Infrastructure | NGI All News Access

Midcontinent Natural Gas Use for Power Could Plunge Without Carbon Capture, Study Finds

Easily dispatchable resources including natural gas with carbon capture likely will be part of the Midcontinent’s future energy mix, but the region should “keep its options open and pursue several very low and zero-carbon options for power generation and storage” to achieve carbon reductions of 80-95% below 2005 levels by 2050, according to a new study.

The “Road Map to Decarbonization in the Midcontinent: Electricity Sector” was researched and authored by members of the Midcontinent Power Sector Collaborative (MPSC), which includes utilities Xcel Energy, WEC Energy Group and MidAmerican Energy, as well as environmental advocacy groups that include the Natural Resources Defense Council and the Environmental Defense Fund.

The initial study focuses on the electricity sector, “which is expected to play a central role in the long-term decarbonization of the region,” researchers said. Future studies are to examine the transportation and buildings sectors.

The MPSC acknowledged that while no mandatory policy exists that would require the region’s electricity sector to substantially decarbonize by mid-century, participants consider it “reasonably likely” that substantial decarbonization will ultimately be required of the sector. Several operators already have announced plans to reduce their carbon footprint.

In May 2017, MPSC member DTE Energy announced a broad $15 billion sustainability initiative to reduce carbon emissions. The plan, among the most aggressive to be announced in the energy industry, included a 25% reduction in carbon emissions in 2017 from 2005 levels, with plans to cut emissions by 45% by 2030 and by more than 80% by 2050.

DTE’s plan includes, among other things, adding 3,500 MW of gas-fired energy capacity and investing $5 billion over five years to modernize the electric grid and gas infrastructure.

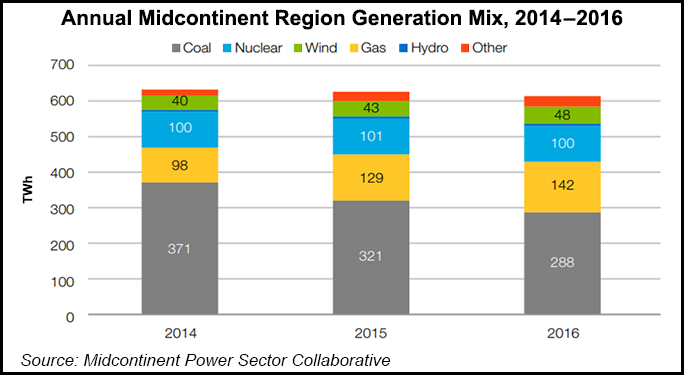

As of 2016, the electric generation fleet in the Midwest Independent System Operator footprint was made up of 41% natural gas, 36% coal, 9% wind and 7% nuclear. Actual generation, however, was 47% coal, 23% natural gas, 16% nuclear and 8% wind.

The gas supply has dramatically increased because of an increase in onshore production, putting downward pressure on gas prices, a trend likely to remain in place through 2050, researchers noted.

But while continued low prices are expected to bring about a gas-dominant future, “over-reliance on natural gas could lead to higher costs in later years when utilization of natural gas must drop precipitously,” they said. More moderate gas prices and low renewables costs would yield a mixed technology future.

In modeling for a level of decarbonization that is 80% below 2005 levels by 2050, the analysis suggested that utilization of gas capacity would plunge after 2040, even in the low price scenarios, “raising the cost of reductions when that gas can no longer be utilized. Gas with carbon capture becomes a significant part of the mix in the latter part of the modeled time horizon, especially when gas prices are lower,” researchers said.

Not surprisingly, alternative energy is a bigger part of the mix when renewables costs are low and gas prices are moderate. Wind capacity would more than double in an 80% decarbonization scenario, while wind and solar combined would make up 38-57% of the generation mix in 2050.

Nuclear plants also would continue to operate in a carbon-constrained future. Most plants that would retire in the business as usual scenarios are seen as continuing to operate under a cap, the study found.

“There is disagreement across existing decarbonization studies on just how deeply wind and solar can cost effectively penetrate given alternative pathways that may cost less,” researchers said. What proves “cost-effective” will depend on the cost of renewables, including technologies needed to integrate them at higher levels, compared to alternatives.

Researchers noted that as in any modeling analysis looking decades into the future, “it is not possible to know what innovations will emerge that favor one part of the mix over another.” Another area to explore is the extent to which advances in flexible demand and other distributed-energy resources can aid in the substantial decarbonization of the electricity sector, according to the report. Wide adoption of smart appliances, smart-charging electric vehicles, demand-response programs and other demand-side technologies could put utilities in the position of being able to “turn off” chunks of electricity demand when low- or zero-carbon resources are not available.

Because the Midcontinent has been a source of zero-carbon electricity for export and is likely to continue playing that role, investments in renewables and transmission in the region are less risky, according to researchers. But deeper decarbonization — 95% — will likely be a more expensive proposition without further efficiency and cost advancements.

“For example, more economical storage of renewable electricity in various forms will enable the system to capture the energy at times the generation would otherwise be curtailed on the system,” researchers said.

The study found that there may be opportunities for importing generation to bolster the system in the Midcontinent. For example, access to expanded hydroelectric power in the northern part of the region could enable deeper penetration of variable renewables. “Transmission plays an important role to provide access to areas with the best renewable energy resources and lowers overall costs of decarbonization,” researchers said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |