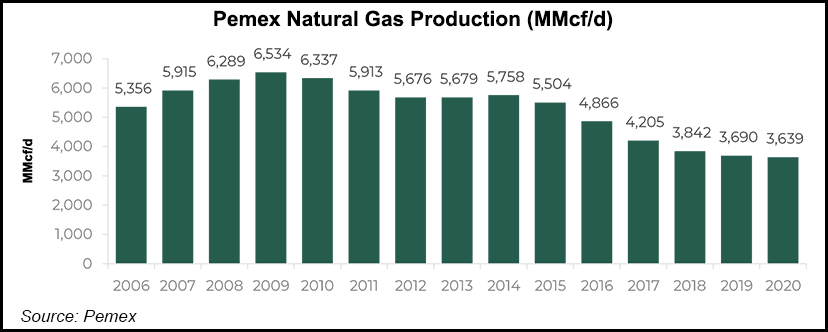

Mexican state oil company Petróleos Mexicanos (Pemex) is forecasting a base-case scenario increase of natural gas production to 4.19 Bcf/d in 2021 from 3.64 Bcf/d realized in 2020, according to its newly released 2021-2025 business plan.

For 2022, Pemex sees production reaching 4.39 Bcf/d before dropping to 4.1 Bcf/d in 2023 and 3.94 Bcf/d in 2024, the final year of president Andrés Maneul López Obrador’s term.

The production ramp-up “reflects the incorporation of new fields, such as Ixachi and Quesqui,” Pemex said.

Pemex has touted the potential of both fields to help reverse years of declining production, though development has been slower than advertised.

Although Pemex has managed to slow the decline in production under the current government, it has not...