NatGas Forwards Leap 22 Cents On Looming Heat, Bullish Storage Report

What a difference a week makes. Just a week after plunging by the double digits, natural gas September forward prices vaulted an average 22 cents from Aug. 4 to 10 as weather forecasts became more convincing that the United States will experience more hot weather for the second half of August and into the first week of September.

A surprising bullish miss on this week’s storage report also worked to catapult the September price above the 40-day moving average and near the psychological $3 mark, according to NGI Forward Look.

It was a quiet start to the week as Nymex futures shifted only a couple of cents on both Monday and Tuesday. Wednesday brought about a more convincing 6-cent increase as weather forecasts showed a very warm to hot upper ridge covering much of the southern two-thirds of the United States beginning around Aug. 19.

“With much of the U.S. expected to be in the 80s and 90s during the last 10 days of August, national demand will again be moderately stronger than normal, especially when considering five-year average storage builds will be quickly increasing after next week’s report as we approach the second shoulder season,” forecaster NatGasWeather said, adding that it expects the strong high pressure to hold through the first few days of September as well.

Meanwhile, natural gas markets got another boost on Thursday when the U.S. Energy Information Administration (EIA) reported a storage injection that fell well short of expectations. The EIA reported a 28 Bcf build into storage inventories for the week ending Aug. 4, compared with estimates that converged in the mid-30s Bcf. As of Aug. 4, working gas in storage stood at 3,038 Bcf.

The injection miss drove the Nymex September futures price up 10.2 cents to $2.985, within arm’s reach of the 100- and 200-day moving averages of $3.074 and $3.096, respectively.

Thursday’s reported 28 Bcf build was 26 Bcf below the five-year average and a mere 4 Bcf ahead of the same week last year. For context, the same week last year was 19% warmer than the reference week, analysts with Mobius Risk Group said. On the surface, this implies that Thursday’s build was approximately 2.5 Bcf/d bullish versus the same week last year and more than 0.5 Bcf/d bullish versus the prior week, the Houston-based company said.

“Clearly one week’s data is not a trend, however, since the beginning of July, inventory builds indicate lower prices are having a material impact on natural gas balances,” Mobius said.

Stocks are now 275 Bcf less than last year at this time, but still 61 Bcf above the five-year average of 2,977 Bcf.

“The last week of July and the first week of August are typically the peak of summer heat … for all practical purposes, summer is over,” analysts with Tudor, Pickering, Holt & Company said. “So with summer in the rear view mirror and supply starting to grow, the outlook for gas prices continues to look bleak.”

For now, though, market bulls are back in the game as gas prices are back near $3. And with the upper ridge building back during the last 10 days of August, declines in storage surpluses will again accelerate and should be quite close to flipping to deficits versus the five-year average during the first few weeks of September, NatGasWeather said.

“The markets viewed this pace as not being fast enough to their liking the past several weeks based on strong selling. But now, all of a sudden, they have concerns, even though impacts from weather on supplies haven’t changed all that much,” the weather forecaster said.

August marks the annual high mark for gas burn, so what happens the next two weeks will likely have a lot to say about where storage ends up heading into winter, NGI’s Patrick Rau, director of commodity strategy and research, said.

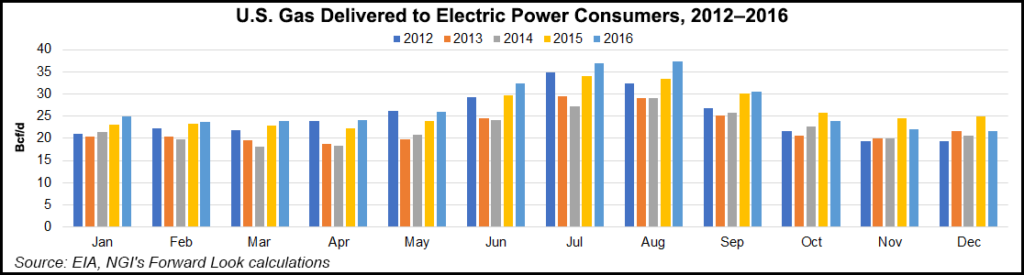

With prices back around $3, that increases the risk that power producers could flip back to coal, Rau said. August 2016 was the highest month in recent years in terms of gas delivered to power producers, at 37.2 Bcf/d.

“If deliveries fall short of that this August, then the current 275 Bcf year-over-year storage deficit could start to shrink, and according to EIA data, it looks like power burn exited July off quite a bit from last year’s pace.

On the other hand, last week featured cool temperatures across much of the U.S., but we still had a bullish storage number, so perhaps power generators aren’t switching away from gas too much just yet,” Rau said.

From a technical standpoint, September faces major resistance at $3, marked not only by the psychological $3 handle, but also by the near-term downtrend line. The September contract screamed higher after the bullish storage figure on Thursday, but the rally came to an abrupt halt once it hit that trend-line, Rau noted.

“To me, traders aren’t yet convinced that current fundamentals warrant a rise above that $3 mark,” Rau said.

On Friday, prices appeared to be taking a breather as the Nymex September futures contract was range-bound and traded in a tight range of less than five cents. The September contract ultimately settled at $2.983, down two-tenths of a cent.

But there are a host of other factors that bode well for market bulls. So much so that the EIA, in its August Short-Term Energy Outlook (STEO), increased its price forecast for the remainder of 2017 and 2018.

“In July, the average Henry Hub natural gas spot price was $2.98/MMBtu, about the same as in June,” EIA noted. “Higher natural gas exports and growing domestic natural gas consumption in 2018 contribute to the forecast Henry Hub natural gas spot price rising from an annual average of $3.06/MMBtu in 2017 to $3.29/MMBtu in 2018.”

Indeed, the U.S. is emerging as a net natural gas exporter in 2017, with exports exceeding imports in three of the first five months of the year, the EIA said Tuesday. “The United States has been a net natural gas importer on an average annual basis for nearly 60 years,” EIA said. “Declining pipeline imports from Canada, growing natural gas pipeline exports to Mexico and increasing exports of liquefied natural gas (LNG) are all contributing to the nation’s ongoing shift toward being a net exporter.”

Mexico gas exports reached near-record levels through May, averaging 4.04 Bcf/d, compared to an average 3.78 Bcf/d for full-year 2016, EIA said. Mexican exports have been increasing since 2010, when pipeline exports across the southern border averaged 0.91 Bcf/d.

Amid declining domestic production, Mexico has been deregulating its natural gas market as pipeline operators are expanding to get gas to the border. NGI has been tracking the growth in pipeline exports to Mexico and recently debuted the Mexico Border NatGas Flow Tracker.

The story has been similar for LNG, with Cheniere Energy Inc. last year shipping the first cargoes from its Sabine Pass terminal in Louisiana to mark the start of LNG exports from the Lower 48. Sabine Pass averaged a record 1.96 Bcf/d of exports in May, EIA said. Cheniere management said during a conference call Tuesday the Sabine Pass Train 4 is expected to produce its first commissioning cargo later this week.

Diving further into the futures and forwards markets, double-digit increases extended into the first part of 2018. Nymex September futures rose 21 cents from Aug. 4-10 to reach $2.985, while October futures jumped 20 cents to $3.017 and winter 2017-2018 shot up 15 cents to $3.23. The rest of the futures curve posted more modest gains of less than a dime, with the Nymex summer 2018 strip up 6 cents to $2.90 and winter 2018-2019 up 4 cents to $3.10. The calendar year 2018 strip was up a solid 8 cents to $3.02.

On a national level, most other pricing locations followed in line with Nymex futures, but Northeast points put up even more substantial gains over the Aug. 4-10 period. Appalachian markets saw September increases of around 35 cents on average amid news that a quorum has been restored to the U.S. Federal Energy Regulatory Commission, which is needed to approve pipeline projects like Spectra’s Nexus project and PennEast.

The Senate confirmed two new commissioners Aug. 3. Then on Aug. 10, former Pennsylvania state utility commissioner Robert Powelson (Republican) was sworn in, joining Commissioner Neil Chatterjee (Republican), who took the oath two days earlier, and holdover Commissioner Cheryl LaFleur (Democrat) in making up a quorum. The official completion of the quorum is expected to be the starting gun for a string of FERC orders on cases that have been backed up since February, when former Chairman Norman Bay resigned.

The new Commission has scheduled its first regular monthly open meeting for Sept. 20. The Commission doesn’t have to hold actions until the meeting, however. Now that it officially has a quorum, commissioners could vote notationally on individual items at any time.

Nexus Gas Transmission LLC has requested immediate action on its project application now that the Commission’s quorum has been restored. Nexus, a 255-mile, 1.5 Bcf/d natural gas pipeline being developed by Spectra Energy Partners LP and DTE Energy Co., was notably left behind when FERC issued a flurry of last-minute certificate orders before losing its quorum in February.

But even with FERC’s quorum restored, Nexus — like other key Northeast takeaway projects awaiting FERC action — isn’t in the clear yet, according to a recent note from BTU Analytics LLC Energy Analyst Matthew Hoza.

Looking at key Appalachian takeaway projects like Nexus, Rover, Atlantic Sunrise, the PennEast Pipeline, the Atlantic Coast Pipelineand the Mountain Valley Pipeline, “even with an approval, the path forward for all the projects above will still be bumpy as they all face obstacles beyond a FERC approval,” Hoza wrote.

“Nexus is facing limited commercial support with only two-thirds of its capacity subscribed, leaving it the only major greenfield in the Northeast not fully subscribed,” Hoza said. “In addition,TransCanada Mainline’s recently discounted tariff rates will make the MichCon/Dawn market even more competitive, hurting shippers’ netbacks on Nexus.”

Hoza noted that many regulatory roadblocks for these projects could come at the state level as well.

Still, the restored quorum was welcome news to the market as evident in the gains seen this week. At Dominion, September forward prices jumped 34 cents from Aug. 4-10 to reach $1.85, while October shot up 40 cents to $2.13, according to Forward Look. Basis prices for those months also closed the gap considerably, tightening by some 19 cents for the week.

Further out the forward curve, Dominion winter 2017-2018 prices climbed 19 cents during that time to $2.73, while the summer 2018 package moved up 8 cents to $2.38 and the winter 2018-2019 tacked on 4 cents to $2.63.

Transco Leidy September forward prices rose 34 cents from Aug. 4-10 to reach $1.876, October edged up 37 cents to $2.13 and the winter 2017-2018 climbed 17 cents to $2.67, Forward Look data show. Smaller, single-digit increases were seen further out the curve.

Gas production in the Marcellus and Utica shales has risen substantially in recent years, often outpacing gas pipeline capacity growth, which in turn has pressured regional prices lower relative to the benchmark Henry price.

“This price decrease reflects constrained pipeline takeaway capacity, which drives producers to lower their natural gas prices. Prior increases in takeaway capacity in the region have narrowed the basis,” the EIA said in its August STEO. That basis could be narrowed further if new pipeline projects are approved.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |