NGI Archives | NGI All News Access

More Processing Capacity on Tap for Mississippian Lime Producers

Caballo Energy LLC is building a cryogenic gas processing plant to serve expanding production in the liquids-rich Mississippian Lime and Cana Woodford Shale plays.

The Carmen Gas Processing Plant will have capacity to process 60 MMcf/d, bringing Caballo’s processing capacity in the region to about 100 MMcf/d. The Carmen plant will be in service by the end of the first quarter of 2013, the company said. The plant would be near Carmen, OK, at the intersection of the liquids-rich Mississippi Lime and Cana Woodford Shale. The 160-acre site would allow for the construction of a second cryogenic plant at the same location.

“The construction of the Carmen plant is a first but very important step in our expansion of the Eagle Chief system,” said Caballo CEO Bob Firth. “The liquids-rich gas found in the Mississippi Lime and Cana Woodford shale formations provides an attractive return for producers, even under current pricing conditions. We believe this area has significant potential for future growth…”

The Carmen plant and Caballo’s existing Eagle Chief plant serve the company’s Eagle Chief system, which includes more than 600 miles of gathering pipelines and compression facilities in Alfalfa, Blaine, Garfield, Major and Woods counties in Oklahoma. Caballo delivers processed gas to Oneok Gas Transportation and Panhandle Eastern Pipe Line.

Natural gas liquids (NGL) are delivered to the Oneok NGL Pipeline. The Eagle Chief system also includes salt water disposal and crude oil gathering systems. Caballo acquired the Eagle Chief system in December 2011.

Some producers view the Mississippian Lime as being cheaper to develop than the Bakken Shale of North Dakota. Last month, IHS Herold in a report highlighted increased interest in the play, which stretches across northern Oklahoma, western Kansas and southern Nebraska (see Shale Daily, Aug. 6).

“The Mississippian’s highly variable drilling results to date, combined with increasing entry costs, might deter new entrants, but recent drilling reports suggest results could improve as knowledge of the play and technical adjustments increase,” said Paul O’Donnell, energy equity analyst at IHS, and author of the report. “This is a shallow carbonate play with depths ranging from 3,000 feet to 6,000 feet, and since it’s shallower than other U.S. unconventional plays, operators can employ less-expensive, lower horsepower rigs to drill it.”

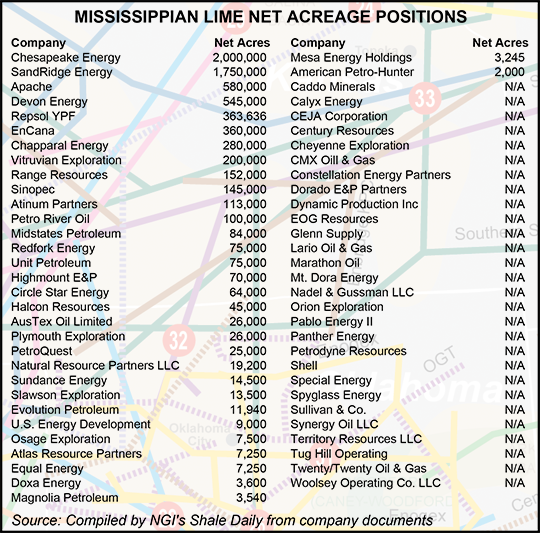

Producers are lining up to develop the play. According to NGI‘s Shale Daily research, Chesapeake Energy holds the largest position in the Mississippian Lime with 2 million net acres. Rounding out the top five are SandRidge Energy (1.75 million net acres), Apache (580,000 net acres), Devon Energy (545,000 net acres) and Repsol YPF (363,636 net acres).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |