NGI The Weekly Gas Market Report | E&P | M&A | NGI All News Access

Murphy Oil Snaps Up Deepwater GOM Assets for $1.375B

Murphy Oil Corp. on Tuesday said it has snapped up producing deepwater Gulf of Mexico (GOM) assets from units of LLOG Exploration Co. for $1.375 billion.

Murphy Exploration & Production Co.-USA entered into a definitive agreement to acquire the assets, which are producing 38,000 boe/d net, from LLOG Exploration Offshore LLC and LLOG Bluewater Holdings LLC.

The transaction, set to be completed by the end of June, is expected to add 66 million boe net of proven reserves and 122 million boe of proven and probable reserves, the El Dorado, AR-based independent said.

In addition to the initial payment, Murphy may pay up to $200 million more in the event that revenue from the properties exceeds certain contractual thresholds between 2019 and 2022, as well as another $50 million following first oil from some of the development projects.

“This immediately accretive transaction continues to strengthen our Gulf of Mexico portfolio by adding quality assets at a very attractive price,” CEO Roger W. Jenkins said. “We expect these newly acquired assets to generate meaningful cash flow over the next several years that will provide us with additional flexibility for future capital allocation.

“Since selling our refining business and successfully spinning out our retail gasoline business over five years ago, we have implemented significant strategic changes in revamping Murphy’s portfolio. Specifically, over the last few months alone we have increased our deepwater, oil-weighted, tax advantaged, Gulf of Mexico assets while we simplified our company by divesting our Malaysian portfolio, again at a very attractive price.”

Murphy in March agreed to sell its Malaysian portfolio for around $2 billion to put more capital to work in the GOM and Eagle Ford Shale with the sale of Malaysian assets.

Jenkins said what he was “most proud of is that through these transactions we have created significant shareholder value. As a result, we have increased our ability to generate meaningfully more cash flow in our long term plan as Murphy is now positioned to grow oil production with an overall compound annual growth rate of 7-9%, all while maintaining our compelling dividend, repurchasing our stock, and decreasing our debt levels.”

The acquired assets would be fully owned by Murphy and not part of MP Gulf of Mexico LLC, which owns all of Murphy’s producing GOM assets.

The transaction would add about 32,000-35,000 boe/d net on an annualized basis this year to Murphy’s GOM output, 60% weighted to oil. Total Murphy GOM output this year is now expected to be 85,000 boe/d net.

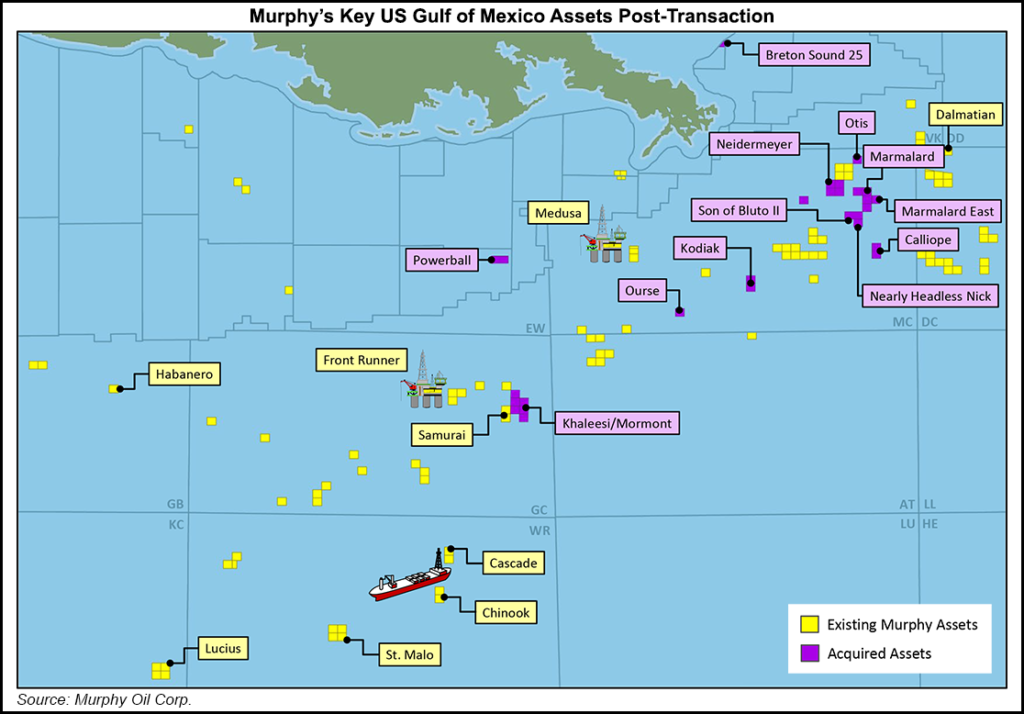

The deal would increase the producer’s deepwater offshore footprint with the addition of 26 GOM blocks that include seven producing fields and four development projects with future start-ups in the Mississippi Canyon and Green Canyon areas. It also would expand operated production across the GOM to 66% of daily output from 49%.

Lease operating expense for the acquired assets is estimated at $10-12/boe.

The acquisition cost of the acquired asset is about $20.75/boe for the proven reserves and $11.25/boe for the proven/probable reserves. The implied cost per flowing barrel of oil equivalent, based on current production, is around $36,200/boe.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |