NGI Archives | NGI All News Access

NatGas Forwards Mixed as Cold Likely to Stick Around Through Early March

Even as much of the central and eastern U.S. continues to experience what some have dubbed the “snowpocalypse,” only a handful of affected natural gas forwards markets saw any significant price action from Feb. 13-19.

Interestingly, Northeast price points recorded steep declines despite the persistent numbing temperatures and record snowfall in areas like New England.

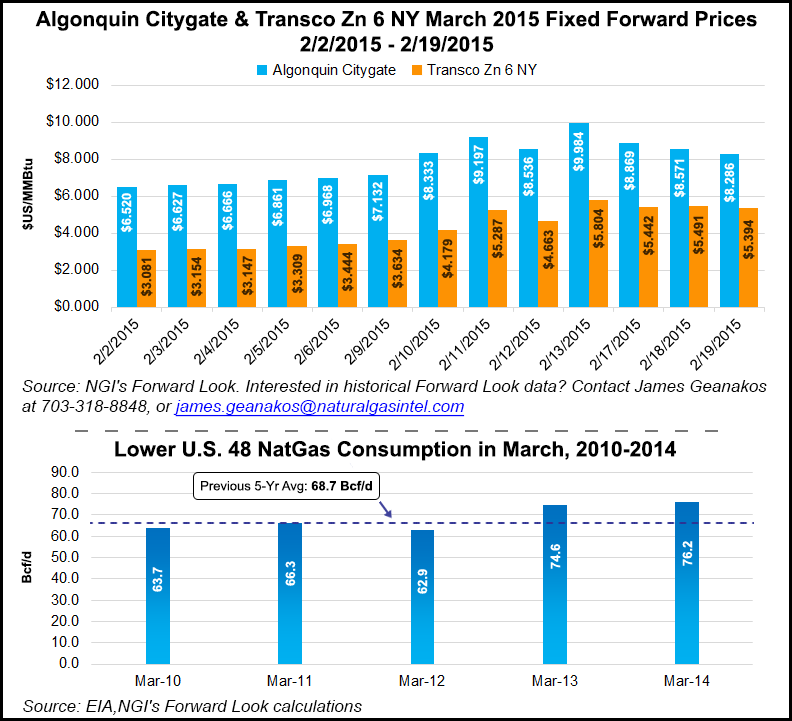

At the Algonquin Gas Transmission citygates, March basis plunged $1.728 between Friday and Thursday to reach plus $5.452/MMBtu, according to NGI’s Forward Look. There was no trading on Monday in observance of the President’s Day holiday.

Algonquin’s April package slipped just 2.7 cents to plus 60.8 cents/MMBtu, while the winter 2015-2016 dropped 12 cents to plus $6.85/MMBtu and the winter 2016-2017 plummeted 24 cents to plus $4.69/MMBtu.

“You have a difficult weather pattern to deal with – two warmer days on Saturday and Sunday,” a Northeast trader said. “Storage is fine, and the cold WILL end sometime in March. It’s not like it’s January, and you have a lot of time left.”

Still, forecasters appear to be in agreement that additional cold blasts will follow through the rest of the month. Several other weather systems are then expected to track across the northern US, with areas of rain and snow during the first week of March.

“What remains somewhat uncertain is just how much cold Canadian air each system will be able to tap,” forecasters with NatGasWeather said. “The weather data has been producing wildly varying solutions on what will ultimately transpire, and once again going into a weekend, there are ways very cold air over Canada continues to push into the northern U.S., but in an unconvincing fashion.”

Matt Rogers, president of Commodity Weather Group, agreed the cold would persist “fairly strongly” going into the first week of March, but said the pattern should then release its grip for the middle third of the month, especially for the Midwest and South.

“The Northeast may be the slowest to warm up, but should do so also during the middle third of March,” Rogers said. “We expect March to be colder than normal on the whole, but warmer than last year.”

Meanwhile, demand in the New England region was expected to reach its highest ever peak of 4.44 Bcf/d on Feb. 20 before sliding back to 3.26 Bcf/d by Feb. 27 and to 3.14 by March 5, according to projections by Genscape.

Forward prices elsewhere in the Northeast also were considerably lower despite the ongoing cold.

At Transco zone 6-New York, March basis fell 44 cents from Friday to Thursday to reach plus $2.56/MMBtu, while April basis slipped about 1 cent to minus 16.3 cents/MMBtu.

Unlike Algonquin, New York’s winter strips further out the curve posted sharp increases this week. New York’s winter 2015-2016 package was up 64 cents to plus $3.91/MMBtu, and winter 2016-2017 was up 29 cents to plus $3.16/MMBtu.

Texas Eastern Transmission zone M3 March dropped 9.4 cents to plus 40.1 cents/MMBtu, and April slid 5.6 cents to minus 61 cents/MMBtu. For the next two winter strips, prices were up 20 cents and 10 cents, respectively.

The declines at the front of the New York and M3 curves come as Appalachian demand is projected by Genscape to reach 24.99 Bcf/d Feb. 20 before sliding to 15.89 Bcf/d by Feb. 27 and to 15.16 Bcf/d by March 5.

In the Midwest, prices were on the rise as the frigid weather and strong demand buoyed the market.

At Michigan Consolidated, March basis climbed 15.6 cents from Friday to Thursday to hit plus 43.6 cents/MMBtu, but April barely budged and the next two winter strips picked up no more than 3 cents.

Similar price action was seen at the Chicago citygates, where March jumped 13 cents to plus 36 cents/MMBtu, and April stayed relatively flat. Gains of no more than a couple of cents were seen further out the curve.

Meanwhile, demand in the Midwest was expected to reach 15.12 Bcf/d on Feb. 20 and then fall to 13.18 Bcf/d by Feb. 27 and to 12.70 Bcf/d by March 5, according to Genscape.

On the production front, Genscape Senior Natural Gas Analyst Rick Margolin said while production in the Lower 48 has reached a 16-day low, freeze-offs are likely not to blame since the most dramatic declines were in areas not affected by the bone-chilling conditions seen in the Midwest and Northeast.

“The largest declines in the market are coming from the Gulf of Mexico, where today’s volumes are 0.27 Bcf/d below yesterday and 0.15 Bcf/d below the seven-day; Green River production is down 0.1 Bcf/d DOD and versus the seven-day,” Margolin said.

Still, some of the production declines are in areas currently experiencing extremely cold weather, he said. Ohio production is down 0.11 Bcf/d from both yesterday and the prior seven-day average, and Southwest Pennsylvania production is off 0.03 Bcf/d DOD and 0.14 Bcf/d below the seven-day. Arkansas production is flat to yesterday but 0.2 Bcf/d below the seven-day.

“This may be a result of freeze-offs given sufficient temperatures in the area, although none of the pipeline operators have issued their typical warnings or notices,” Margolin said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |