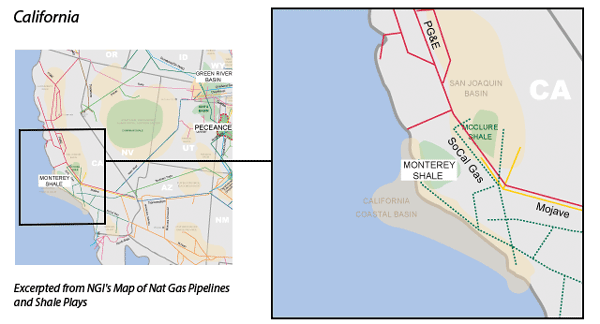

View more information about the North American Pipeline Map

Background Information about the Monterey Shale

There is oil and gas in California’s Monterey Shale formation, but it’s not unconventional and it’s not much, according to a means assessment of unconventional, technically recoverable resources in a portion of the Monterey formation in the deepest parts of the San Joaquin Basin, by the U.S. Geological Service in late 2015.

The Monterey Shale, primarily a crude oil formation located in both onshore and offshore Southern California at depths between 8,000’-14,000’, is easily one of the most polarizing unconventional formations in North America. The Monterey had the potential to be one of the most prolific oil producing basins in the United States, or a complete bust, depending on the source. There isn’t even always certainty within the same source. In 2011, the U.S. Energy Information Administration (EIA) estimated that the Monterey could hold up to 23.9 billion barrels of oil, which would be more than the Eagle Ford and Bakken Shales combined. However, just three years later, the EIA reversed course, and slashed its estimate of recoverable oil in the Monterey Shale to just 600 million barrels, a whopping 96% decrease from its earlier estimate. Ouch.

Estimates by the geologists in the deep basin have never come anywhere near EIA’s stratosphere, starting in 2003 with an estimated mean of 121 million bbl of recoverable oil, and dropping in their latest investigation to 21 million bbl of oil, 27 Bcf of natural gas and 1 million bbl of natural gas liquids (see Shale Daily, Oct. 7, 2015).

The area of the potential continuous accumulation assessed in the new study was limited to where the Monterey is deeply buried, thermally mature and thought to be generating oil. USGS concluded that most of the petroleum that has originated from shale in the Monterey migrated from the source rock, “so there is probably relatively little recoverable oil or gas remaining there, and most exploratory wells in the deep basin are unlikely to be successful.”

And according to the latest geological data from more than 80 older wells that penetrated the deep formation, oil or gas retention in the Monterey shale source rock “is poor, probably because of natural fracturing, faulting and folding.” The resources “readily migrate from the deep Monterey formation to fill the many shallower conventional reservoirs in the basin, including some in fractured Monterey formation shale, and accounts for the prolific production there.”

The data suggest there aren’t a lot of unconventional resources in the Monterey’s deep basin, but “there are still substantial volumes of additional conventional oil and gas resources in the Monterey formation in the shallower conventional traps in the San Joaquin Basin, as indicated by earlier assessments,” USGS noted.

In 2012, USGS also assessed the potential volumes that could be added to reserves from increasing recovery in existing fields. The results of 2012 study suggested that a mean of about 3 billion bbl eventually could be added from Monterey reservoirs in conventional traps, mostly from diatomite rock.

Out in the field, early drilling results in the play have been mixed, which has no doubt contributed to differing opinions on how economic the Monterey might ultimately prove to be. On the downside, early results from Plains Exploration and Berry Petroleum have come in below expectations, and Chevron flat out told CNBC in February 2013 that the company “does not see the same level of promise in the Monterey Shale as other companies…we have not been encouraged by the results of the wells we have drilled into the formation.” Similarly, while Venoco Inc. remains hopefully optimistic, it has seen some early hiccups. In its 2012 10-K filing, Venoco states: “Since 2010, we have pursued an active drilling program targeting the onshore Monterey shale formation. From that time through December 31, 2012, we have spud 29 wells and have set casing on 26 of those wells. To date, we have not seen material levels of production or reserves from the program and have, following the completion of the going private transaction, reduced our capital expenditures related to the project. However, based on the data we have gathered and the results we have seen to date at the Sevier field in the San Joaquin basin, we believe that our testing efforts and delineation drilling in the area will ultimately result in commercial levels of production from the field.”

An official with the Western States Petroleum Association (WSPA) said in November 2015 that “unofficially, given the low-price environment [producers] are facing, no one is being very bullish on production – at least not in the short term. The last reassessment of the potential resource in the Monterey didn’t cause much of a ripple in our world. And I’m not hearing much chatter about any major technological advances that would change the picture dramatically.”

Perhaps the biggest obstacle facing Monterey operators is the fact that much of the shale in California is highly folded, which means it is far more difficult to drill the Monterey using the longer laterals that have become common practice in shale formations that feature flatter, “cake layer” levels of shale, such as the Bakken and the Eagle Ford shales.

A geologic expert on the Monterey, Richard Behl, professor of geologic sciences at California State University, Long Beach, calls the play “highly deformed” and no slam dunk for development. “We don’t know how extensively fractured the rocks may be off of the tectonic structures where companies have been producing for years,” Behl said. “If it is as fractured as the rocks in the higher parts of the structures, maybe the oil is lost already and we’re too late. What this means is that large areas of the Monterey formation that aren’t associated with the known structural and stratigraphic traps are now open to exploration; it’s up to us [geologists] to come up with a model to find the places where the oil is still there.”

If you get past the geological problems, there are the more onerous operating conditions within the State of California, which include (but are not limited to): slow permitting, uncertainty over fracking rules, relatively stringent environmental and land use provisions, the temporary suspension by the U.S. Bureau of Land Management to auction off California acreage in 2013, and the threat of earthquakes and other natural disasters. California has been suffering from drought for several years to the point of restricting water use. The state tends to be at the forefront on environmental protection issues and narrowly missed banning hydraulic fracturing in recent years.

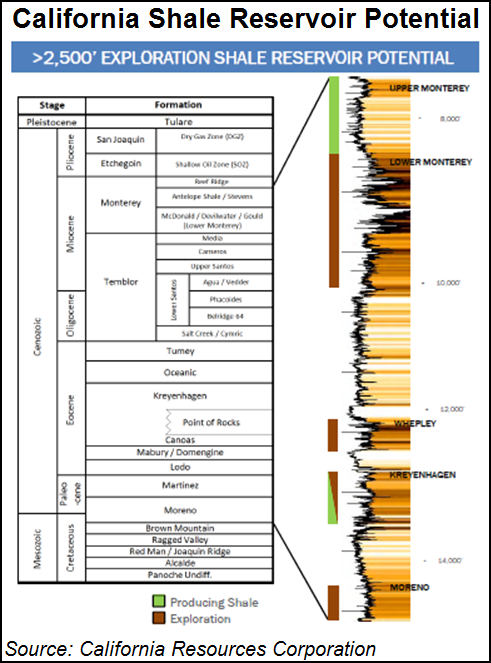

But at least one company sees great potential in the Monterey, and that company is a big one. Occidental Petroleum, which holds more than 2.3 million net acres in California, had drilled and completed more than 570 development wells in unconventional reservoirs in California through mid-2014, primarily in the upper Monterey formation, with what it calls “a nearly 100% commercial success rate.” On December 1, 2014, the company completed the spin-off of its California assets into a separately traded pure-play California E&P company called the California Resources Corporation (CRC). One of the main goals of the CRC was to accelerate oil & gas production in California, including various unconventional sources such as the Monterey Shale. All of this changed with the crude oil price collapse, and CRC is now concentrating on its water and steam flood operations, along with an asset sales program designed to shed $1.6 billion in debt by the end of 2016.

Longer term, CRC hopes to grow its California oil & gas production by more than 10% per year, and its unconventional properties would be a major driver in achieving this goal. To this end, the company also plans to test various intervals within the Monterey. In its 2014 10-K filing, CRC notes it has approximately 4,800 identified drilling locations targeting unconventional reservoirs primarily in the San Joaquin basin.”We have successfully produced from seven discrete stacked pay horizons within the Upper Monterey. The Lower Monterey is believed to be the principal source rock within the Monterey. We plan to apply the knowledge acquired from our successes in the upper Monterey to other shales in the San Joaquin basin such as the Kreyenhagen and Moreno formations. The Kreyenhagen and Moreno formations are hydrocarbon source rocks that have generated oil and gas, and we believe they offer similar development opportunities to the upper Monterey due to their multiple stacked pay reservoirs and general reservoir characteristics. The lower Monterey has an extremely limited production history compared to the upper Monterey, and therefore very limited knowledge exists regarding its potential. For example, only about 25 wells have been drilled into the lower Monterey to date. However, we believe we will be able to apply knowledge we gain from the upper Monterey in the lower Monterey as well.”

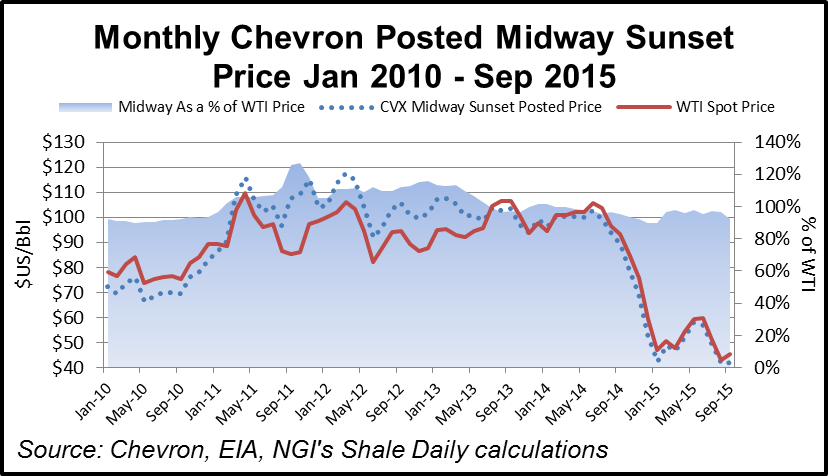

There is certainly more room for oil production in California, as the state imports more than 60% of its crude oil needs. Oftentimes, this deficit means that producers earn a premium over WTI production, depending on the grade of crude. However, the benchmark Midway Sunset price in Southern California has traded at both a discount and a premium to WTI over the past several years. For September 2015, the Midway Sunset index came in at $41.99/bbl, just 92% of the WTI price.

“We presently import more than 1.2 million b/d,” said state oil/gas supervisor Steve Bohlen at Loyola Marymount University in the fall of 2014. “The big reason we import so much oil is that Californians drive almost a billion miles a day. It is conceivable that with the development of unconventional resources from the Monterey Shale formation, [eventually] we may be able to get our production up by several hundred thousands of barrels per day, maybe as much as a half-million b/d [see Shale Daily. Sept. 22, 2014].”

Much of California’s oil imports come via rail or waterborne methods, as there are no pipelines that move crude into the state. However, Kinder Morgan has been working to change that, via its Freedom Pipeline that would transport oil from the Permian Basin to various points of delivery within Southern California. The company held its original open season for 277,000 bbls/day of capacity in 2013, but cancelled the project after receiving little interest from potential shippers. As one industry source told NGI in late 2014, California refineries tend to like the flexibility that comes with delivery by rail, and do not wish to be subject to the long-term contracts required to underwrite such pipeline projects. Not to mention that pipeline projects that must traverse the Sierra Nevada Mountains can create expensive engineering challenges.

But as noted by industry consultant Genscape, “many of those West Coast industry players have faced crude-by-rail permitting delays amid increasing environmental impact scrutiny,” and that has led Kinder Morgan to reconsider the Freedom line, only this time with several modifications, the most important of which would be the ability to transport both crude oil and condensate. That condensate could then be exported overseas, thus giving the U.S. a second condensate export center to go along with the Gulf Coast. If built, Freedom would target a 2019 in-service date, and would require the conversion of part of the El Paso Natural Gas system into crude lines.

In addition, Questar has proposed converting the western portion of its Southern Trails natural gas pipeline that lies within California to a crude oil system, that would move crude from a rail loading facility to the various refineries in the Long Beach area. The project, known as Inland California Express, was still in the development stages as of Questar’s March 2015 Customer Meeting.

Counties

California: Fresno, Kern, Kings, Los Angeles, Monterey, Orange, San Luis Obispo, Santa Barbara, Tulare, Ventura, Also prospective in portions of offshore California

Local Major Pipelines

Natural Gas: PG&E, SoCal Gas

Crude Oil: Freedom (proposed), Inland California Express (proposed), Phillips 66, San Joaquin Valley (Exxon), West Coast System (Plains)

NGLs: None

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Mississippian Lime | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily