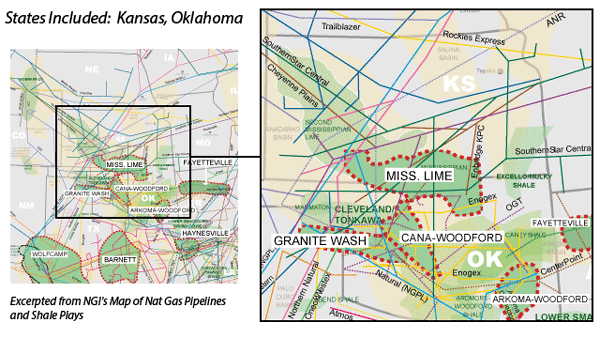

View more information about the North American Pipeline Map

Background Information about the Mississippian Lime

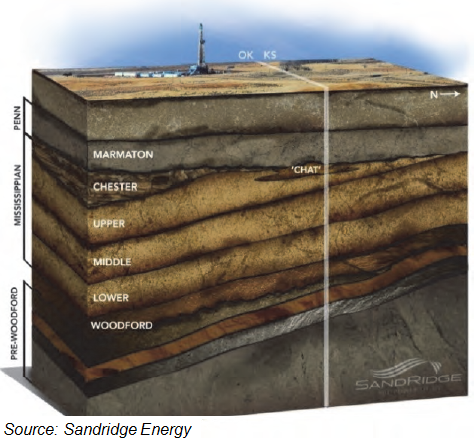

The Mississippian Lime (ML), a carbonate formation that primarily produces oil, underlies a large portion of Northern Oklahoma and Southern Kansas. The formation has been drilled vertically since the 1940s, with its first horizontal well drilled in 2007. The play lies at a fairly shallow depth (4,000-7,000 feet), and it features different drilling characteristics from shale and tight sands formations. Carbonate plays tend to be more permeable, which reduces the amount of drilling horsepower required to navigate through the rock. This, along with its shallower depth, tends to reduce drilling costs, everything else being equal.

Oklahoma, one of the country’s most reliable oil and gas producers, experienced a big bump in production starting in 2005 with the advent of unconventional drilling. With a stable horizontal rig count between 2011-2014, light oil production increased to nearly 300,000 b/d from less than 50,000 b/d, mostly driven by an activity shift from shale gas toward liquid-rich areas. In 2009, Woodford Shale activity across gassy Arkoma and Anadarko basins accounted for 60% of total Oklahoma unconventional drilling, but it dropped to 20% in 2014, according to Rystad Energy.

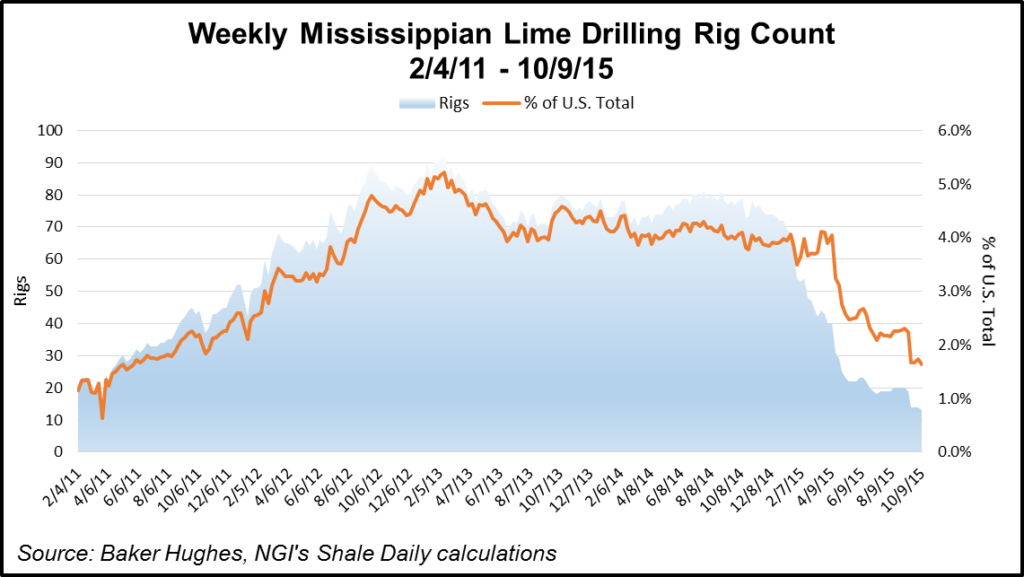

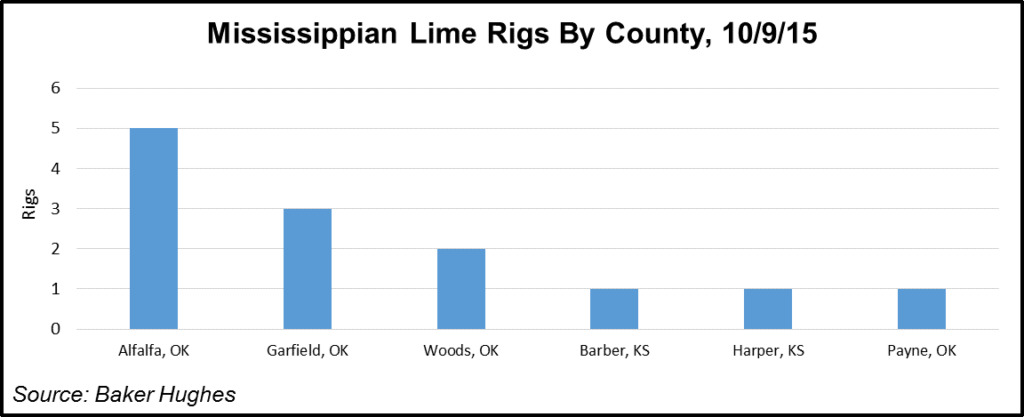

As drilling activity plunged in 2015, the “Miss Lime,” as it is often called, experienced one of the sharpest declines in rig counts of all tight oil plays. Baker Hughes Inc. reported as of early October 2015 the ML rig count had fallen to 13 versus 79 a year earlier — a dropoff of 84%. 10 of those 13 rigs were working the Oklahoma side of the play. With relatively shallow well depths, oil prices under $50/bbl may not support full economic development of the play. However, many operators were making the play work even under low prices by drilling adjacent interval wells, which are numerous across the massive Oklahoma landscape.

As of October 2015, 60% of the activity was “attributable to Mississippian Lime and Woodford Shale activity across the Mississippian Trend, both with approximately 40% of light oil content, which is high for Oklahoma shale plays,” Rystad noted. “Besides the shift toward liquids, Oklahoma also experienced a common shale industry trend: increased well completion intensity with positive impact on well productivity.”

Well productivity has improved considerably because of a focus on the sweet spots of the Miss Lime between 2014 and 2015. Newfield Exploration Co.’s “well performance improvements were caused by both 50% increase in completion intensity and focus on the oil window of the Anadarko Basin (mainly Woodford Shale),” said Rystad.

Chesapeake Energy Corp. considers Miss Lime to be a big part of its liquids program. “In the Miss Lime, the teams have been continually outperforming in the area,” Senior Vice President Jason Pigott said in 2015. “It’s one area that every time we drill a well, it continues to exceed our expectations. Even at $3.00 gas and $50.00 oil, we’re getting an 18% rate of return on the Miss Lime in our core, so they’re really strong returns” (see Shale Daily, Feb. 25, 2015).

Chesapeake was reducing costs in the ML by targeting other intervals, including the Oswego and Meramec, at the same time. Among just those three intervals, Chesapeake has a nearly 400,000-acre position, Pigott said in November 2015 during a third quarter conference call. The company’s first two 10,000-foot wells were drilled in the ML during the third quarter of 2015 for an incremental $200,000 of drilling.

“So those economics will be competitive with Meramec, Oswego, any other formation out there,” Pigott said. Wells in the Meramec had fallen to about $6.9 million from $7.1 million. By lining up ML wells while drilling other intervals, Chesapeake could “have a whole rig line of wells to do…That takes the curve down by 35%, if that is a successful program.” Based on Chesapeake’s internal breakeven prices across the onshore, payback in the ML “can be at two years or less.”

Continental Resources Inc., Newfield Exploration Co., Devon Energy Corp. and Midstates Petroleum Inc. were among some of the many operators keeping activity high in ML and surrounding intervals during 2015. Drilling efficiencies were telling the tale, with costs dropping and better output from every new well.

Between July and September 2015, Midstates Petroleum’s ML assets were producing 27,029 boe/d. Through Oct. 26, 2015, the company had 275 wells on production for more than 30 days with an average peak 30-day production rate of 557 boe/d. Three rigs were drilling in its horizontal well program in Woods and Alfalfa counties, OK for most of the third quarter. Midstates also spud a total of 19 wells, of which eight were producing, eight were awaiting completion and three were drilling at the end of the quarter. The company also brought 19 fracture stimulated horizontal wells online. In early November 2015, the company had surpassed its year-end well cost target of $3.3 million, with average wells costing $3.1 million. At that price, “Midstates is generating rates of return in excess of 35% at current strip pricing.”

Counties that make up the Northern Oklahoma portion of the Miss Lime are also prospective for several other stacked oilier intervals, including the Marmaton, Chester, Woodford Shale, and Hunton Limestone.

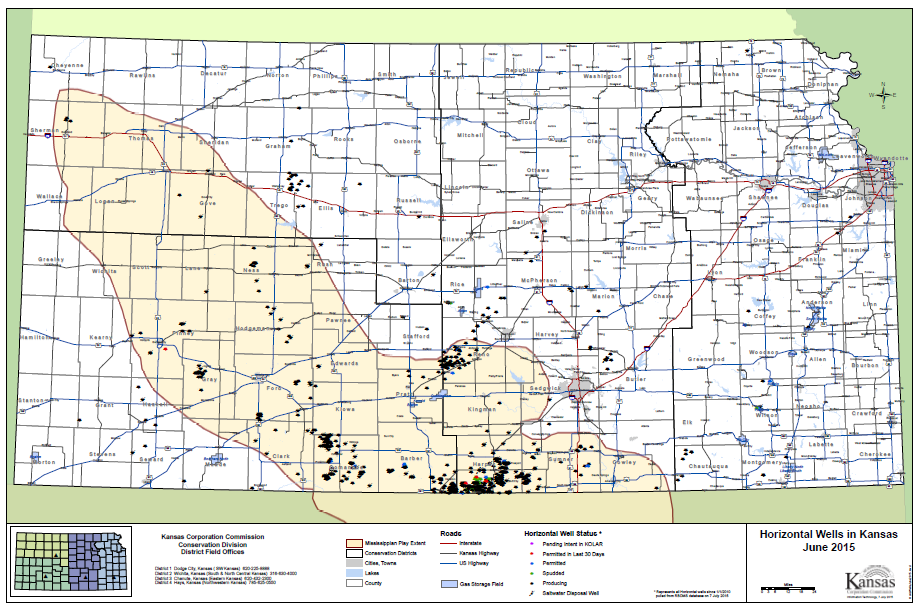

Most operators’ horizontal drilling activity has centered in Northern Oklahoma thus far, with a smattering of horizontal in Comanche, Barber, and Harper counties in Kansas along the Kansas/Oklahoma border, and a few others in the Northwest Kansas portion of the play.

The following map illustrates Kansas horizontal drilling activity through July 2014, along with those counties the Kansas Corporation Commission deems to be part of the ML fairway. However, many of those Kansas counties that are not along the Kansas/Oklahoma border may not be conducive for horizontal drilling, at least not in any meaningful economic quantities. Several major operators have abandoned or sold their ML acreage in Kansas within the last few quarters, including Apache Corp., Encana Corp., and Royal Dutch Shell plc.

For every “good” well that’s been drilled into the ML, there have been 10 “bad ones,” Longfellow Energy President Todd Dutton told NGI in April 2014. Similarly, Wood Mackenzie upstream analyst Samir Sharma agreed in 2014 that at that time there had been more flops than not in the ML, telling NGI that “results haven’t matched expectations.” However, it is still far too early to declare the drilling in these stacked intervals a ringing success. The stacked formations within the ML fairway are so varied and the pilots are still so new that determining whether there’s enough oil and liquids for the taking remains elusive. It likely will take a few more years — and better prices — before there’s a move to true manufacturing.

Oklahoma City-based private Longfellow, also an ML producer, placed its chips on its Nemaha Project, a stacked oil play in Oklahoma’s Garfield and Kingfisher counties. The Midcontinent formations are spread within the Central Kansas Uplift and the Nemaha Ridge, which runs between the Sedgwick and Cherokee basins in Kansas. To the south of the Los Animas Arch is the gassy Hugoton Embayment, which is north of the Oklahoma border and the prolific Anadarko Basin. Those stacks of formations are requiring science and patience, and upfront investments.

The ML is one thing. The Woodford is another. In between, “we’ve got a different reservoir, a different rock dynamic,” said Dutton. The Kansas border is where the whispers about the oil-rich content first were heard. “And those are the counties that were getting a lot of activity. Those also are the counties where it’s turning out that it’s noncommercial, really…The stack play is not in a high water cut, like the Mississippi Lime,” Dutton said. “In large respects, the Mississippi is…really more of a conventional reservoir, getting areas where there is a high oil saturation…”

In the stacks, producers can use unconventional drilling to their advantage by drilling down and across, fracturing through the many layers. The stacked play is varied throughout. Producers can’t necessarily produce through a lateral in the Woodford or between the ML and the Woodford, said Dutton. It requires more finesse. Where ML is stacked with the Woodford, production can flow through one unit, he explained. “You get to produce out of one flow unit, or at least they are related to each other, because they sit right on top of each other..”

“The stacks are good targets. It’s not more expensive to develop, but yes, you have to drill more wells in the stacked formation,” Dutton noted. The company’s wells in 2014 cost about $4 million for a lateral about 4,500-5,000 feet. Operators were working to hold leases by production, but once results are more transparent, “that’s when we go to manufacturing stage and make money. You drill laterals as close as you can to do it. One in the Woodford, the next in the Mississippi, then move over…”

It was taking up to 25 days to complete one well in 2014, but efficiencies were bringing the time down. The stacked intervals have been found to be a mix, some areas 55% weighted to oil, 45% to gas, another piece 60-40.

“It starts off a little more oily, and over time, it’s more gassy,” Dutton said. At the same time the pilots are being drilled, infrastructure is underway. “It’s prudent” to get all of the infrastructure in place before the true manufacturing begins. “It’s kind of like jumping off a cliff. You can’t turn around easily and you’ve got to know what you’re doing.” Once the infrastructure is in, however, including for saltwater disposal, “it will be hard for anyone to compete with you,” he said.

There’s no land grab in sight, in part on low prices, but mostly because acreage already is held by production because it overlaps into the Cana-Woodford formations.

Counties

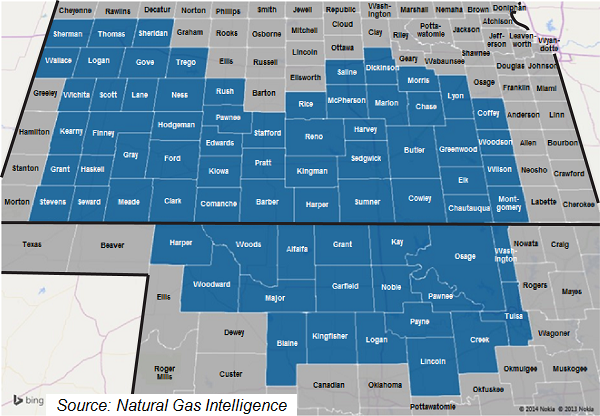

Note: The list and map on the next page include all counties that may be prospective for the Miss Lime, but in reality, horizontal drilling has been focused mostly in Oklahoma counties, with a handful in Kansas along along the KS/OK border.

Kansas: Barber, Butler, Chase, Chautagua, Clark, Coffey, Comanche, Cowley, Dickinson, Edwards, Elk, Finney, Ford, Gove, Grant, Gray, Greenwood, Harper, Harvey, Haskell, Hodgeman, Kearny, Kingman, Kiowa, Lane, Logan, Lyon, Marion, McPherson, Meade, Montgomery, Morris, Ness, Pawnee, Pratt, Reno, Rice, Rush, Saline, Scott, Sedgwick, Seward, Sheridan, Sherman, Stafford, Stevens, Sumner, Thomas, Trego, Wallace, Wichita, Wilson, Woodson

Oklahoma: Alfalfa, Blaine, Creek, Garfield, Grant, Harper, Kay, Kingfisher, Lincoln, Logan, Major, Noble, Osage, Pawnee, Payne, Tulsa, Washington, Woods, Woodward

Local Major Pipelines

Natural Gas: ANR, CenterPoint Energy, Cheyenne Plains, Enbridge KPC, Enogex, NGPL, Northern Natural, OGT, PEPL, Southern Star, Tallgrass

Crude Oil: Cushing to Whiting (BP), Glass Mountain, Keystone, Midcontinent (Ozark), Osage (Magellan), Pony Express, Spearhead, White Cliffs

NGLs: Blue Line (ConocoPhillips), South Leg (Enterprise), Southern Hills, Wattenberg (DCP)

More information about Shale Plays:

Utica | Permian | Bakken | Tuscaloosa Marine Shale | Haynesville | Rogersville | Montney | Arkoma-Woodford | Eastern Canada | Barnett | Cana-Woodford | Eaglebine | Duvernay | Fayettville | Granite Wash | Horn River | Green River Basin | Lower Smackover / Brown Dense Shale | Monterey | Niobrara – DJ Basin | Oklahoma Liquids Play | Marcellus | Eagle Ford | Upper Devonian / Huron | Uinta | San Juan | Power River | Paradox

Shale Daily

Shale Daily