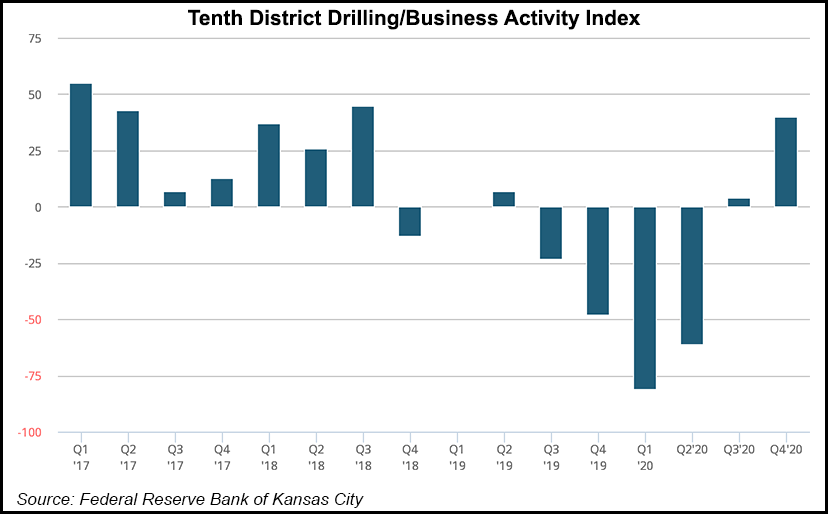

Oil and natural gas activity in the Midcontinent expanded moderately in the final three months of 2020, but it still lagged year-ago levels, according to a survey by the Federal Reserve Bank of Kansas City.

Energy operators also said they need West Texas Intermediate (WTI) oil to average $56/bbl “for a substantial increase in drilling to occur.” Henry Hub natural gas needs to average $3.28/MMBtu, the executives said in the Tenth District survey by the Kansas City Fed, as it is known.

The Tenth District covers Colorado, Kansas, northern New Mexico, western Missouri, Nebraska, Oklahoma and Wyoming. The latest survey was conducted Dec. 15-Dec. 31.

“The drilling and business activity index rose significantly from 4 to 40,” economists said. “Total revenues, profits,...