NatGas Cash Gains Outpace Futures; May Still Sub-$2

Prices for natural gas for delivery Thursday staged a broad advance in Wednesday’s trading, and even a weak Northeast with points averaging about a dime loss couldn’t contain the market advance.

The NGI National Spot Gas Average rose 4 cents to $1.72. Despite the bullishness in cash, a futures settlement above $2 will have to wait another day as May added 1.5 cents to $1.996 after trading as high as $2.015. June gained 1.3 cents to $2.110. May crude oil added 4 cents to $38.32/bbl.

Midwest gas buyers have seen only a modest market response to the torrent of gas now moving west out of the Utica and Marcellus shales.

“It’s been so minor we really haven’t noticed anything,” said a gas purchaser for a Midwestern utility. “The main thing we are seeing is how flat [Northern Natural] Ventura is to [Northern Natural] Northern Natural Demarc, or even at times priced lower. When it’s priced lower it’s not that it is much lower, but a penny at most.

“We are not sure if it is because of that backup, or the lack of winter this year,” the gas purchaser said. “Historically, Ventura was always stronger. Depending on timing it could be a nickel or a dime, and now it has been fairly flat, if not inverted slightly. It’s kind of hard to judge things off this winter. There was really no demand anywhere.”

According to NGI, Northern Natural Demarc and Ventura both added more than a nickel. Gas for delivery Thursday at Northern Natural Demarcation came in at $1.82, up 9 cents, Northern Natural Ventura rose 8 cents 1.81. Gas on Alliance was seen at $1.86, also 9 cents higher, and deliveries to the Chicago Citygate added 12 cents to $1.95.

Gas delivered off the REX Zone 3 expansion traded close to even with Midcontinent delivery locations. Gas on REX at the interconnect with NGPL at Moultrie, County, IL, and deliveries to Panhandle Eastern at Putnam County, IN, added 9 cents to $1.81.Gas on Trunkline delivered to the Douglas County, IL, interconnect gained 9 cents to $1.82.

Major market trading points were stronger. Gas at the Henry Hub gained 7 cents to $1.84, and deliveries to Opal added 11 cents to $1.72. Gas priced at the SoCal Border Avg. Average changed hands 11 cents higher as well to $1.80.

“We have always been offered Rockies REX gas,” said the gas buyer. “Usually, it would be a Demarc minus price, but there is some risk involved. We would do an alternate receipt in primary delivery. We would pick it up in an alternate location, but deliver it to the same receipt point. Northern has been known to allocate that capacity.

“The pipelines want the shipper to pay to deliver it to Demarc, and then they want me to pay to transport it from Demarc. The pipeline gets paid twice,” the buyer said.

Going into the week’s trading, technical analysts noted that futures failed last week to breach key technical resistance, thus setting the stage for a move lower to test market support.

“The bear case for another set of new lows in natgas required a reversal lower by the $1.963 level,” United ICAP analysts said in a weekly report. “Natgas reversed lower from a $1.957 high [March 18]. The bull case pegs the $1.680 to $1.660 key support. The bear case suggests $1.590 to $1.510 key support.

“All of these levels are well within striking distance. And the background question is whether we get a preseason rally from one of these levels into a summer peak.”

The technical picture for natural gas changed with the strong performance by the expired April contract advancing nearly 10 cents Monday and Tuesday. In what may be a prescient comment Tuesday, technical analysts saw the market poised to break into new high territory.

It’s a “moment of truth for the bulls,” said United ICAP technical analyst Brian LaRose. “If this rally is legit, the May contract should be able to blow through $1.980 (flat price resistance) and $2.023-2.043-2.056 (May contract resistance).” If it succeeds, “there is immediate airspace up to $2.112-2.138 (a=c from 1.611) next.” But if it fails to punch through resistance, “a larger degree ABC type pattern will have an opportunity to develop from the $1.957 high.”

Forecasters are looking for cooler temperatures in the next few days.

“Next week’s brief cooler to colder period gets slightly stronger again on [Wednesday’s] update for the Midwest, South and East,” Commodity Weather Group President Matt Rogers said in a Wednesday morning six- to 10-day outlook. “There are also some cooler Western changes late next week,” versus Tuesday’s outlook.

“This idea of a bit more robust cooling next week goes back to the stronger-looking 11-15 day outlooks from last week, but the epicenter of coolest anomalies is more toward southeast Canada and the Northeast instead of the Midwest and Plains,” Rogers said. “Despite a second day of cooler adjustments, there are still cooler to colder risks to our outlook next week, especially toward the Northeast. Otherwise, the pattern trends warmer for the 11-15 day, but at a slightly slower pace again.”

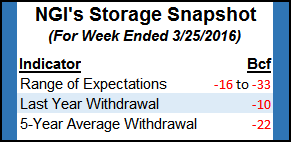

Estimates for the week’s storage report for the week ending March 25 are coming in at about a 20 Bcf withdrawal. Last year 10 Bcf was withdrawn and the five-year pace is for a 22 Bcf decline. Ritterbusch and Associates is calculating a 16 Bcf pull, and a Reuters survey of 24 traders and analysts revealed an average 22 Bcf withdrawal with a range of 16 Bcf to 33 Bcf. ICAP Energy is forecasting a 28 Bcf decline.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |