NatGas Cash Mixed, But Futures Can’t Hold $3, Skid 6 Cents

Physical natural gas for Thursday delivery traded in a choppy, sideways fashion Wednesday, taking little guidance from changes in the weather outlook or the screen.

Weak pricing in the Midwest, Midcontinent, Louisiana and the Rockies outdid flat pricing in California and gains in West Texas. The NGI National Spot Gas Average fell 2 cents to $2.78.

Futures bulls were undone by a modest change in weather forecasts with a slight reduction in near-term cooling degree days (CDDs). At the close August had given up 6.2 cents to $2.985 and September was lower by 6.3 cents to $2.975. August crude oil continued its winning ways and rose 45 cents to $45.49/bbl.

With the exception of the Mid-Atlantic, temperatures were forecast to ease Thursday and Friday. AccuWeather.com predicted Boston’s Wednesday high of 84 degrees would drop to 75 Thursday and fall further to 64 by Friday, 18 degrees below normal. Chicago’s 82-degree high Wednesday was seen holding Thursday before falling to 75 Friday, 10 degrees below normal.

Philadelphia, on the other hand, was expected to see its 92-degree high Wednesday rise to an uncomfortable 97 Thursday before receding to 90 on Friday, 3 degrees above normal. The heat index Thursday was expected to reach 109 by mid-afternoon.

Next-day gas prices took the path of least resistance — lower. Gas at the Algonquin Citygate fell 9 cents to $2.63 and deliveries to Dominion South shed a penny to $2.23. Packages delivered on TETCO M-3 were seen 6 cents lower at $2.28, and gas headed for New York City on Transco Zone 6 eased 2 cents to $3.05.

Other market centers were also lower. Gas at the Chicago Citygates fell 2 cents to $2.86, and deliveries to the Henry Hub dropped a penny to $2.98. Gas on El Paso Permian was one of the brighter spots adding 8 cents to $2.59 while deliveries to Northern Natural Demarcation were quoted 4 cents lower at $2.77.

Parcels at Opal rose a nickel to $2.71, but gas on Transwestern San Juan changed hands 2 cents lower at $2.69. Gas on Kern Delivery was flat at $2.88 and gas priced at the SoCal Citygate fell 3 cents to $3.17.

August natural gas opened about 4 cents lower Wednesday morning at $3.01 as traders rethought their expectations of pervasive heat, and technical resistance loomed. Overnight oil markets firmed.

Weather models overnight shaved some of the expected heat in near-term forecasts. WSI Corp. in its six- to 10-day morning report to clients said the “period forecast is generally a bit warmer than yesterday’s forecast over the southern U.S., but the remainder of the continental United States is cooler or not as hot. As a result, Continental United States population-weighted CDDs are down 1 to 67.7 for the period, which are 11.8 above normal.

“Forecast confidence has improved and is a little better than average for a change as medium range models are in good agreement with the evolution of the mid-high latitude flow. There is a minor hotter risk over portions of the southern and eastern U.S. during the back half of the period.”

For the first two trading days of the week August futures have added over 18 cents, but that has yet to really catch the attention of technical analysts who still see seasonality in play.

“Have seen several measures of longer term support hold this past week,” said Brian LaRose, analyst at United ICAP. “On top of that, the longer term technicals are starting to display hints of bullishness. However, I would emphasize, it is far too soon to abandon the case for a deeper seasonal decline. For now we will be treating any rally as countertrend in nature.”

LaRose says he still has several candidates for resistance in the range of $3.10 to $3.30.

With stout technical resistance above the market, and new government price forecasts, the bulls have their work cut out for them.

For a second consecutive month, the Energy Information Administration (EIA) has lowered its natural gas price forecast, saying it expects Henry Hub spot prices to average $3.10/MMBtu this year and $3.40/MMBtu next year.

Those price forecasts, including in EIA’s latest Short-Term Energy Outlook (STEO), are both down from last month, when EIA forecast prices to average $3.16/MMBtu this year and $3.41/MMBtu in 2018. The May STEO included forecasts of $3.17/MMBtu in 2017 and $3.43/MMBtu next year.

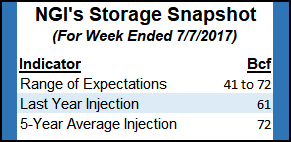

Analysts at Tudor Pickering Holt looking at Thursday’s storage report say that an expected print “would back up last week’s 2 Bcf/d structural undersupply continuing at 1 Bcf/d looser than the recent run of 3 Bcf/d undersupplied.” They contend the market is expecting a 57 Bcf injection versus 72 Bcf the previous week and the 72 Bcf five-year average on sequentially much hotter weather. Last year 61 Bcf was injected.

The week’s weather is showing 79 CDDs, “well above last week’s 56 CDDs though now in-line with seasonal norms. Weather adjusted market implied at 2 Bcf/d undersupplied…flat sequentially and behind the 3 Bcfd-plus undersupplied trend seen earlier in the year,” they said.

Other estimates include Wells Fargo at a 56 Bcf injection and Raymond James at a 65 Bcf injection. A Reuters survey of 24 traders and analysts showed an average 59 Bcf build with a range of +43 Bcf to +65 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |