Mostly Oil Rigs Return; Associated NatGas Production Won’t Be Enough, Analyst Says

More rigs came back during the week just ended, natgas-directed units, too, according to Baker Hughes Inc. (BHI). Meanwhile, analysts are looking to new natural gas takeaway capacity and production growth, particularly in the Northeast.

One-dozen rigs returned to the Permian Basin, and that propelled Texas to an overall gain of seven units during the week. But the good news for the energy patch isn’t confined to the Permian or to Texas.

“Growth in the Permian has been well documented, but natural gas-heavy basins like the Marcellus, Utica, Haynesville and Eagle Ford have been ramping as well,” East Daley Capital said in a recent note. “The southwestern Marcellus and Utica have seen rig counts nearly triple as producers ramp production into the startup of Energy Transfer’s Rover Pipeline.”

Besides Rover, TransCanada Corp.’s Leach Xpress and Rayne Xpress, and Transcontinental Gas Pipe Line Co. Dalton Project and mainline reversal for the Atlantic Sunrise Project should also serve to debottleneck the Marcellus and Utica later this year, the firm said. The company’s Leach and Rayne XPress projects received certificates in January.

Societe Generale analyst Breanne Dougherty is looking to the same shale plays and waiting for some production growth.

“There has yet to be any signs from the production base of a re-orientation to growth,” Dougherty said in a note Friday. “Between January and December 2016, the shale play that delivered the most amount of gas growth was the Permian (+1.1 Bcf/d); Marcellus growth was under +0.5 Bcf/d, Utica was only slightly better. Most importantly, growth from those shale plays was not enough to offset wider U.S. natural gas declines.

“As we look to our near-term base-case production growth outlook, we expect continued associated gas growth from oil-directed drilling in the Permian, but it will have to be complemented by a strong re-acceleration of growth in the northeast (both Marcellus and Utica) and also a re-orientation to growth in the Haynesville.”

According to BHI, during the week ending Friday (April 7) the Marcellus picked up one rig to rest at 45, up from 29 one year ago. The Utica was flat with 22 rigs, up from 12 one year ago. The Haynesville Shale was also flat for the week at 38 but up significantly from 12 rigs one year ago. The Eagle Ford lost one rig to end the week at 72 but still up from 43 one year ago.

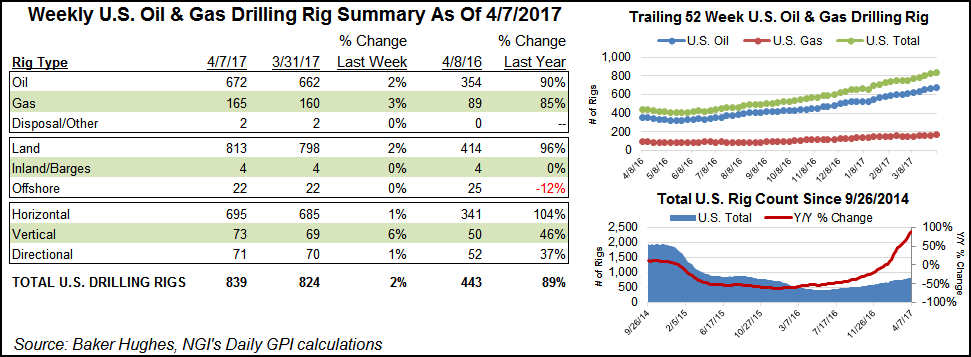

Overall, the U.S. land rig count gained 15 units to end the week at 813; add in the static inland waters and offshore counts of four and 22, respectively, and the U.S. count ended at 839 for the week.

Ten U.S. oil rigs returned along with five natural gas units. Ten horizontals, one directional and four vertical units returned.

Canada continued the spring breakup stampede and dropped 23 rigs to end at 132 active. Thirteen oil rigs left along with 10 natural gas units.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |