E&P | NGI The Weekly Gas Market Report

Montney in ‘Top Five’ of Natural Gas Fields on Planet, Says Encana

The Montney formation by 2020 is expected to grow to 7 Bcf/d, representing 38% of the Western Canadian Sedimentary Basin’s production, and Encana Corp. expects to be leading the charge, executives said Tuesday.

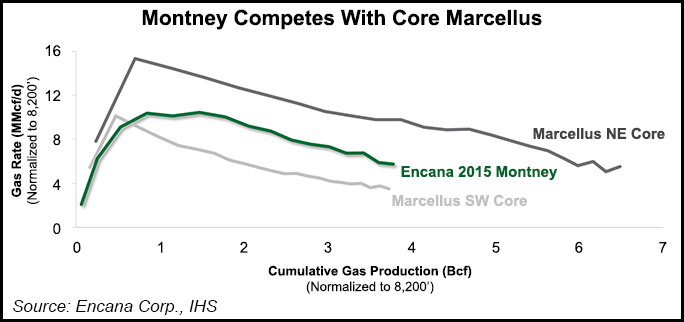

During a morning-long presentation in New York City, CEO Doug Suttles and his management team provided an overview of the Montney, which Encana considers to be on par with the Marcellus Shale (see Shale Daily, May 3).

It’s “ironic to be talking about Western Canadian natural gas on one of its lowest price points in quite some time,” Suttles said, but he wanted to convey to investors Montney’s worth — not only to Encana but to the future of North American resources.

The Montney “is one of the top five gas plays in the world, not in Canada…not in North America, but in the world. It has incredible liquids potential. And I’m not talking about C2, C3, C4, I’m talking about C5-plus, the most valuable liquids that come with natural gas.” It’s also a play “that’s well connected to market, both east and west.”

The National Energy Board of Canada in 2013 said the Montney’s expected recoverable resource was estimated at 450 Tcf of gas and 15.6 billion bbl of liquids, both natural gas liquids and oil.

“This truly sets it in the top five of natural gas fields in the world,” enough to supply Canada for 100 years, said Executive Vice President David Hill, who handles exploration and business development.

There were 54 gas rigs on average working in the Montney between January and March — more than any other play in North America. The Marcellus/Utica shales had an average of 46 gas rigs working in the first quarter, while the Rockies had 33 and the Haynesville Shale had 17. The Montney also is unique in that it works across the gas, liquids and oil windows, Encana engineer adviser Blair Porter said. Over several million years, the Montney was layered with thick, multiple stacked zones.

The size and scale actually is the “same as the Marcellus,” Porter said, with deeper, stacked reservoirs making the condensate window of the Montney “larger and richer.”

Porter and his team compared the two plays by drawing an oval 375 miles long and 130 miles wide. “By any measure these two plays are both massive plays,” he said. “Core areas have emerged within both of these plays…The Montney is unique in that the transition from gas to liquids occurs along the entire length of the play…While both plays have exposure to each fluid window…the advantage tips to the Montney when it comes to scale and productivity of this condensate window.”

The Montney has three distinct regions: the Northwest, the Central and the Southeast. The stacked zones are more comparable to the Permian Basin than the shallower Marcellus and Eagle Ford shales, according to Porter. Across a 350-mile stretch 1,000 feet deep of the Upper Montney to the base of the Sexsmith formation, there are up to six stacked laterals with 50-200 Bcf/section.

By comparison, a 100-mile stretch of the Permian, 2,000 feet in depth from the Middle Spraberry to base Wolfcamp C , has more than eight stacked laterals with more than 150 million bbl/section. Across 350 miles of the Marcellus, 250-feet deep, a single lateral has 50-60 Bcf/section, while 200 miles of the Eagle Ford also 250-feet deep, has up to two stacked laterals with 30-40 million bbl/section.

Naysayers exist about the siltstone formation, which straddles British Columbia and Alberta, pointing to market challenges from a lack of pipeline and related infrastructure. But Suttles and his team attempted to make the case that nothing could be further from the truth.

For the Montney, Encana has identified about 10,000 locations, including 6,500 in the condensate-rich window of the play.

Encana is producing 750 MMcf/d of gas and 21,000 b/d of liquids today, COO Mike McAllister said. Wells are producing up to 16 MMcf/d, about five times better than when development began. Estimated ultimate recoveries are up by eight-fold, with up to 2 million boe wells, while finding and development costs have fallen by six times.

Today, the strategy in Montney is “drill to fill,” Suttles said. In British Columbia, Encana has a partnership with Mitsubishi Corp., which paid the operator $2.9 billion in 2012 to capture a 40% share — including drilling costs over five years (see Shale Daily, Feb. 21, 2012). The drilling carry still would have about $650-700 million at the end of this year.

“There’s kind of two halves to Montney…In British Columbia, that’s where we have our, Cutbank Ridge partnership with Mitsubishi, that’s where three big plants are built in a large piece of that curve…” Veresen Inc. in December agreed to build the Tower gas processing complex in northeast British Columbia for the partners (see Shale Daily, Dec. 8, 2015).

In the Alberta Montney, Encana is proving out the liquids window, but no significant expansion is planned yet.

“In other words, the main compression component is to keep the gas rate the same, but change the front-end of these plants so that we can massively grow liquids. As declined happens, we actually take basically pretty dry gas wells and replace some with these very condensate wells. And we have to decide where we want to go in Alberta.”

Things turned positive for producers when Alberta revamped its royalty structure, Suttles said.

“The old royalty structure in Alberta created a penalty for oil wells…This new structure actually doesn’t differentiate. And in fact it’s advantageous to efficient operators…We needed to get that structure in place…We needed to get certainty, now that’s out. We’re actually looking at how we build that up in time. So as we’ve moved into 2017, we’ve a fully landed the plan next year.”

The question now is how to efficiently add capacity in 2017 and 2018 — and effectively deploy capital. But Encana has no intentions to build up a backlog of drilled but uncompleted (DUC) wells. “I wouldn’t expect us to build a big DUC backlog, but the rig count will grow over time as we get closer to the startup of these three plants.” The first one comes on in September 2017 with the another in early 2018 and the final one late that year.

The Calgary-based explorer has a case to make. One of the leading gas producers in North America, the portfolio-rich operator had almost 30 plays from which to choose as late as 2012. But low gas prices and high costs led incoming CEO Suttles to overhaul the company.

Montney’s strategic place in Encana’s portfolio was set in late 2013, as the operator began to whittle down its massive portfolio. At the time, the long-term plan was to create a portfolio to a select few targets, one that could work through any volatile commodity price cycle. Encana honed its techniques across North America’s onshore unconventionals — and it had a good selection from which to choose.

“If you’re not in the best rocks, you’re not going to be successful through the cycle,” Suttles said. “If the rocks aren’t good, great management can’t make bad rocks good.”

The portfolio was whittled to seven, then to four, and today 95% of capital funding is divided between Canada’s Montney and Duvernay formations and the Texas Permian Basin and Eagle Ford Shale.

It’s not a manufacturing process,” Suttles said. “It’s an innovation process…We do not try to standardize and duplicate. We constantly try to make it better…and expect that things will change, not only every year but almost every quarter.”

There are, of course, a lot of risks, particularly in today’s commodity world. Nothing is black and white, Suttles said.

“Because of our portfolio and where we’re at in the efficiency in which we’re executing within the portfolio, the more capital we deploy the better the business gets, but we’re also conscious of uncertainty in price, so you have to weigh that up against how much balance sheet risk you want to take. And that’s the decision we’ll take as we move into each year.

“That’s probably the biggest uncertainty we have to deal with, and part of that will be driven by things not only what the price deck is and what we could do with cost efficiency, it will also do with what we do for instance asset sales…”

Encana has the land position, “which we could probably more than double our current growth plan…We’ve actually self-constrained our growth in the Montney just to manage market risk. We have the land secure, we have the land today. We have the resource, which could more than double our planned growth profile, and what we said is, it’s more driven by strategy, how much risk do we want to take in actually Western Canadian gas until we actually see how these markets develop and our access to these markets develop.

“We can ramp this up quite quickly, really the ramp time is two years. It’s the time to build, gathering, and processing, and we are doing that today. We know it from the time we say go to the time we actually have the capacity online is about two years and it’s not anything doing drilling wells. We can fill these plants up really fast with drilling activities…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1266 | ISSN © 2158-8023 |