Markets | NGI All News Access | NGI Data

NatGas Cash Eases, But Futures Barely Move After Fresh Storage Data

Physical natural gas for Friday delivery slipped lower as traders hunkered down and got their deals done ahead of the Energy Information Administration (EIA) inventory report.

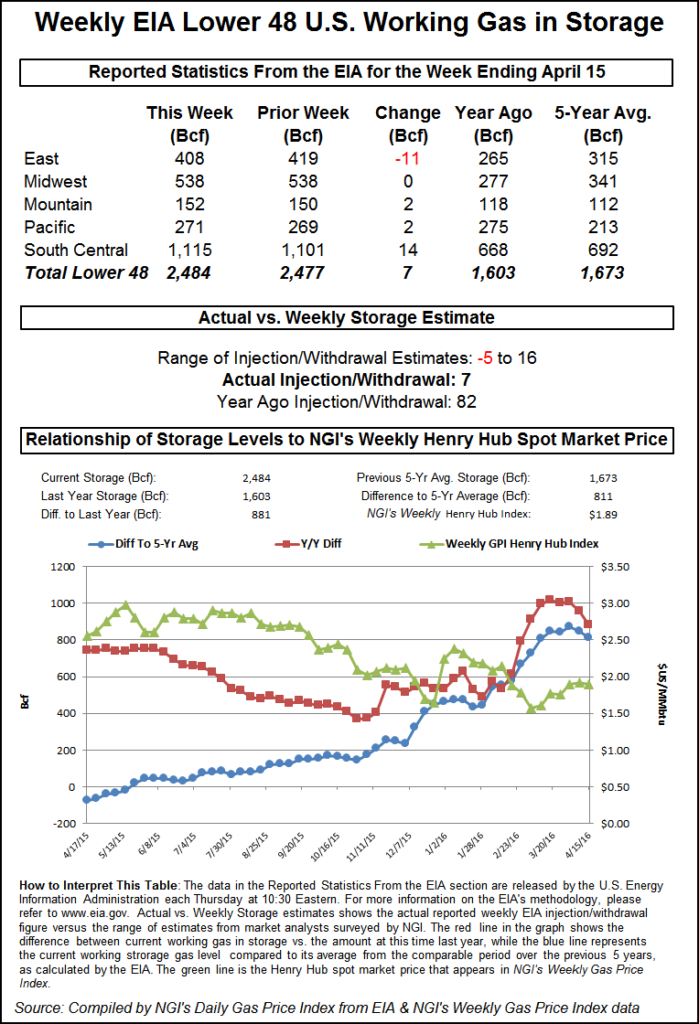

Strength in the East was unable to overcome setbacks in the Rockies and California, and the NGI National Spot Gas Average fell 4 cents to $1.81. The EIA reported a storage build of 7 Bcf, about 3 Bcf greater than market expectations, and traders, for the most part, ignored the bearish implications. May eased to a one-tenth cent loss to $2.068 and June and more deferred contracts added anywhere from 1 to 2 cents. June crude oil skidded $1.00 to $43.18/bbl.

Next-day gas on the West Coast slumped as power loads were forecast lower and next-day power prices fell. The California Independent System Operator forecast that Thursday’s peak load of 29,743 MW would fall to 28,161 MW Friday. Intercontinental Exchange reported that next-day on-peak power at NP-15 tumbled $5.87 to $21.30/MWh. Friday peak power at SP-15 dropped $6.93 to $16.66/MWh.

Friday gas at Malin shed a dime to $1.79, and deliveries to PG&E Citygate fell 5 cents to $2.04. Gas at the SoCal Citygate gave up 11 cents to $2.00, and gas priced at the SoCal Border Avg. Average changed hands 11 cents lower at $1.83. Gas on El Paso S. Mainline/N. Baja retreated 11 cents to $1.85.

On the East Coast, well above normal temperature forecasts prompted weakness in next-day gas. Forecaster Wunderground.com said Boston’s Thursday high of 77 degrees would dip to 76 Friday before sliding to 62 Saturday, 4 degrees above normal. New York City’s 75 maximum Thursday was seen rising 4 degrees Friday to 79 and then easing to 71 degrees Saturday, still 8 degrees above its seasonal norm. In Philadelphia, Thursday’s 74 high was anticipated to jump to 80 Friday before settling back to 73 Saturday, 10 degrees above normal.

Deliveries to the Algonquin Citygate fell 7 cents to $2.21, and gas at Iroquois, Waddington changed hands 4 cents lower at $2.15. Gas on Tenn Zone 6 200L fell 3 cents to $2.07.

In the Mid-Atlantic, gas on Texas Eastern M-3, Delivery dropped 7 cents to $1.35, and gas bound for New York City on Transco Zone 6 fell 9 cents to $1.37.

In the futures arena, traders were keying in on the 10:30 a.m. EDT release of EIA storage data. EIA reported a build of 7 Bcf, about 3 Bcf more than what traders were anticipating. May futures were trading at about $2.077 just prior to the release of the data. and by 10:45 a.m. May was trading at $2.099, up 3.0 cents from Wednesday’s settlement.

Prior to the release of the data, estimates were coming in somewhat lower. A Reuters survey of 21 traders and analysts revealed an average 4 Bcf build, thus making the report somewhat bearish. If the assumption is made of a bearish report and the market is still able to post gains, that is often construed as a sign of underlying market strength.

“The build of 7 Bcf was modestly more than the consensus expectation and therefore a bearish influence on market sentiment, although the figure was still supportive on a seasonally adjusted basis compared with the 46 Bcf five-year average gain,” said Tim Evans of Citi Futures Perspective. “The larger than expected build does imply a somewhat weaker supply/demand balance, however, which may carry over into the reports to follow.”

Inventories now stand at 2,484 Bcf and are a robust 881 Bcf greater than last year and 811 Bcf more than the five-year average. In the East Region 11 Bcf was withdrawn and the Midwest Region saw inventories unchanged. Stocks in the Mountain Region rose 2 Bcf, and the Pacific Region was higher by 2 Bcf as well. The South Central Region added 14 Bcf.

May futures stumbled to a 2-cent loss Wednesday after posting a 60-day high at $2.137, and some traders were thinking the near-term lows are in. “We are still closing above the $2 range, which is a good sign,” said a New York floor trader. “Anything under $2, in the $1.90s might be a good opportunity to get in. Let’s see if this thing continues this way.”

Shoulder season storage is always difficult to forecast, yet ahead of the storage report observers weren’t expecting any surprises. John Sodergreen publisher of Energy Metro Desk said that “none of our usual indicators point to a 5 Bcf surprise out of EIA this week. Our survey range is an underwhelming 10 Bcf wide. The spread between the three categories we track is also relatively low, at 1.2 Bcf (if the spread was 3 Bcf or higher, it would signal a possible surprise).”

The EMD survey came in at a 4 Bcf increase yet its GWDD Model was higher at 8 Bcf. “May be a bumpy ride,” he said.

This is likely to be the last of the thin builds for a while. The National Weather Service (NWS) forecasts well below normal heating requirements for the week ended April 23. NWS predicts New England will see just 89 HDDs, or 38 below normal, and New York, New Jersey and Pennsylvania will have just 69 HDD, or 36 below its normal seasonal tally. The Midwest from Ohio to Wisconsin is anticipated to see just 45 HDD, or 62 below its seasonal tally.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |