Mild October Forecast, Comfortable Storage Outlook Limit Upside for Natural Gas Bidweek Prices

Leaving behind the summer-like temperatures that persisted for much of September, October natural gas bidweek traders contemplated the price impacts of a potentially mild start to the heating season and a more comfortable storage situation compared to a year ago.

NGI’s October Bidweek National Avg. finished at $2.005/MMBtu, up 7.5 cents month/month but well below the $2.675 average recorded during October 2018 bidweek.

With futures prices already on a downswing through the back half of September, the October Nymex contract rolled off the board at $2.428 last week. The October expiry occurred on the same day that a surprise triple-digit storage injection from the Energy Information Administration (EIA) dealt a major blow to those harboring bullish sentiment heading into the last few weeks of the refill season.

The pace of injections in 2019 has put Lower 48 stocks well ahead of last year and largely erased the deficit to five-year average inventory levels. It was an unusually large year-on-five-year average deficit that raised deliverability concerns and helped drive significant futures volatility early in the 2018/19 winter.

“Overall, we see the 2019 balance significantly more comfortable than last year ahead of the winter season,” analysts at Goldman Sachs Commodities Research said in a recent note to clients. “To be clear, although higher temperatures have helped support September power burns 2.4 Bcf/d higher than previously expected, which (after other adjustments) has lowered our expected end-October 2019 inventory number to 3,683 Bcf from 3,711 Bcf; that number is almost 500 Bcf above end-October 2018 storage levels.”

And while storage levels are up significantly year/year, the Goldman team expects a similar storage draw for the 2019/20 winter compared to a year ago.

“This suggests a low stock-out risk, particularly in comparison to last year,” the Goldman analysts said. “Further, it is important to note that the price moves observed in the past month have on net reduced our expected power burns through 2020 via lower coal-to-gas substitution, which…contributed to an increase in our end-October 2020 storage expectations to 4,005 Bcf from 3,841 Bcf previously.”

Late-season heat helped raise weather-driven demand levels in September, but warm anomalies will flip from bullish to bearish as the calendar turns over to October, according to analysts at EBW Analytics Group. This comes as production is poised to accelerate on the start-up of Kinder Morgan Inc.’s 2.0 Bcf/d Permian Basin takeaway Gulf Coast Express (GCX) pipeline, and as “Appalachian producers increase output heading into winter,” they said.

“Together with bearish comparisons to cold November 2018 weather, the year/year natural gas surplus is likely to exceed 525 Bcf by the beginning of the withdrawal season — potentially setting the stage for a significant mid- to late-winter pullback,” the EBW analysts said.

Still, over the next month and a half or so “it is possible a mix of increasing net exports and reluctance to aggressively short natural gas may help neutralize bearish factors,” according to the firm.

Following the bearish 102 Bcf injection EIA reported for the week ended Sept. 20, which came in about 10 Bcf above consensus, market observers noted a surprisingly large injection in the South Central region. The South Central should remain a region of particular significance in terms of both incremental demand and supply going into the 2019/20 winter.

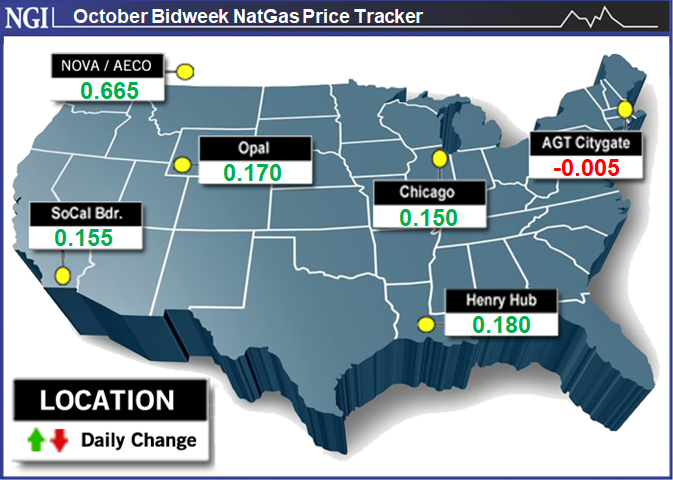

October bidweek prices rallied throughout the South Central region, moving higher in step with an 18.0 cent month/month gain at benchmark Henry Hub. Despite selling off into expiry, the October Nymex contract still finished well ahead of the September contract’s $2.251 expiry to push the benchmark higher month/month.

In East Texas, Houston Ship Channel gained 15.5 cents to average $2.330 in October bidweek. Farther south, Texas Eastern S. TX climbed 18.5 cents to $2.345.

Even on the Gulf Coast, where Goldman analysts expect most of the year/year U.S. demand growth this winter, incremental production and higher storage levels are sufficient to cover the higher demand, according to the firm.

“On the demand side, we expect liquefaction feedstock demand to increase by 2.9 Bcf/d year/year this winter driven by the start-up of five new liquefaction trains,” the Goldman analysts said.

Goldman has lowered its expected ramp-up for the Freeport and Cameron liquefied natural gas (LNG) terminals, and it has also “modestly pushed back” the expected start dates for Trains 2 and 3 at Cameron to next April and June, respectively, from previous expectations of February and May. This is based on “a more cautious stance on performance and start-up scheduling following observed issues with their initial trains.”

Elsewhere on the export front, pipeline supply to Mexico “increased significantly” in late September, according to Goldman, which follows the recent start-up of the 2.6 Bcf/d Sur de Texas-Tuxpan marine pipeline. The firm predicted a 500 MMcf/d year/year increase in winter exports to Mexico.

Regarding another demand-side factor to consider, Goldman analysts expect coal-to-gas substitution to “provide significant support to year/year burns this winter given the sharp rally in natural gas prices in the 2018/19 winter, which implies gas is significantly more competitive versus coal this winter.” This has Goldman anticipating a net increase of 1.9 Bcf/d for U.S. power burns this winter, “with potentially a meaningful share of that year/year increase taking place in the Gulf, where coal-to-gas substitution is so significant relative to the rest of the country.”

Even with the incremental demand from exports and power burns, supply this winter is also expected to climb significantly year/year, including additional Permian associated gas volumes debottlenecked by the start-up of GCX.

Still, higher production and storage does not eliminate deliverability risks on the Gulf Coast, according to the Goldman analysts, who noted that the higher year/year storage levels are concentrated in nonsalt facilities, with the high-deliverability salt facilities sitting closer to year-ago levels. Additionally, the market’s increasing reliance on production growth to satisfy incremental demand indicates “increased vulnerability to freeze-offs,” they said.

For natural gas sellers in West Texas during October bidweek, the start-up of GCX must have felt like Christmas, as regional prices significantly outgained hubs in Texas and Louisiana.

El Paso Permian rallied 36.5 cents to average $1.645 for October bidweek, while Waha gained 43.5 cents to $1.625.

West Texas prices are still trading at a discount to Henry Hub, but it was only a few months ago that producers in the liquids-focused Permian had to pay to offload their gas.

“After months of severe natural gas pipeline constraints, Permian producers and shippers are reveling in the relief of new takeaway capacity,” RBN Energy LLC analyst Jason Ferguson wrote in a recent blog post. “…With the start-up of GCX and the corresponding price rally, many market participants are trying to determine just what it all means for future gas prices in the Permian Basin. But beyond the quite predictable price improvement over the short-term, drawing definitive conclusions is going to be difficult.”

This is because as an intrastate line, the market does not have as much visibility on GCX flows, Ferguson said.

“Despite the pitfalls that come with evaluating this event, we think it’s fair to say the price improvement should last through the end of the year,” the analyst said. “…What flows and pricing data we can see suggest the new route likely siphoned some of its volumes away from not just the Midcontinent but also the other Texas intrastate pipelines leaving the region.

“That means those other pipelines possess spare capacity and will be able to accommodate expected gas production growth during the last three months of this year. In fact, we wouldn’t be surprised if Waha basis strengthens even more in the weeks ahead as the competitor pipelines look to backfill volumes that have been lost to GCX.”

A recent look at the forward curve suggests sellers in the Waha market will be able to enjoy “relatively strong pricing” through 2Q2020, according to analysts at Tudor, Pickering, Holt & Co. (TPH).

“While intrastate volumes are tricky to pin down, we estimate GCX is flowing about 1 Bcf/d, and our current forecast has it filling by next May,” the TPH analysts said. “The forward strip appears to be generally in agreement with our assessment, although slightly more bearish, with material pricing weakness returning to the market in April.”

Elsewhere during bidweek, an outlook suggesting comfortable conditions will limit October heating season demand accompanied weak pricing throughout the Midwest and Northeast.

As of Tuesday NatGasWeather described the overall pattern as “quite bearish and very comfortable across most regions most days through mid-October apart from brief cool shots” for the northern part of the country and some “localized heat” in the southern United States.

Bidweek pricing indicated little fear among buyers in the populated Midwest and Northeast as many regional hubs finished below the $2 mark. Dawn slid 11.0 cents month/month to $1.935. Transco Zone 6 NY tumbled 22.0 cents to average just $1.465 for October bidweek. Algonquin Citygate averaged $1.840, off 0.5 cents.

Looking ahead, recent maintenance schedule changes from Algonquin Gas Transmission could have significant implications for the upcoming winter in New England, according to Genscape Inc. analyst Josh Garcia.

A recent update extended ongoing maintenance on the 26-inch diameter mainline between the Southeast and Cromwell compressor stations, limiting capacity through Cromwell, CT, to 728 MMcf/d, Garcia said.

“Last year, flows at Cromwell reached above this level by mid-October and maxed at 1,224 MMcf/d in November, meaning max curtailments could reach 496 MMcf/d,” the analyst said. “Should colder temperatures materialize in November, this restriction would be incredibly bullish for Algonquin Citygate prices.

“Algonquin released another update…clarifying it expects that this curtailment would be completed by Nov. 15. Additionally, the Brookfield interconnect with Iroquois will be limited to 293 MMcf/d in net deliveries for the duration of the maintenance.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |