NGI Mexico GPI | E&P | NGI All News Access

Moody’s Sees Pemex Oil Output Rising 1% in 2020 As Difficulties Abound

Moody’s Investors Service said in a note Friday it expects crude oil production from Mexican national oil company Petróleos Mexicanos (Pemex) to rise by 1% in 2019.

The forecast follows a full-year loss of about $18.3 billion reported by Pemex for 2019, nearly double the loss reported in 2018. If Pemex were to fulfill the projection of a 1% increase, 2020 output would average some 1.7 million b/d in 2020, well below the 1.87 million b/d originally forecast by Pemex in its 2019-2023 business plan.

Moody’s highlighted that oil production remained essentially flat in 4Q2019 compared to 3Q2019, “demonstrating good progress” on Pemex’s “key objective to stabilize production.”

However, low oil prices and delays at Pemex’s priority fields will likely prove challenging obstacles to overcome this year, according to market observers.

“For 2020, Pemex’s investment budget amounts to $16.7 billion, of which 81% would be allocated to exploration and production,” Moody’s researchers said, “although in the past the company has invested much less than planned and such [a] high amount of capital expenditure would require much higher crude and fuel prices…”

Export revenues for the state-owned firm declined by 16.5% in 2019 as the Mexican crude oil basket averaged $55.63/bbl, down 9.4% y/y.

“I think that is perhaps the biggest warning sign about what they’re trying to do,” Mexico City-based energy consultant Gonzalo Monroy told NGI’s Mexico GPI, explaining that “Pemex’s cost structure…is quite rigid and has not been able to adjust downward.”

Monroy said that lower oil prices in 2020 would “only amplify the losses that we saw last year.”

The Ixachi field, meanwhile, the only major natural gas project in Pemex’s upstream portfolio, is “completely behind schedule” due to its technical complexity, Monroy said.

Fitch Ratings downgraded Pemex debt to junk status in June 2019, the same day that Moody’s lowered its outlook for the firm to negative from stable.

Moody’s said Friday that a $5 billion capital injection by the Mexican government in September 2019 improved Pemex’s liquidity position and debt maturity profile, as did a series of refinancing transactions between June 2019 and January 2020 totaling $36 billion.

Pemex’s total debt stood at 1.98 trillion pesos as of end-2019, or about $101 billion at current the current exchange rate, down from 2.08 trillion pesos at the end of 2018.

Pemex crude oil production fell by 7.6% year/year (y/y) to 1.68 million b/d in 2019, while total natural gas output was off 4% to 3.69 Bcf/d.

Natural gas production in 4Q19 averaged 3.77 Bcf/d, up from 3.69 Bcf/d in the preceding quarter.

Production of gas associated with oil wells fell 2.6% y/y to 2.75 Bcf/d, while non-associated gas output dropped 7.7% to 936 MMcf/d.

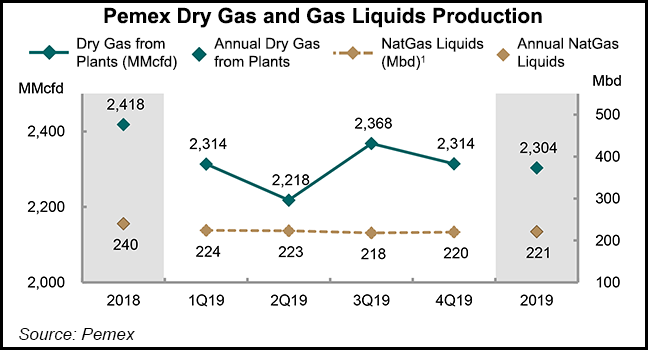

Dry gas production from Pemex processing centers declined 4.7% y/y to 2.3 Bcf/d.

Monroy said he thinks a subsequent downgrade by another ratings agency in 2020 “is already a given.

He said he is “not sure if it’s completely priced in yet, but I tend to believe that this will be the year…when it will become evident that oil production is not increasing,” and that the Dos Bocas oil refinery “will not be completed in due time…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |