NatGas Cash, Futures Waltz Higher; September Adds 6 Cents

With the exception of sharp declines in the Northeast and Appalachia, physical natural gas for Thursday delivery posted solid gains, led in large part by a rising screen. All points outside the Northeast and Appalachia followed by NGI made gains, and the NGI National Spot Gas Average rose 7 cents to $2.62.

Futures prices were driven higher by forecasts of warmer temperatures later in the 11-15 day period. At the close Wednesday, September had risen 6.1 cents to $2.883, and October was up 6.0 cents to $2.920. September crude oil rose 39 cents to $49.56/bbl.

Northeast spot prices plunged as weather forecasts called for load-killing, cooler conditions. Wunderground.com forecast that Boston’s high Wednesday of 84 would ease to 80 Thursday and 78 Friday, 3 degrees below normal. New York City’s 82 high Wednesday was seen rising to 83 Thursday and falling to 80 by Friday, 4 degrees below normal.

Gas at the Algonquin Citygate shed 23 cents to $2.08, and gas on Tetco M-3 Delivery lost 9 cents to $1.63. Packages bound for New York City on Transco Zone 6 skidded 12 cents to $1.77, and deliveries to Dominion South shed 8 cents to $1.59.

“High pressure will bring dry, pleasant conditions and comfortable humidity levels through Thursday night,” said the National Weather Service in southeastern Massachusetts. “A series of air masses from the north/west will bring wet weather chances to the region through the weekend into next week, but not looking at a washout. [This will keep] sub-tropical moisture and more humid air at bay just immediately offshore…”

Elsewhere, prices firmed in concert with a firming screen. Gas at the Chicago Citygate rose 8 cents to $2.80, and gas at the Henry Hub was quoted 8 cents higher also at $2.85. Gas on El Paso Permian rose a stout 14 cents to $2.61, and gas on Northern Natural Demarcation changed hands 9 cents higher at $2.72.

Gas priced at the PG&E Citygate rose 6 cents to $3.26, and deliveries to the SoCal Citygate rose 20 cents to $3.23.

Traders were wrestling with the potential market-altering dynamics of the Rover Pipeline as construction of Rover’s Phase 1A should be completed next week, with Phase 2 on track to start-up in late November or early December, the management team for Energy Transfer Partners LP (ETP) said Wednesday.

Speaking to analysts during a 2Q2017 conference call, management for the Dallas-based midstreamer, which is backing Rover, said an ongoing FERC investigation into diesel fuel found near a Rover horizontal directional drilling (HDD) site shouldn’t present any issues in terms of bringing the project online before the end of the year, pending approval by the Federal Energy Regulatory Commission.

Market observers were circumspect about the pipeline’s eventual implementation. “From a consumer’s perspective, it will be great,” said Steve Blair, vice president at Rafferty Technical Research in New York. “From a trading perspective it’s just what the market needs, more supply, no summer weather, and more shale production,” he added sarcastically.

Traders looking for a return of warm weather got their wish with the day’s medium-term outlook. Wednesday’s “11-15 day period is warmer across the board, especially the South,” compared to Tuesday’s forecast, said WSI Corp. in a report to clients. Continental U.S. population-weighted cooling degree days “are up +3.3 to 50.6 for the period, and forecast confidence is considered near average levels.

“Models have begun to trend deeper with a Western Canadian trough, resulting in more of a ridge to build in across the East towards the latter half of the period. There are both warmer and colder risks to the East pattern, dependent on amplitude and southward extent of the trough over western Canada,” WSI said.

Other bullish factors include the emergence of the United States as a net natural gas exporter in 2017, with exports exceeding imports in three of the first five months of the year, the Energy Information Administration (EIA) said Tuesday. The United States was a net gas exporter in February, April and May, according to the latest EIA data.

“The United States has been a net natural gas importer on an average annual basis for nearly 60 years,” EIA said.

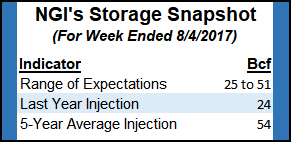

Traders’ eyes will be trained on the 10:30 a.m. release on Thursday of storage data by the EIA. Estimates continue to come in shy of the five-year pace of 54 Bcf. Wells Fargo Securities LLC is calculating a 35 Bcf injection. Tradition Energy is looking at a 40 Bcf build, and a Reuters survey of 24 traders revealed an average 36 Bcf increase with a range of +25 Bcf to +49 Bcf. Last year 24 Bcf was injected.

In its 2 p.m. EDT report on Wednesday, the National Hurricane Center reported that Tropical Storm Franklin was expected to make landfall in Mexico Wednesday evening as a hurricane.

Franklin on Wednesday afternoon had passed over the Yucatan Peninsula and was heading west toward Veracruz. It was located 135 miles east northeast of Veracruz with up to 70 mph winds, heading to the west at 13 mph.

The National Oceanic and Atmospheric Administration (NOAA) on Wednesday updated its Atlantic hurricane season outlook issued in May to reflect what it sees as a higher likelihood for an above-normal season.

The agency now is forecasting a 60% chance of an above-normal season, up from a 45% chance forecast in May. The season is now expected to see 14-19 named storms and two to five major hurricanes, compared to 11-17 named storms and 2-4 major hurricanes predicted in May.

“In just the first nine weeks of this season there have been six named storms, which is half the number of storms during an average six-month season and double the number of storms that would typically form by early August,” NOAA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |