Markets | NGI All News Access | NGI Data

NatGas Cash Fizzles, But Futures Shake Off Bearish Storage Data

Physical natural gas for Friday delivery fell about a dime Thursday as traders scurried to get trading done before the Energy Information Administration (EIA) storage report.

Outside of California losses were uniformly within a few pennies of a dime decline, but California locations, on average, shed close to 20 cents. The NGI National Spot Gas Average fell 11 cents to $2.50.

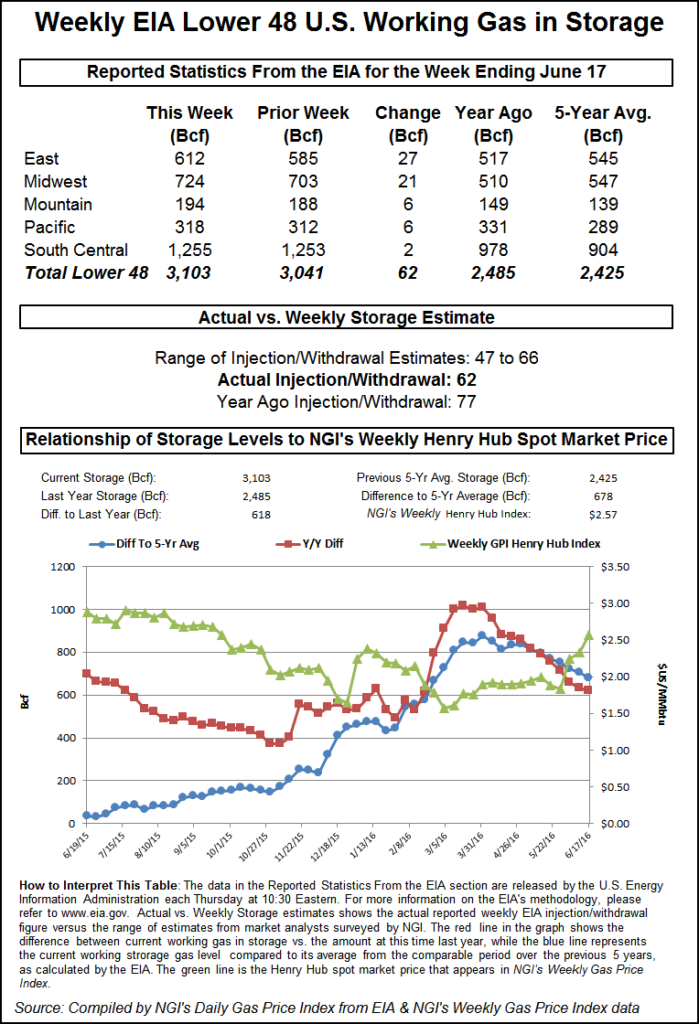

EIA reported a somewhat larger than expected storage build of 62 Bcf for the week ending June 17, about 4 Bcf above expectations, and prices eased initially only to recover by the end of trading. At the close, July had added 2.1 cents to $2.698 and August had gained 2.6 cents to $2.737. August crude oil rose 98 cents to $50.11/bbl.

Buyers of California gas for power generation reveled in their good fortune as loads decreased and next-day power prices softened as well. Intercontinental Exchange reported that next-day power at NP-15 fell $3.33 to $31.25/MWh and on-peak power at SP-15 fell 40 cents to $33.77/MWh. On-peak power at COB shed $2.11 to $19.96/MWh.

Next-day gas at Malin fell 12 cents to $2.55, and deliveries to the PG&E Citygate tumbled 27 cents to $2.75. Packages at the SoCal Citygate were down by 17 cents to $2.82, and gas priced at the SoCal Border Avg. Average dropped 19 cents to $2.65. Gas on El Paso S Mainline was seen a stout 20 cents lower at $2.67.

Major trading points were generally down pretty hard. Gas on Transco Zone 5 added 3 cents to $2.76, but deliveries to the Chicago Citygate skidded 11 cents to $2.62. Gas at the Henry Hub was quoted 10 cents lower at $2.68, and packages at Opal came in 9 cents lower at $2.52.

CAISO forecast that Thursday’s forecast peak load of 37,122 MW would ease slightly to 36,779 MW Friday.

Gas buyers can expect a return of western heat next week. According to weather blogger Steve Gregory of Wunderground.com, “While the extreme, record heat out West is easing off as record-setting upper-level heights fall some, Temps will remain well above normal across the entire western half of the nation for the next two weeks — with a possible resurgence to record levels west of the Continental Divide during week two.”

Going into the EIA storage report it was unclear whether traders might be in for a surprise adjustment. According to industry consultant Genscape, Monday saw SoCalGas report an adjustment to its storage inventory that could affect this week’s EIA storage number.

“SoCal announced on May 26 they would be adjusting system inventory down by 4.62 Bcf due to adjustments applicable to Aliso Canyon storage. However, the change was not actually reported on the SoCal website until this Monday,” Genscape said.

“At this point it is unclear when SoCal will report this change to the EIA and when it will appear in EIA’s weekly storage report. Significant adjustments are required to be reported to EIA, and adjustments greater or equal to 4 Bcf are noted in the weekly report. However, the timing of when the adjustment makes it into the report depends on when SoCal reports it to EIA. Last fall, ANR posted a surprise 9 Bcf inventory change midweek, which was reported in that week’s report released the following Thursday.”

“They are not obligated to tell EIA the moment they know anything,” Energy Metro Desk publisher John Sodergreen told NGI.

“If they told them three days after the fact, that is very possible, but the rules are very vague as to what people have to do or necessarily not have to do, particularly if they are intrastate. If they don’t go outside the state [which SoCalGas doesn’t], what they post is voluntary.

“The adjustment didn’t show up this week, but it might show up next week, or the week after. That just gives you a little sense of angst. There may be internal reporting issues. Did they reduce it all at once or factor it in over a period of days?”

With or without the 4.62 Bcf adjustment, additions to inventory once again failed to reach longer-term averages. Last year 71 Bcf was injected and the five-year pace stands at a stout 88 Bcf. IAF Advisors calculated an inventory gain of 60 Bcf while United ICAP was looking for a build of 64 Bcf. Citi Futures Perspective expected an increase of 56 Bcf and the Energy Metro Desk survey resulted in a 60 Bcf estimate.

Inventories now stand at 3,103 Bcf and are 618 Bcf greater than last year and 678 Bcf more than the five-year average. In the East Region 27 Bcf were injected and the Midwest Region saw inventories increase by 21 Bcf . Stocks in the Mountain Region rose 6 Bcf, and the Pacific Region was higher by 6 Bcf. The South Central Region added 2 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |