E&P | NGI All News Access | NGI The Weekly Gas Market Report

Midcontinent Oil, Gas Execs Looking for Higher Prices to Boost Activity as Covid-19 Takes Toll

Oil and natural gas operators that work through the midsection of the country faced dire activity levels during the second quarter and don’t expect much of an uptick through the rest of the year.

The Federal Reserve Bank of Kansas City, aka the Kansas City Fed, every quarter traces energy activity in the Tenth District, which includes energy firms located and/or headquartered in Colorado, Kansas, Nebraska, Oklahoma and Wyoming, as well as the northern half of New Mexico and the western third of Missouri.

According to the Fed economist Chad Wilkerson, Oklahoma City Branch executive, “energy activity dropped considerably again during the second quarter of 2020, but many firms expected some stabilization heading forward.”

The Kansas City Fed’s quarterly survey, like the one done by the Eleventh District based in Dallas, offers indicators of drilling, capital spending, employment and projections for oil and gas prices.

Covid-19 is clearly on the minds of the energy executives who responded to the survey.

“Summer and fall waves of Covid-19 are driving down demand,” said one executive.

“The demand destruction from Covid-19 impact on the economy is the biggest unknown until an effective vaccine is developed,” said another. “Underinvestment will drive higher prices in future years.”

One executive said the firm was “starting our fourth month without any revenue. Currently, we have nothing scheduled to drill.” While another predicted that the orphan well inventory in the United States “will explode to new highs if the current price continues. In addition, I don’t see a market for stripper wells in the future so many small producers will be surrendering their wells…”

For natural gas prices, executives are looking for a Henry Hub average of $2.88/Mcf to boost activity, a far cry from futures prices that on Monday were averaging around $1.779/MMBtu. In six months, executives expect gas prices to average $2.17, increasing to $2.41 in one year, $2.64 in two years and $3.02 in five years.

West Texas Intermediate (WTI) prices need to average $51/bbl to substantially increase drilling, the energy executives said. August crude futures were at $40.06/bbl early Monday. Executives expect WTI in six months to average only $41, climbing to around $47 in a year’s time. In two years, WTI is seen averaging around $53, and it is forecast to hit $60 in five years.

Tenth District energy activity declined nearly as much in the second quarter as in the first quarter, according to firms contacted in the second half of June.

“The drilling and business activity index rose somewhat, from minus 81 to minus 61, but indicated continued substantial decreases in activity,” economists said. “The drop in the revenues and profits indexes accelerated, and the employment and wages and benefits indexes fell further.”

Meanwhile, the access to credit index “declined at a similar pace as 1Q2020, and the supplier delivery time index decreased less sharply in 2Q2020.”

The Fed’s expectations indexes rose considerably from 1Q2020, and future energy activity was expected to remain largely unchanged.

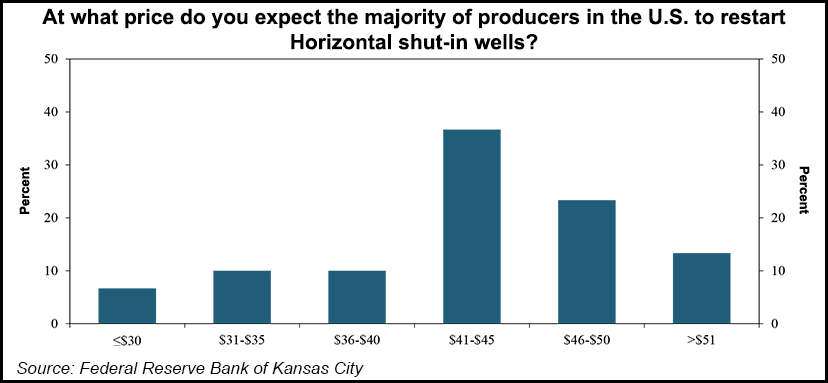

Asked about shut-in wells, more than 62% said they had curtailed or shuttered wells in the second quarter primarily because of prices. More than one-third (37%) expect most U.S. producers to restart drilling at prices of $41-45/bbl, while the same percent said oil needed to be above $45 to restart.

Energy executives also were asked about solvency.

Most of the executives in the survey said they applied for and received the Small Business Administration’s Paycheck Protection Program loans to help during the Covid-19 crisis, “but low energy prices have hurt profitability,” Wilkerson said. “Most regional firms do not plan to increase production levels until oil prices recover more.”

More than two-thirds of executives responding said they “could survive more than a year if current revenues were to continue, while around 32% would not survive a year if current revenue levels persist.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |