NGI Data | Markets | NGI All News Access

NatGas Futures Inch Lower Following On-Target Storage Figures

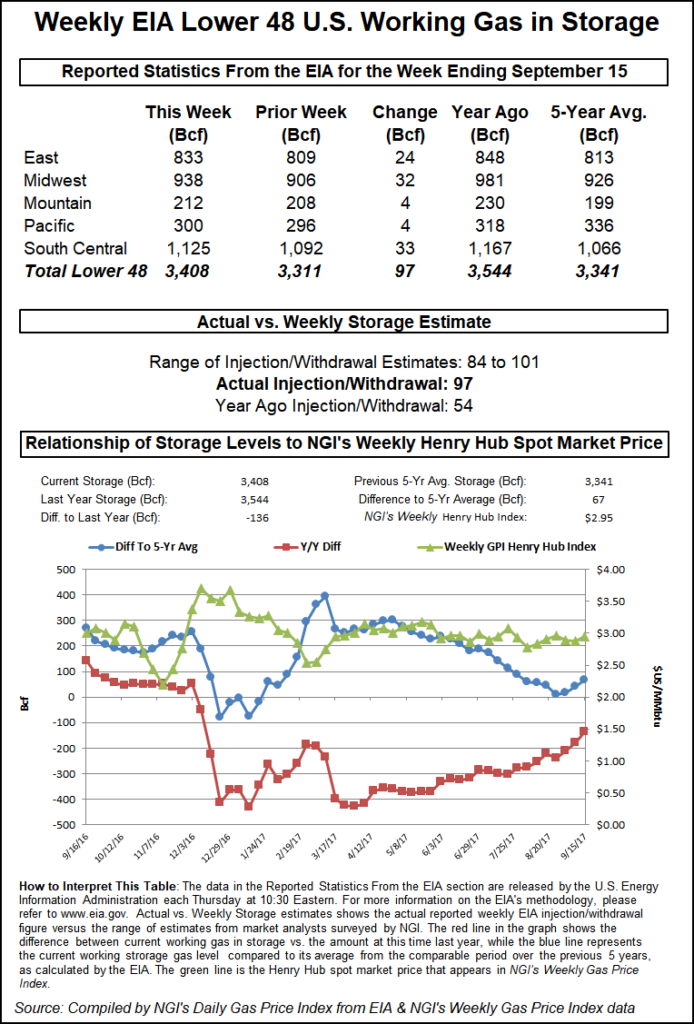

Natural gas futures traded lower but snapped back Thursday morning after the Energy Information Administration (EIA) reported a storage injection that was about in line with what the market was expecting.

EIA reported a 62 Bcf storage injection in its 10:30 a.m. EDT release, about what surveys and estimates by traders and analysts showed. October futures reached a low of $2.834 immediately after the figures were released, but by 10:45 a.m. October was trading at $2.884, down five-tenths of a cent from Wednesday’s settlement.

“We were hearing a 62 to 63 Bcf figure and it was not much of an event,” said a New York floor trader. “The market was down but then it jumped back. You see that almost all the time.”

“The 62-Bcf refill for last week was a match with the consensus expectations and so neutral on that account,” said Tim Evans of Citi Futures Perspective. “However, we note that that was also a step up from the 36 Bcf net injection and was also within 7 Bcf of the five-year average report. By that measure, this was the smallest, least-supportive variance to the five-year average since April.”

Inventories now stand at 3,499 Bcf and are 184 Bcf greater than last year and 299 Bcf more than the five-year average. In the East Region, 20 Bcf was injected, and the Midwest Region saw inventories increase by 26 Bcf. Stocks in the Mountain Region rose 3 Bcf, and the Pacific Region was up by 4 Bcf. The South Central Region increased 9 Bcf.

Salt cavern storage was up 5 Bcf at 285 Bcf, while the non-salt cavern figure was higher by 5 Bcf at 885 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |