Markets | NGI All News Access | NGI Data

NatGas Cash Up A Nickel, Northern Border Ventura Flounders; Futures Gain 4 Cents

Physical gas for Tuesday delivery gained ground Monday as a strong screen and firm pricing in the East, Gulf and Midwest were able to overcome softer pricing in the Midcontinent and California.

The NGI National Spot Gas Average gained 6 cents to $1.66, and locations in the East were higher by more than 20 cents. Supportive weather forecasts helped lift futures, and at the close May had added 3.8 cents to $1.940 and June was up by 4.8 cents to $2.045. May crude oil recovered some of its early losses, but still shed 58 cents to $39.78/bbl.

In spite of gains at the national level, a number of points breached their 30-day lows, according to NGI data.

On the West Coast, quotes at Malin slid through its previous 30-day low of $1.60 to $1.56, and gas at NOVA/AECO C C posted a new all-time low of C87 cents/gigajoule, 1 cent lower than its 30-day low. Northwest Northwest Sumas came in at $1.06, well below its 30-day low of $1.18, and Stanfield was seen at $1.42, down 2 cents from its earlier 30-day low.

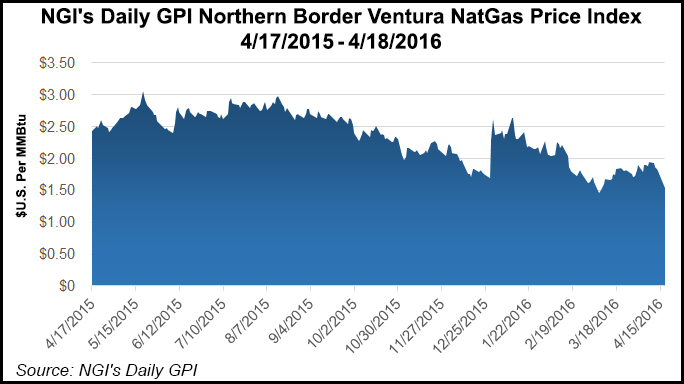

In the Midcontinent, a major pipeline outage prompted rerouting nearly 3/4 Bcf/d of gas headed to Midwest markets. Gas on Northern Border Ventura, at $1.38, fell 16 cents below its 30-day low, and quotes at NGPL Midcontinent Pool were seen at $1.53, 5 cents below its 30-day minimum.

Northern Border Pipeline incurred a force majeure event and was unable to flow gas past MLV 74 from Tuesday (April 19) until Friday (April 22). The event is expected to prevent gas from flowing through a section of pipe in Grundy County, IL southwest of Chicago, while pipeline repairs are made. According to industry consultant Genscape Inc., the outage will force a whopping 736 MMcf/d to be rerouted, which should impact market prices upstream at AECO and Ventura, and downstream at the Chicago Citygate.

In addition to West Coast and Midcontinent points, Rockies locations also dipped under their 30-day lows. Gas at the Cheyenne Hub changed hands at $1.51, 4 cents under its previous 30-day low, and gas on CIG came in at $1.47, a nickel under.

At eastern points, next-day gas got a boost from gains in next-day power pricing. Intercontinental Exchange reported on-peak Tuesday power at the ISO New England’s Massachusetts Hub rose $5.36 to $32.36/MWh, and next-day power at the PJM West terminal added $6.89 to $42.82/MWh.

At the Algonquin Citygate, gas for Tuesday delivery was quoted at $2.47, up 48 cents, and deliveries to Iroquois, Waddington gained 15 cents to $2.11. Gas on Tenn Zone 6 200L rose 64 cents to $2.48.

In the Mid-Atlantic, gas on Texas Eastern M-3, Delivery rose 4 cents to $1.34, and gas headed for New York City on Transco Zone 6 gained 9 cents to $1.40.

As positive as the move in the futures may seem, traders see time running out for the bulls.

“It’s still hovering in the $1.90s, and if we don’t get a close above $2 and maintain that close for a few days, you are not going to see much momentum to the upside,” a New York floor trader told NGI.

Other market centers firmed. Gas at the Chicago Citygate added 3 cents to $1.71, and parcels at the Henry Hub rose 4 cents to $1.76. Gas at the SoCal Citygate gained 6 cents to $1.87, and gas on Transwestern San Juan was flat at $1.58.

Genscape also reported the fifth liquefied natural gas shipment left last Friday (April 15) with the departure of the Creole Spirit carrying 3.67 Bcf. Shipments from Sabine Pass began in late February with the loading of the Asia Vision.

Risk managers expect the market to wait on how the summer cooling season develops.

“Natural gas will most likely be in a holding pattern until we get closer to the summer cooling season,” said DEVO Capital President Mike DeVooght. “If we get warmer than normal temperatures early in the season, we could move back into the mid-$2 range. On a trading basis, we will continue to stand aside and await further developments.”

However, DeVooght recommended that should the April-October strip reach $2.70, producer hedges should be implemented. The strip settled Friday at $2.127.

Commodity Weather Group President Matt Rogers, in his Monday morning report, noted cooler temperatures in more deferred time periods.

The themes noted in the previous outlook “continue again,” Rogers said, “with warmer changes this week over the Midwest and East contributing to some demand loss, and then cooler changes in the six-15 day over these same areas edging up late-season heating degree days (with primary impacts in the overnights over the Midwest and upper East).

“The upper-level pattern through the six-15 day continues to look fairly complicated, with high-latitude ridging into upper Canada and lots of undercutting energy into the West that brings precipitation there and across into Texas. By late spring, westerly/active Pacific flow offers more cooler than warmer risks.”

Market technicians said the market needed to hold key support levels if a test of previous market lows is to be avoided. “a=c off the $2.074 high targets the $1.869-1.862-1.842 zone; 1.618 a=c of the same targets $1.757,” said United ICAP analyst Brian LaRose in closing comments Friday.

“If natgas is going to have a chance at avoiding new lows, these are the levels that should be able to provide support,” he said. “Fail to find support and we would expect the $1.611 low to be challenged. Like last year, I suspect the direction of the rest of the petro complex will dictate where natgas goes from here.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |