NGI Mexico GPI | Infrastructure | NGI All News Access

More Natural Gas Infrastructure in Queue to Move Supply from Permian to Southern Markets

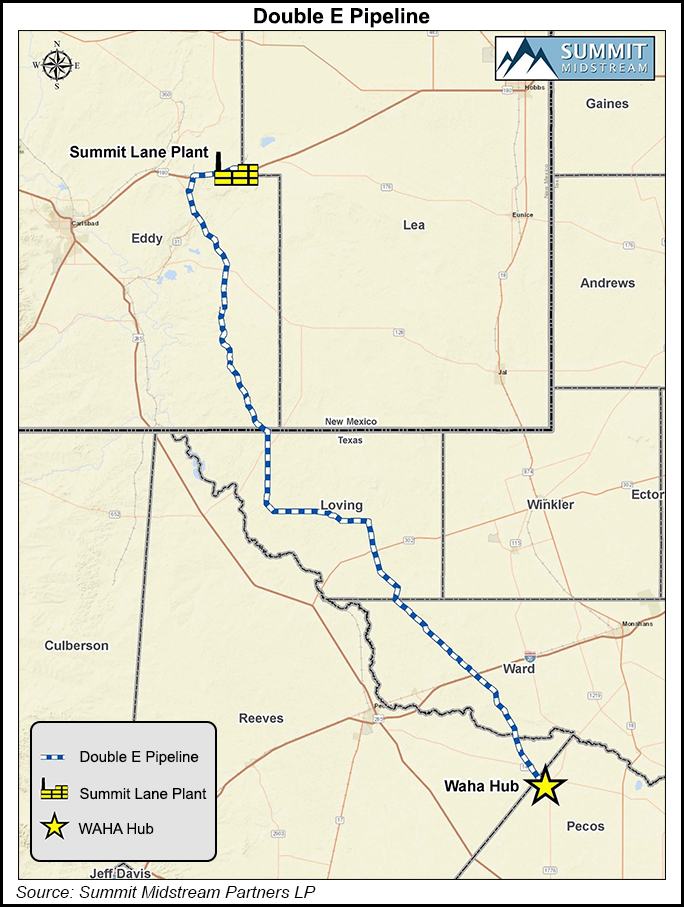

The Double E Pipeline, sanctioned in late June by Summit Midstream Partners LP, would carry up to 1.35 Bcf/d from the Permian Delaware to the Waha hub and beyond.

Summit, headquartered in The Woodlands north of Houston, said the final investment decision (FID) was issued after securing “sufficient” binding commitments for long-term, firm transportation service. Joint venture (JV) agreements also were secured with an affiliate of Double E’s undisclosed foundation shipper.

“We are excited to announce our FID on the Double E Pipeline Project, which will provide critical energy infrastructure for rapidly growing residue natural gas volumes in the northern Delaware Basin,” said CEO Leonard Mallett. “The Double E Project will serve an infrastructure-constrained area, alleviate natural gas flaring, and provide access to growing markets along the U.S. Gulf Coast.”

Double E “is a marquee project” for the partnership, “and when combined with our existing gathering and processing operations in the Permian Basin, promotes our strategy of achieving scale, diversifying our operations downstream of wellhead gathering and becoming more integrated in our core focus areas.”

Although the JV partner for Double E was not disclosed, ExxonMobil Corp.’s XTO Energy Inc. and Summit in 2017 teamed up to develop and operate an associated gas gathering and processing system to serve Permian operators in New Mexico.

XTO has been active in securing oil and gas capacity to move supply from its No. 1 U.S. onshore target. Last year it also signed a letter of intent to take up to 450,000 Dth/d of capacity on the Permian Highway Project (PHP).

Double E expects to file its application with the Federal Energy Regulatory Commission in 3Q2019. An in-service date is estimated for 3Q2021 pending approvals.

With the PHP FID long in place, work already is underway on the Kinder Morgan Inc.-led pipeline, a 2 Bcf/d, $2 billion system that would move gas to the Gulf Coast. A court challenge by Texas landowners had threatened to derail the work, but last month a Texas court alleviated near-term worries.

The Travis County District Court’s decision, pending appeal, crushed a challenge by landowners to the licensing process at the Railroad Commission of Texas (RRC), which allows pipeline operators to determine the route and acquire land without a landowner’s consent.

The 42-inch diameter pipeline, which could be in service by late 2020, was sanctioned last year by Kinder Morgan Texas Pipeline LLC and EagleClaw Midstream Ventures LLC. Altus Midstream Co., which owns most of Apache Corp.’s gas-rich assets in the Alpine High in West Texas, in May acquired a 26.7% stake.

PHP would move gas through a 430-mile pipeline from Waha to Katy, west of Houston, with connections to the Gulf Coast and Mexico markets. Shippers already committed include EagleClaw, Apache and XTO.

Plaintiffs had argued that the RRC had not sought public comments or properly supervised the pipeline’s route, which would move gas through the iconic Texas Hill Country. They argued that PHP would cross “sensitive environmental features,” including endangered species habitats, sites of historical significance and residential subdivisions.

Kinder’s Tom Martin, president of natural gas pipelines, said the Houston-based operator was encouraged by the ruling.

“The court’s finding validates the process established in Texas for the development of natural gas utility projects, as well as the steps we have taken to comply with that process,” he said. “We will continue to engage all stakeholders as we work to complete PHP.”

The state’s eminent domain process “ensures that no single landowner can block critical infrastructure necessary to moving the energy needed to heat and cool homes, schools, businesses and public buildings in Texas, while providing substantial local and state revenues.”

Throughout PHP’s development, “the route has been carefully evaluated to minimize potential impacts to the environment and landowners, while also being cost-effective and constructible.” According to Kinder, PHP is expected to provide nearly $1 billion/year in additional revenue to the state and its counties “to support local schools, first responders and other vital needs. Additionally, individual leaseholders are projected to receive more than $2 billion/year in new oil and natural gas royalties.”

Hays County, the City of Kyle and three landowners filed the lawsuit in April, claiming that the process for determining the route of natural gas pipelines violated the Texas Constitution. The plaintiffs also sued the RRC in Sansom et al v. Texas Railroad Commission et al, No. D-1-GN-19-002161, in the 345th District Court for Travis County.

“This ruling is in line with well established Texas precedent regarding the constitutionality of the eminent domain process and the substantial safeguards that the process provides to Texas landowners,” said Baker Botts LLP partner Bill Kroger, whose firm represented Kinder.

“This was the most important oil and gas pipeline case pending in the state, and we are happy to have achieved such a great result for our clients.”

The Texas Real Estate Advocacy and Defense Coalition, a landowner advocate, said it is considering an appeal and “additional legal actions in other venues to challenge this severely problematic route.”

Kyle Mayor Travis Mitchell called the ruling “unfortunate but not unexpected…We will be working to determine the best path forward. We’re certainly not giving up.”

A long list of gas transport projects are on the drawing table to carry gas from the increasingly constrained Permian, as producers are practically giving gas away. Apache in late March began deferring about 250 MMcf/d gross volumes because of low prices at Waha; it got some relief in June with the start-up of the first of three cryogenic processing plants at Altus Midstream Co.’s Diamond Cryo Complex.

The already sanctioned Gulf Coast Express is set for completion this fall. Even with a plethora of projects in the queue. analysts still expect gas takeaway capacity from the Permian could become constrained again by 2022.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |