back from Wednesday’s gains. Algonquin Citygate shaved off 16 cents to average $3.99, while Iroquois Waddington dropped 14 cents to $3.04.

In the Midwest, one of the first regions impacted by this week’s wintry weather, prices sold off. AccuWeather called for a high of 37 in Chicago Friday, versus a high of 27 Thursday.

Chicago Citygate tumbled 21 cents to $2.70, and Joliet gave up 20 cents to $2.69.

The Midcontinent saw similar declines, with Northern Natural Demarcation falling 20 cents to $2.64.

In places like Chicago, “what I’ve been seeing is the low temperatures have not been performing as well” as expected this week, Rogers said.

Bespoke said in an afternoon update “the current cold shot is a bit underwhelming compared to the potential seen on previous long-range guidance.” This could be influencing the futures market to focus “more on medium-term gas-weighted degree day losses than lingering long-range cold risks.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |