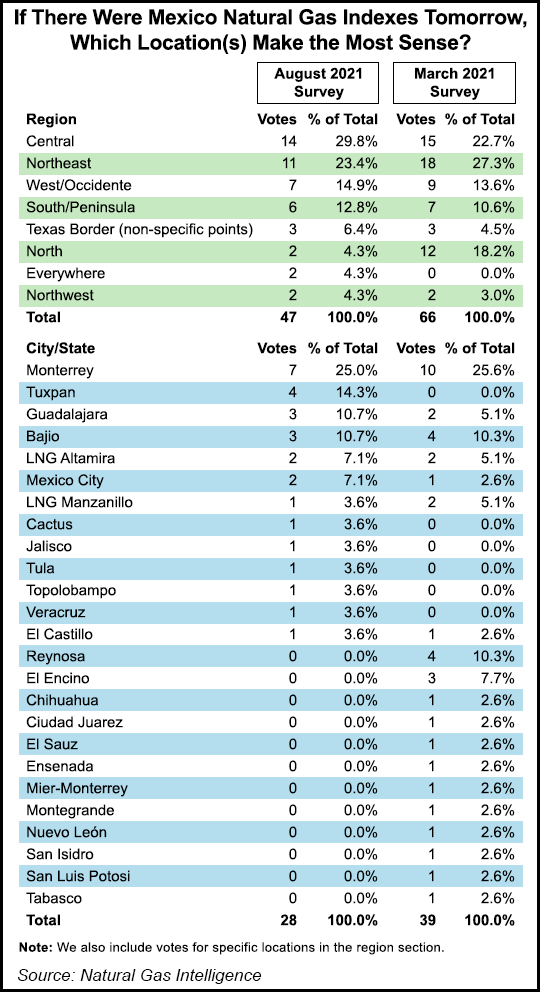

Mexico’s industrial center Monterrey was once again picked as the best location for a domestic price index in the fifth survey of the natural gas market undertaken by NGI’s Mexico GPI.

The survey, conducted in August, received 30 responses from buyers and sellers in Mexico, compared to 23 for the March survey.

While most natural gas contracts in Mexico are written based on U.S. prices with cost added for transportation into Mexico, the impetus is growing for an independent Mexico-driven natural gas price index.

“Our intention in the future is that we use domestic prices,” Rodrigo Aranda, trading manager at Mexico City-based power company Fénix told NGI’s Mexico GPI. “In the end though we get most of our supply from the United States, the two markets are separate....