NGI Archives | NGI All News Access

NatGas Forwards Tumble On Storage, Weather; NE Rally Continues On More Bad News

The double-digit gains seen last week in natural gas forwards markets were just as quickly erased during the April 22-28 period as seemingly bearish storage news and mild weather sent June prices spiraling downward by an average 16 cents, according to NGI’s Forward Look.

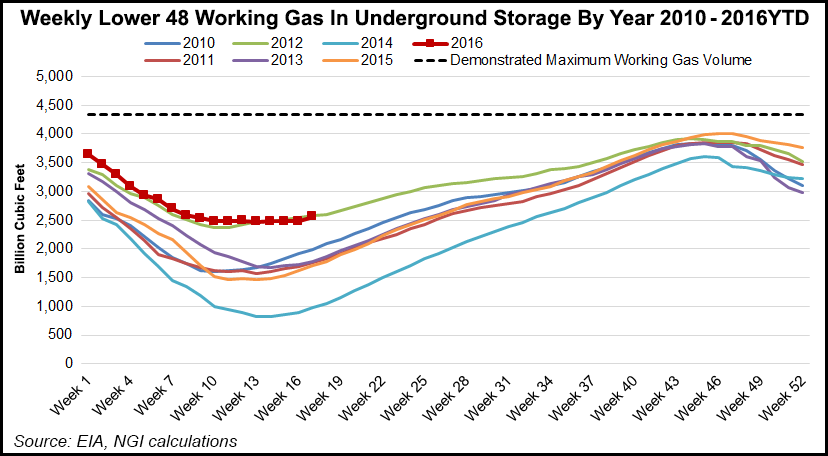

The Nymex June contract, which moved into the prompt-month position April 28, plunged 18.7 cents during that time as storage inventories swelled to some 51.6% above year-ago levels and 48.2% above the five-year average.

The U.S. Energy Information Administration reported a 73 Bcf build to inventories for the week ending April 22.

But while the reported build was considered bearish as it was slightly higher than market estimates, it was actually quite bullish relative to degree days and seasonality, according to Genscape.

Genscape, based in Louisville, KY, is real-time data and intelligence provider for energy and commodity markets.

“Versus degree days and seasonality, this week’s stat appears tight by 4.7 Bcf/d versus the prior five years and is the tightest stat we have seen in more than two years,” said Genscape’s Eric Fell, senior natural gas analyst.

The eight-week moving average has been tight by just over 2 Bcf/d, he added.

“Given current storage levels, the market needs to average tight vs. normal by 1.7 Bcf/d in order to stay within operational storage limits ~4.34 Tcf, or 2.7 Bcf/d tight to end at 4.12 Tcf, which would represent 95% of demonstrated capacity,” Fell said.

Fell said strong gas burn in the power stack contributed to the tighter stat this week.

Gas burn increased week over week despite a ~6.1 GW decline in average loads, as other forms of generation fell much harder than loads, Fell said.

“Wind, in particular, fell by 7 AGWh [Average Gigawatt hour] week over week. Nuke/Renewable generation was down 5.8 AGWh and coal was down nearly 4 AGWh, allowing gas to increase despite a large decline in overall loads,” Fell said.

The possibility of more substantial builds in storage in the coming weeks appears likely as widespread mild weather is forecast, however.

“Overall natural gas demand will be light to moderate with minor swings every few days due to warm conditions out ahead of weather systems and slightly cool temperatures as they pass. This will drive just enough demand to keep builds relatively close to the five-year average for the next several [days], but then with better chances of them increasing to approach +100 Bcf after May 7 as the northern U.S. finally sees better opportunity for widespread high temperatures into the 70s,” forecasters with NatGasWeather said.

The weather team at Bespoke Weather Services agreed models are pointing to a warmer trend after the first week of May, but cautioned that while heating demand could be wiped out, cooling demand later in the month could mean demand bounces back rather quickly.

“Overall, these trends were not all that significant, though we expect weather to play a more significant role in the next few weeks. We still see $2 as support and $2.15 as resistance,” Bespoke said.

But while the natural gas market was overwhelmingly bearish this week, some Northeast prices continued to surge amid the recent spate of bad news related to various pipeline projects that had been proposed to improve the supply-demand picture in the region.

Algonquin Gas Transmission citygates, which followed the general downtrend at the front of the curve, saw its prompt winter (winter 2016-2017) package jump 37 cents between April 22 and 28 to reach $6.46, according to Forward Look.

Most other markets shifted only a couple of cents.

The next two winter strips at AGT were strong as well, with winter 2017-2018 surging 43 cents to $6.44 and the winter 2018-2019 climbing 42 cents to $6.40, Forward Look data reflects.

Meanwhile, Transco zone 6-NY posted solid gains of its own.

The NY prompt winter moved up 20 cents between April 22 and 28 to reach $5.80; the winter 2017-2018 rose 37 cents to $6.22 and the winter 2018-2019 picked up 32 cents to reach $6.27, according to Forward Look.

This week’s gains are in addition to the rally seen the previous week after news broke that Kinder Morgan would be suspending work on the proposed Northeast Energy Direct (NED) project, citing insufficient contractual commitments (see Daily GPI,April 21).

The greenfield project had two components — the 1.2 Bcf/d Supply Path would have transported Northeast Pennsylvania production to the Wright interconnect with Iroquois and Tennessee Gas Pipeline (TGP) in New York, while the Market Path would have provided 1.3 Bcf/d of eastbound flows from Wright to Dracut, MA.

“It is still believed the additional capacity is needed in the region, and KMI has promised to continue work with LDC customers to scale future projects as demand develops, Genscape’s Rick Margolin, senior natural gas analyst, said.

“However, it is not likely that future projects will add up to the size of NED, due to other infrastructure development happening in the same locale,” Margolin said.

In addition to the Kinder Morgan announcement, the New York State Department of Environmental Conservation on April 22, Earth Day, denied the Clean Water Act permit for the Constitution Pipeline Project.

The 125-mile pipeline would carry Marcellus Shale gas from Susquehanna County, PA, interconnecting with the Iroquois Gas Transmission and TGP systems in Schoharie County, NY.

Furthermore, Genscape’s Infrastructure team believes Dominion’s New Market Project may miss its November 2016 in-service date, and may not come into service until late 2017/early 2018.

While Dominion hasn’t officially declared a delay, a late start to construction due to a delayed environmental assessment effectively guarantees a delay, Genscape said.

Dominion’s New Market Project will create 112 MMcf/d of new capacity to move Clinton County, PA-produced gas to interconnects in New York.

Based on similar cases, Genscape’s Infrastructure group doesn’t see Dominion receiving necessary permits until June, meaning construction wouldn’t start until September 2016.

“Assuming construction follows a 14-month schedule, this would place the likely in-service date at November 2017, although it could feasibly stretch into early 2018,” Genscape said.

In the past two weeks, AGT has seen its prompt winter soar by some 79 cents, the winter 2017-2018 grow by 73 cents and the winter 2018-2019 edge up 77 cents, according to Forward Look.

During the same time frame, New York has seen its prompt winter grow 50 cents, the winter 2017-2018 strip gain 56 cents and the winter 2018-2019 strip climb 49 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |