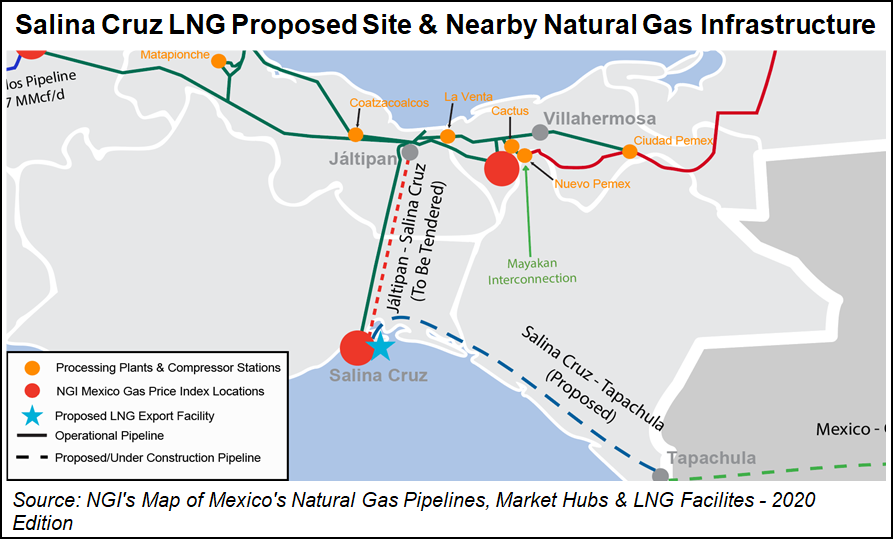

Mexico’s government unveiled its long-awaited infrastructure investment plan on Monday including a liquefied natural gas (LNG) export project set for Salina Cruz on the Pacific Coast.

Worth around $14 billion, the list of 39 projects is meant to jumpstart the ailing economy and also opens space for the private sector to participate in key national projects.

“It’s very important that we all know that we can’t go alone, that the public sector can’t reactivate economic activity on its own,” President Andrés Manuel López Obrador said during the announcement of the plan.

Analysts see Mexico’s economy shrinking by as much as 10% this year.

Of the 39 announced projects, seven are already underway, and five are considered to be energy-focused.

State oil giant...