Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Midcontinent E&Ps, OFS Firms Report Record Slump in 1Q, with Little Relief Seen Through Year

Matching economic indicators across the nation, the Federal Reserve Bank of Kansas City said energy activity during the first three months plummeted at a steep pace, with few expectations that future activity would be better.

The quarterly Energy Survey of the Tenth District by the Kansas City Fed, as it is known, provides a snapshot of how exploration and production (E&P) and oilfield services (OFS) operators are doing in Colorado, Kansas, Nebraska, Oklahoma and Wyoming, as well as the western third of Missouri and the northern half of New Mexico.

“District energy activity fell sharply during the first quarter of 2020, with our index dropping to its lowest level since we began the survey in early 2014,” said Oklahoma City Branch executive Chad Wilkerson. “Expectations for future activity also fell to their lowest level since late 2014, as most firms do not expect energy prices to return to profitable levels this year.”

The data compiled responses by E&P and OFS executives between March 16 and March 31 using total firm activity regarding changes in drilling, capital spending and employment.

As is usual, economists also posed questions to the respondents. Executives were queried about what prices would be needed for drilling to be profitable.

“The average oil price needed was $47/bbl, with a range of $25 to $65,” economists said. “This average was below the prices reported in 2019, and the lowest recorded profitable price. The average natural gas price needed was $2.74/MMBtu, with responses ranging from $1.90 to $4.50.”

Asked what they expected prices to be in six months, one year, two years and five years, respondents said they expect Henry Hub natural gas to average $2.02/MMBtu in six months, $2.34 in one year, $2.57 in two years and $2.94 in five years. West Texas Intermediate (WTI) oil prices were forecast to be $33/bbl in six months, $42 in one year, $50 in two years and $58 in five years.

If low oil prices were to persist, economists asked about the expectations to remain solvent. “Contacts anticipated on average that 61% of firms would remain solvent in the next year if the WTI price of oil were to stay at $30/bbl, and 64% of firms would remain solvent if the WTI price of oil were to stay at $40.”

Respondents also expect “considerably fewer firms to remain solvent if oil prices stay low for more than one year.”

Asked if there was pressure from investors or customers regarding environmental practices, 58% said there was increased pressure in the last two years. More than 48% reported natural gas flaring as a top environmental concern, and 45% each listed water management and carbon emissions (other than gas flaring) as top environmental concerns.

The first quarter survey offered little optimism among those queried.

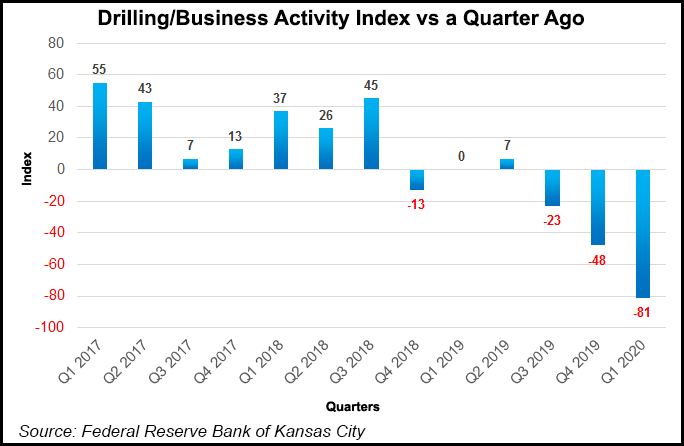

“The drilling and business activity index fell from minus 48 to minus 81, the lowest reading in survey history (since early 2014), indicating a continued, deep decrease in activity,” economists said. “The revenues and profits indexes fell sharply to levels last seen in 1Q2015.

Indexes for employment and employee hours also decreased significantly, and the wages and benefits index turned negative. Additionally, the indexes for supplier delivery time and access to credit turned even lower.

Year/year indexes also plunged substantially, the Kansas City Fed noted.

“The year/year drilling and business activity index sank further, to minus 92 from minus 50, a record survey low,” economists noted. Indexes for total revenues, capital expenditures, delivery time, profits, employment, employee hours and access to credit decreased again in the first quarter, marking more than six months in negative territory.

The index for wages and benefits compared with 1Q2018 also turned negative, while expectations indexes dropped further.

“The future drilling and business activity index worsened from minus 16 to minus 78, the weakest outlook for activity since 4Q2014.” Meanwhile, indexes for future capital spending, delivery time, profits, employment, employee hours, wages/benefits and access to credit decreased again.

“The future revenues and profits indexes dropped steeply to the most negative readings in survey history. Price expectations for oil and natural gas liquids decreased compared to the previous quarter, while price expectations for natural gas rose.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |