Markets | NGI All News Access | NGI Data

NatGas Futures Recover After Initial Drop Following On-Target EIA Build

Natural gas futures inched lower Thursday morning following the release of government inventory figures showing an increase in working gas storage that was about what traders were expecting.

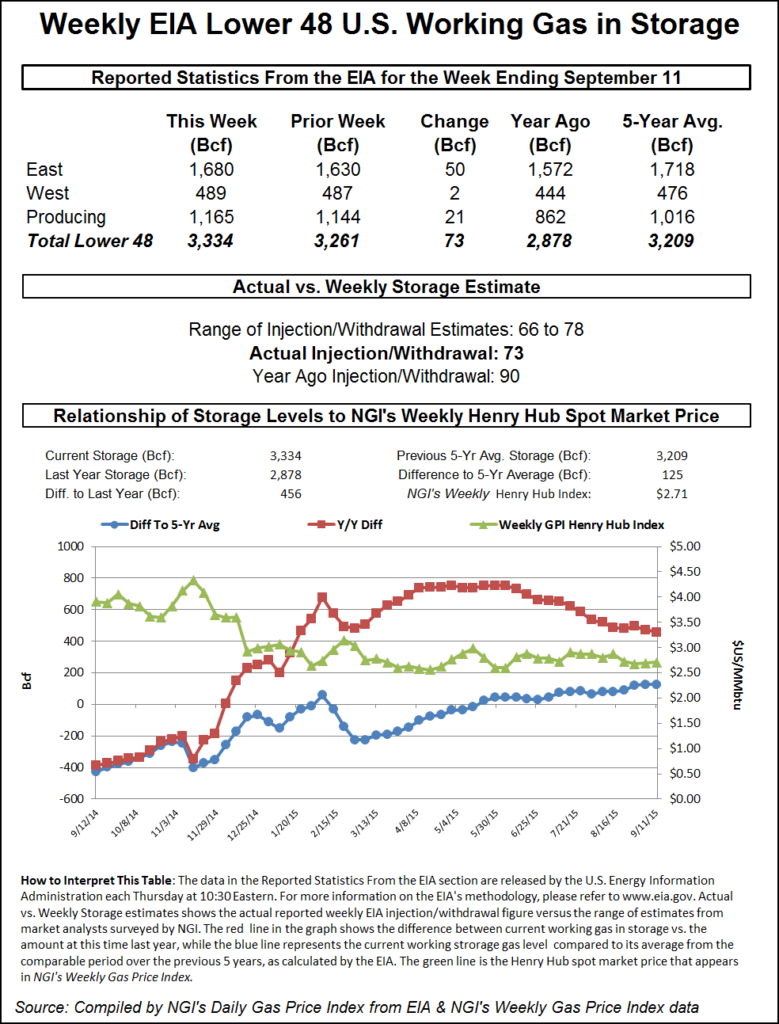

For the week ended Sept. 11, the Energy Information Administration (EIA) reported a 73 Bcf injection in its 10:30 a.m. EDT release. October futures slammed to a low of $2.603 after the number was released, but by 10:45 a.m. October was trading at $2.654, down 0.6 cent from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase right at 73 Bcf. Bentek Energy estimated 71 Bcf, utilizing its flow model, and IAF Advisors had calculated a 73 Bcf increase. A Reuters poll of 24 traders and analysts showed an average 73 Bcf with a range of 66-78 Bcf.

“As soon as the number was released, the market made a new low of $2.603, but then you looked back up and it was trading $2.66. That’s how quick it was,” a New York floor trader told NGI. “Why it jumped down, I don’t know. We had heard numbers from 70 Bcf to 75 Bcf, so it’s right in there. It was a crazy move for no reason. I would think that was an algorithmic trader.”

Neither bulls nor bears found much to their liking. “The 73 Bcf net injection for last week was a direct match with the consensus expectation, a neutral result,” said Tim Evans of Citi Futures Perspective. “The refill was still slightly less than the 76 Bcf five-year average level, but this comparison looks rather neutral as well.”

Inventories now stand at 3,334 Bcf and are 456 Bcf greater than last year and 125 Bcf more than the five-year average. In the East Region 50 Bcf was injected, and the West Region saw inventories increase by 2 Bcf. Stocks in the Producing Region rose by 21 Bcf.

The Producing Region salt cavern storage figure was up 5 Bcf at 298 Bcf, while the non-salt cavern figure increased 16 Bcf to 867 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |