E&P | NGI All News Access | Permian Basin

More Than Ever, Permian Drillbits Going Sideways

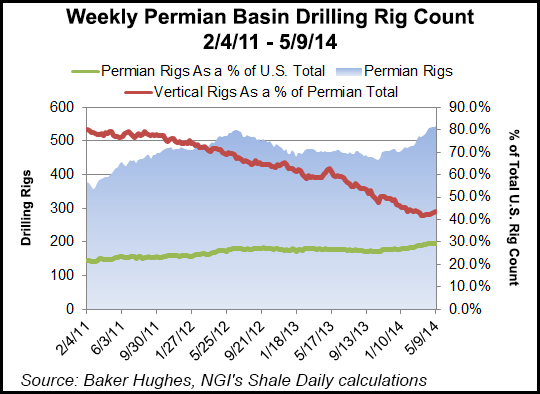

Over the last five months, the number of horizontal drilling rigs targeting oil in the Permian Basin of West Texas and southeastern New Mexico has climbed by more than five dozen, according to the U.S. Energy Information Administration (EIA), marking a steep ramp-up in activity.

“A change in the horizontal, oil-directed rig count of the scale seen in the Permian indicates a significant rise in activity in its tight oil plays relative to recent developments in other major production areas,” the agency said.

At the start of last year, South Texas’ Eagle Ford Shale and the Williston Basin in North Dakota and Montana had more oil-directed horizontal rigs than the Permian. But by the end of the year, the 215 rigs in the Permian topped the Eagle Ford (173 rigs) and Williston (164 rigs).

“During the first quarter of 2014, the increase in oil-directed horizontal rigs in the Permian Basin was more than four times the combined increase in the Eagle Ford and Williston Basin,” EIA said.

According to the Baker Hughes Rig Count for May 9, there were 545 rigs running in the Permian, up 16% from a year ago when the basin had 468 rigs. These figures include rigs targeting conventional formations as well as those typically drilled with horizontal rigs. Meanwhile as of May 9, the Eagle Ford had 218 rigs and the Williston Basin had 182. The Eagle Ford count was down 7% from a year ago, and the Williston count was down by 3%.

Producers are going after tight oil in stacked pay zones in formations such as Spraberry, Wolfcamp and Bone Spring. During the first quarter, nearly 80% of all new horizontal, oil-directed drilling in the Permian took place in five counties that contained such formations.

The Texas counties are Reeves (14 rig increase); Ward County (nine rig increase); Martin and Midland (eight rigs each). Martin and Midland counties typically rank among the top oil-producing counties in Texas, according to monthly data compiled by the Railroad Commission of Texas (see Shale Daily,April 28). In New Mexico, Eddy County saw an increase of six rigs.

During the first quarter, Texas statewide oil production grew further from already robust levels, reaching heights not seen since 1980, according to an economist who tracks Texas industry data for the Texas Alliance of Energy Producers (see Shale Daily, April 15).

“Texas producers increased oil output by more than 22% in February compared to February 2013, and natural gas production was up about 1.0%,” said economist Karr Ingham.

“Combined with higher wellhead prices for both commodities, the value of oil and gas produced in Texas during February increased by more than $2.85 billion in the past year to about $10.63 billion.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |