Marcellus | E&P | NGI All News Access | Utica Shale

MPLX Lowers Capex, Growth Rate Expectations in Response to Downturn

With the MarkWest Energy Partners LP/MPLX LP merger completed in December, the master limited partnership (MLP) reported its 4Q2015 results Wednesday, announcing that it has lowered its projected 2016 capital expenditures (capex) and revised down its expected distribution growth rate in response to the ongoing commodity downturn.

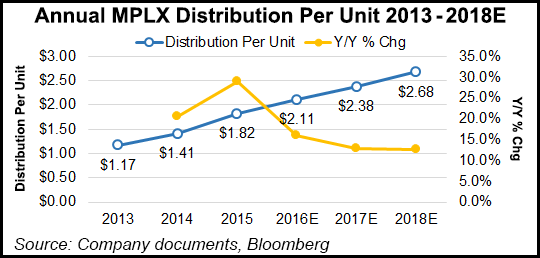

MPLX CEO Gary Heminger told analysts during the MLP’s 4Q2015 earnings call that it expects a 12-15% distribution growth rate for 2016, revised from its previous expectation of 25%.

“The continued decline in commodity prices and the market’s increasing belief that these conditions will persist for some period of time has a direct impact on our producer customers,” Heminger said. “While our producers are in some of the best areas and continue to manage capital production plans very carefully, changes in volume growth will continue to impact income growth for the partnership.”

CFO Nancy Buese said MPLX expects 2016 capex to be $1-1.5 billion, with the midpoint representing a $450 million decrease from its previous forecast of $1.7 billion.

The focus in 2016 will be on supporting growth in MPLX’s producer customers and to “complete new projects on a just-in-time basis, which results in higher utilization of our existing facilities. The majority of our organic growth investments are focused on supporting producers’ requirements for gathering, processing and fractionation services in the Marcellus and Utica shales, where we forecast overall processed volumes to increase by approximately 20% in 2016.”

MPLX forecasts average utilization rates of 80% for its Marcellus facilities and 85% for its Utica facilities, President Donald Templin said.

For the quarter, the company’s gathering and processing segment, which represents the MarkWest side of the business, processed over 3.9 Bcf/d in the Marcellus and Utica, up 22% year/year, while it operated a total of 5.2 Bcf/d in processing capacity.

“We expect processed volumes to increase by another 20% in 2016 as producers continue developing their rich gas acreage positions in these high-performance resource plays,” Templin said.

In 4Q2015, the company fractionated over 250,000 b/d of ethane and heavier natural gas liquids (NGL) in the Marcellus/Utica, expanding total fractionation capabilities to over 400,000 b/d with the completion of new facilities at the Keystone complex in Pennsylvania and the Sherwood complex in West Virginia. Total fractionated volumes in the region are forecast to increase 30% in 2016, Templin said.

Templin said the company is “making strong progress” on its Cornerstone Pipeline project in Ohio, which will be aimed at moving “condensate, natural gasoline and ultimately butane out of the Utica and Marcellus to demand centers throughout the Midwest and Western Canada. We expect to place the pipeline into service by the end of 2016.”

In the Southwest, processed volumes were 1 Bcf/d during the quarter, with average utilization of 79%. “We are making great progress on construction of our new Hidalgo Complex, which is on track to be completed during the second quarter of this year and will mark our entry into the prolific Permian Basin. In addition, we continued to expand our position in the Cana-Woodford Shale to support the exciting growth occurring” there, Templin said. “We forecast year/year processed volumes to grow by approximately 15% in 2016 as our producers continue to develop highly productive acreage in Texas and Oklahoma.”

For its logistics and storage segment, generally corresponding to the MPLX side of the business, Templin said the company completed an expansion of its Patoka, IL, tank farm, adding over 1.2 million bbl through a fee-for-capacity contract with Marathon Petroleum Corp. (MPC). This “increases our storage capacity to support the startup of the Southern Access Extension pipeline, which commenced operations at the end of 2015.”

MPLX will also acquire a substantial portion of MPC’s marine business in 2Q2016, Templin said, describing the deal as “a great example of strong sponsor support.

“MPC has offered to contribute its marine transportation business to the partnership at a supportive multiple, with funding anticipated to consist entirely of MPLX equity issued to MPC. MPC’s marine business is a fully-integrated waterborne transportation service provider, capable of moving light products, heavy oils, crude oil, renewable fuels, chemicals and feedstocks throughout the interior river system” of the United States. Assets include 18 tow boats, 205 tank barges and “a state-of-the-art repair facility.”

Heminger said the resources available through MPC’s sponsorship will “provide tremendous flexibility to the partnership as we navigate through this very challenging environment. We think this will become very evident once we complete our marine dropdown process over the next several months.”

Total gathering throughput for the quarter was 3.075 Bcf/d, with total natural gas processed volumes reaching 5.468 Bcf/d and 307 million b/d of total NGLs fractionated.

For the quarter, MPLX reported a net loss of $20 million (minus 14 cents/share) after factoring in limited partners’ interest in income attributable to the partnership, down from net income of $27 million in the year-ago quarter. The company reported a net income of $99 million for full-year 2015 ($1.23/share), down from $115 million ($1.55/share) in 2014.

The partnership reported $227 million in total distributable cash flow (DCF) after accounting for the MarkWest merger, compared with $32 million in the year-ago. Full-year 2015 DCF was $399 million, compared with $137 million in 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |