NGI The Weekly Gas Market Report | Infrastructure | Mexico | NGI All News Access

Mexico’s First NatGas Storage Tender to Launch in Early 2018, Sener Says

The Mexican Energy Ministry (Sener) is dusting off a defunct natural gas storage project in the expectation that a new sponsor will take over its development.

The ministry is prepping a depleted field in northeastern Mexico, near the border with South Texas, for what would be the country’s first tender of a gas storage project. Mexico currently lacks large-scale natural gas storage capacity and has no underground facilities in operation or under construction.

National pipeline system operator Centro Nacional de Control del Gas Natural (Cenagas) is to carry out the tender, according to Energy Minister Pedro Joaquin Coldwell. The tender process should kick off at the beginning of next year, he said earlier this month at an event in Mexico City.

“It’s located in the state of Tamaulipas in the Brasil field, which the National Hydrocarbons Commission has already declared depleted,” Coldwell said. “We’ve already filed the paperwork with the respective authorities… in order to remove the field from the national patrimony and have it transferred over to Cenagas shortly.”

“This is going to be a flagship project as we’ve had to come up with a special procedure to assign this new function to a depleted field,” he added.

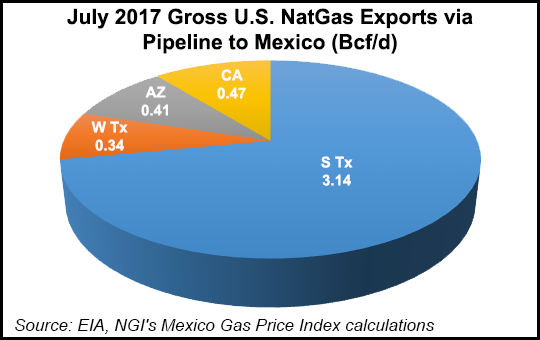

The site for the proposed storage project is at an abandoned well, previously operated by Petroleos Mexicanos (Pemex), in the Burgos Basin near Reynosa, which sits on the Texas border. More than half of U.S.-to-Mexico pipeline imports currently flow through this portion of Mexico, mostly coming from the Agua Dulce hub area in South Texas.

NET Mexico, Texas East Transmission LP (Tetco) and Tennessee Gas Pipeline (TGP) deliver gas at or near Reynosa to pipelines on the Mexican side of the border.

The well in the Brasil field appears to be at the same site whereTexas-based Tidelands Oil & Gas Corp. attempted to develop an underground storage project during the mid-2000s. The proposed facility was part of the unrealized Burgos Gas Hub project, which would have also included a1.2 Bcf/d cross-border gas pipeline and a liquefied natural gas (LNG) import terminal.

The Tidelands storage project would have entailed building a 50 Bcf underground facility with peak injection and extraction rates of 350 MMcf/d and 500 MMcf/d, respectively, according to permitting documents filed with Mexican regulators in 2005.

Coldwell did not provide any technical details or cost estimates for the new project that is to be put out to tender.

Lacking storage facilities, Mexico has relied instead on its LNG import terminals for short-term supply balancing. Sener is now working on a storage policy that would set minimum natural gas inventories, intended to create strategic reserves that would shore up the country’s energy security.

Ministry officials previously said a draft policy would be released in September, but no document has been forthcoming so far.

“I think they would like to issue the definitive policy by the end of this year,” Infraestructura Energetica Nova’s Tania Ortiz Mena said during an earnings call last week. “That would create an obligation to create those inventories and therefore build that infrastructure.”

Cenagas, for its part, is wrapping up a geological study with the Mexican Petroleum Institute in which it is surveying potential sites for underground storage facilities.

“There are many candidate fields,” Cenagas’ Eduardo Prud’homme, head of the technical and planning unit, told NGI. “There are sites near the border area, as well as in Veracruz and all the way down in the southeast. Almost everywhere there has been gas production, there are potential sites.”

Cenagas, as the technical operator of Mexico’s main pipeline system, the Sistrangas, views storage as necessary to strengthen its operations and flexibility, according to Prud’homme. To this end, the operator is also exploring using salt domes, aquifers and Mexico’s existing LNG terminals as storage options.

Prud’homme said Cenagas aims to propose a storage component for inclusion in the next iteration of the five-year Sistrangas expansion plan, which is due for a revision in March. To date, the 2015-2019 plan has only included pipeline projects.

“It will depend on how far along we are in these studies,” Prud’homme said. “Maybe we won’t say where [the storage facilities would be sited] but we will specify a capacity requirement.”

“We’re looking at all of the options, and based on that we will determine which one we would propose for the five-year plan to develop of some kind of storage capacity, and when it would be feasible to have that,” he added.

The operator also recently surveyed Mexican shippers to gauge their appetite for transport capacity and other services, including storage. The survey results, released in late October, showed a market demand for storage of 3.683 Bcf/d. The idea is to aggregate those commercial needs with Cenagas’ operational requirements.

“Based on that we can also determine what type of storage technology and which sites are best suited” to these needs, ”Prud’homme said. “If we take the systemic requirements for operational balancing, which is our main concern as an operator, and add to that the users who are willing to store gas for commercial purposes, we could then start to envision even larger facilities.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |