Markets | Infrastructure | NGI All News Access

NatGas Futures Fail to Hold Early Gains, Slide After Bearish Storage Stat

An early-session rally for natural gas futures petered out later Thursday after the latest government storage data reflected incredible looseness in the market. The November Nymex natural gas futures contract settled at $2.218/MMBtu, down 1.6 cents on the day. December slipped 1.9 cents to $2.417.

Spot gas markets were also lower as high pressure resulted in pleasant temperatures across the eastern United States. Another round of steep decreases was seen out West and in Appalachia, but the NGI Spot Gas National Avg. ultimately fell just 5.0 cents to $1.765.

Although long-range weather models have started to converge a bit, neither shows early-season cold sticking around longer than a few days in key demand regions. All overnight weather models lost a little demand for the coming 15-day forecast, including the European model.

“There remain considerable differences between the Global Forecast System (GFS) and European models where the GFS is 18 heating degree days colder for the coming 15-day forecast, although narrowing the gap slightly compared to previous days,” NatGasWeather said.

The midday GFS data lost some demand for next week but added demand for Oct. 20-24, “although is still quite bearish this period due to warm high pressure returning across much of the eastern half of the United States, just a little less so this run,” the firm said.

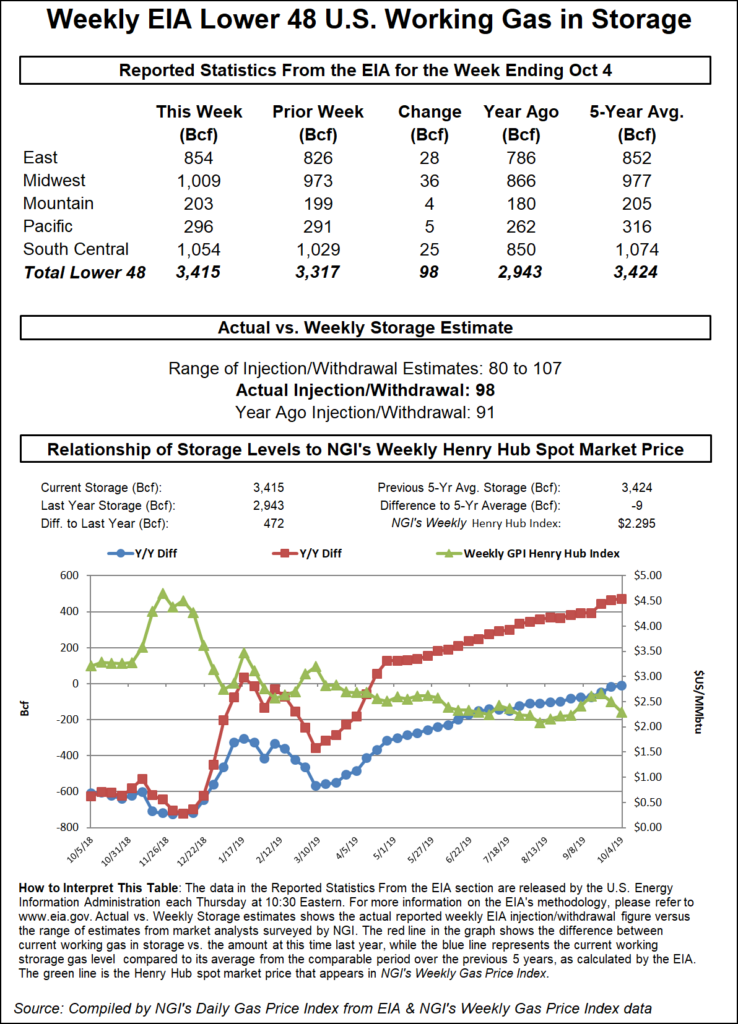

With few concerns about demand, all eyes were on the latest Energy Information Administration (EIA) storage report. The EIA reported a 98 Bcf injection into storage facilities for the week ending Oct. 4, falling well within the wide range of expectations.

The reported injection was several Bcf above last year’s 91 Bcf as well as the five-year average of 89 Bcf, according to EIA.

Excluding weather-related demand, Thursday’s injection implies that market demand was 3.3 Bcf/d looser versus the same week last year and has averaged 2.75 Bcf/d looser over the past four weeks, according to Raymond James & Associates.

Genscape Inc., which correctly called the 98 Bcf injection, painted an even bleaker picture as it noted the figure is about 5 Bcf/d looser than the five-year average.

Broken down by region, the Midwest added 36 Bcf into storage stocks, while 28 Bcf was injected into East facilities, according to EIA. South Central inventories rose by 25 Bcf, including 16 Bcf into nonsalt facilities and 9 Bcf into salts.

Het Shah, managing director at energy chat room Enelyst, noted that salt inventories continue to sit below the five-year average of 278 Bcf, “but overall, South Central storage levels look quite healthy going into the winter.”

Total working gas in storage rose to 3,415 Bcf, which puts inventories at a 472 Bcf surplus over last year and just 9 Bcf below the five-year average, according to EIA.

“Overall levels at 3,415 Bcf — that’s where the market expected we’d end up on Oct. 31 at the beginning of this summer. We hit that by week ending Oct. 4,” Shah said.

The rapid refill of storage inventories following a prolonged 2018/19 winter that left stocks at steep deficits to historical levels continues to astound market observers.

Bespoke Weather Services chief meteorologist Brian Lovern pointed to the epic heat that enveloped much of the United States from July through September, not to mention multi-year price lows. “And yet end-of-season estimates have risen 150-200 Bcf since late June despite all of that.

“Without tightening or colder weather, risk to prices is still skewed toward more downside ultimately, though it is tough to press the bear pedal too hard at $2.23 prompt month with winter still ahead of us. Should models show warmth into the end of October and early November, that would likely be the catalyst for another leg lower.”

Current Week 4 weather outlooks from DTN reflect strong warmth along the populous Atlantic Seaboard, with relatively normal temperatures west of the Mississippi. The forecast calls for 78 gas-heating degree days (GHDD), which is 7 GHDD below normal, yet still represents a 20 GHDD and 5.2 Bcf/d week/week increase in demand from Week 3.

Forecast confidence, however, has dipped on concerns over the Madden-Julian Oscillation (MJO) progression, according to the forecaster. “While the MJO has been fairly quiet in recent weeks, its progress out of Phase 1 is generally correlated with cooler temperatures in the Midwest and Northeast.”

Less than a month since Kinder Morgan Inc. brought into service its Gulf Coast Express gas pipeline project in the Permian Basin, cash prices in the region are heading toward the bargain-basement levels seen this summer as production continues to flood a market without enough demand to soak it up.

Waha prices tumbled 18 cents to average just 74.0 cents on Thursday, although deals were seen as low as 60 cents and all priced below $1.

The losses at Waha were part of a widespread sell-off across much of Texas, where temperatures were forecast to drop on Friday as thunderstorms roll across the state. Houston Ship Channel was down 8.5 cents to $2.235, while Transco Zone 1 was down 10.5 cents to $2.090.

Midcontinent cash prices were also lower as the producing region attempts to incentivize buyers. NGPL Midcontinent was down 14.0 cents to average just 89.0 cents.

Most markets across Louisiana and the Southeast fell less than a dime day/day, while far more dramatic losses were seen at Transco Zone 5, which plunged 30.0 cents to $1.905.

There stands to be some upside to Transco Zone 5 prices in the coming days as Genscape’s proprietary observations indicate the Cove Point liquefied natural gas (LNG) terminal should be returning to operations shortly following an extended maintenance outage.

Feed gas deliveries to U.S. LNG export terminals continue to hover around the 6 Bcf/d mark as Cove Point has yet to return from maintenance and flows to Freeport remain volatile. Total feed gas deliveries were estimated at 5.9 Bcf/d on Thursday.

“While this is in line with the October month-to-date and September averages, it is about 0.7 Bcf/d below September’s peak day,” Genscape said. “Volumes should start ticking back up soon, though.”

Meanwhile, Kinder Morgan on Thursday said that it had begun commercial operations from the first of 10 production units at its Elba Liquefaction project near Savannah, GA.

Startup activities are underway on the second and third units, the commissioning of units four through six is ongoing and construction on the remaining units is largely complete, according to Kinder Morgan. Under full development, the $2 billion Elba Island Liquefaction facility is expected to have a total capacity of about 2.5 million metric tons/year of LNG for export, which is equivalent to approximately 350,000 Mcf/d of natural gas.

Farther East, Appalachia prices were mostly lower, with Tennessee Zone 4 Marcellus coming off 27.5 cents to $1.185.

In the Northeast, Iroquois Zone 2 managed to churn out one of the only gains in the region as prices rose a penny to $1.775.

Out West, widespread, double-digit losses were seen again across the region as temperatures have returned to more normal levels. However, PG&E Citygate slipped only 5.5 cents to $3.195 as pipeline maintenance has softened the blow to prices from a massive power shutoff across much of the Pacific Gas & Electric (PG&E) territory.

PG&E’s proactive power shutoff, implemented early Wednesday due to fire risk in the region, had left around 600,000 customers still without service as of Thursday. But the utility said improving weather conditions had allowed it to begin safety inspections, repairs and restoration in some areas.

The utility said wind gusts as strong as 75 to 77 mph had been recorded in parts of Central and Northern California between midnight and 6 a.m. local time Thursday. The severe winds, elevating the risk of fire, were a major factor behind the utility’s decision to cut power. The National Weather Service had a “Red Flag Warning” in effect for the region through Friday morning due to “extreme fire weather danger.”

PG&E, whose equipment was linked to last year’s devastating Camp Fire, said no fires related to its equipment had been reported in the areas where it enacted the safety shutoffs.

The utility said it had 6,300 field personnel and 45 helicopters standing by, with plans to begin inspections, repairs and restoration in specific areas once weather conditions sufficiently improved. PG&E estimated nearly 25,000 miles of distribution lines and 2,500 miles of transmission lines would require inspection following the severe weather event.

“We deeply apologize for the inconvenience and the hardship, but we stand by the decision” to conduct the preemptive shutoffs, “because the safety of our customers and communities must come first,” said PG&E senior vice president Michael Lewis, who heads electric operations for the utility.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |