NGI The Weekly Gas Market Report | M&A | Markets | Mexico | NGI All News Access | NGI Mexico GPI

Mexico’s CFEnergia Inks $1B NatGas Supply Contract with ArcelorMittal

The world’s largest steelmaker, ArcelorMittal SA, has signed a five-year, $1 billion natural gas supply contract with CFEnergÃa, the fuel marketing arm of Mexican state power utility Comisión Federal de Electricidad (CFE).

The contract takes effect in April and includes the option for a five-year extension after the initial term, CFEnergÃa CEO Guillermo Turrent told NGI.

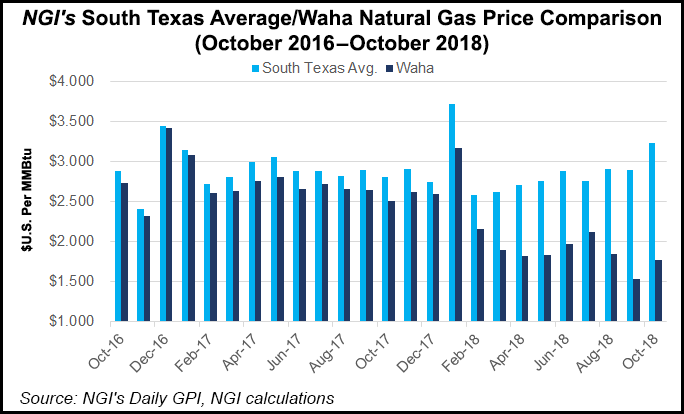

The contract entails supplying 200-240 MMBtu/d of gas imported from the Waha hub in West Texas that would be transported to the border via CFE’s new Waha header system, or, alternatively, from Energy Transfer Partners’ TransPecos or Comanche Trail pipelines, Turrent said.

The gas would then be shipped to ArcelorMittal’s base of steelmaking operations in the city of Lázaro Cárdenas, Michoacán state, via pipelines owned by Sempra Energy unit Infraestructura Energética Nova, aka IEnova, and Fermaca.

ArcelorMittal’s previous supply contract with CFE was for $240 million, and entailed supplying 160 MMcf/d over a period of 12 months.

Cash market prices for gas traded in the South Texas and East Texas regions averaged between $3.020-3.400/MMBtu and $2.940-$3.550/MMBtu, respectively, last Friday (Oct. 26), according to NGI. By comparison, the range for the West Texas/Southeast New Mexico region was $1.500-2.050/MMBtu.

“We’re the only ones today that have access to new infrastructure to get additional gas from this basin [West Texas],” Turrent told Mexican paper Reforma, which first reported the new contract.

The new gas contract would allow ArcelorMittal, which reported global revenue of $68.7 billion in 2017, to save on the costs of both the molecule and its transportation, the report said. The company aims to increase its Mexico steel production from 4 million metric tons/day currently to about 5.3 Mt/d by 2020, according to a 2Q2018 earnings presentation.

CFE Swings To Profit in Q3

CFE reported net income of 2.058 billion pesos ($103 million) for the third quarter, up from a loss of 1.49 billion pesos in the same quarter a year ago. Revenue rose 20% to 24.02 billion pesos ($1.2 billion) on increased electricity sales, partial recognition by the government of subsidies for electricity end-users, and increased third-party fuel sales.

CFE reported a 65% increase in fuel costs because of a rise in global fuel price benchmarks, scarcity of gas supply domestically, and higher costs associated with the sale of fuel to third-parties.

Plummeting oil and gas production by national oil company Petróleos Mexicanos (Pemex) has lead to fears of gas shortages for industrial consumers in the country’s southeast.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |