NGI The Weekly Gas Market Report | Markets | NGI All News Access

Mexico’s Cenagas Focuses on Southeast, Industrials in New Consulta Pública

Mexico’s Centro Nacional de Control del Gas Natural (Cenagas) has launched the Consulta Pública 2020 with a specific focus this year on the natural gas needs of the south and southeastern parts of the country and industrial users.

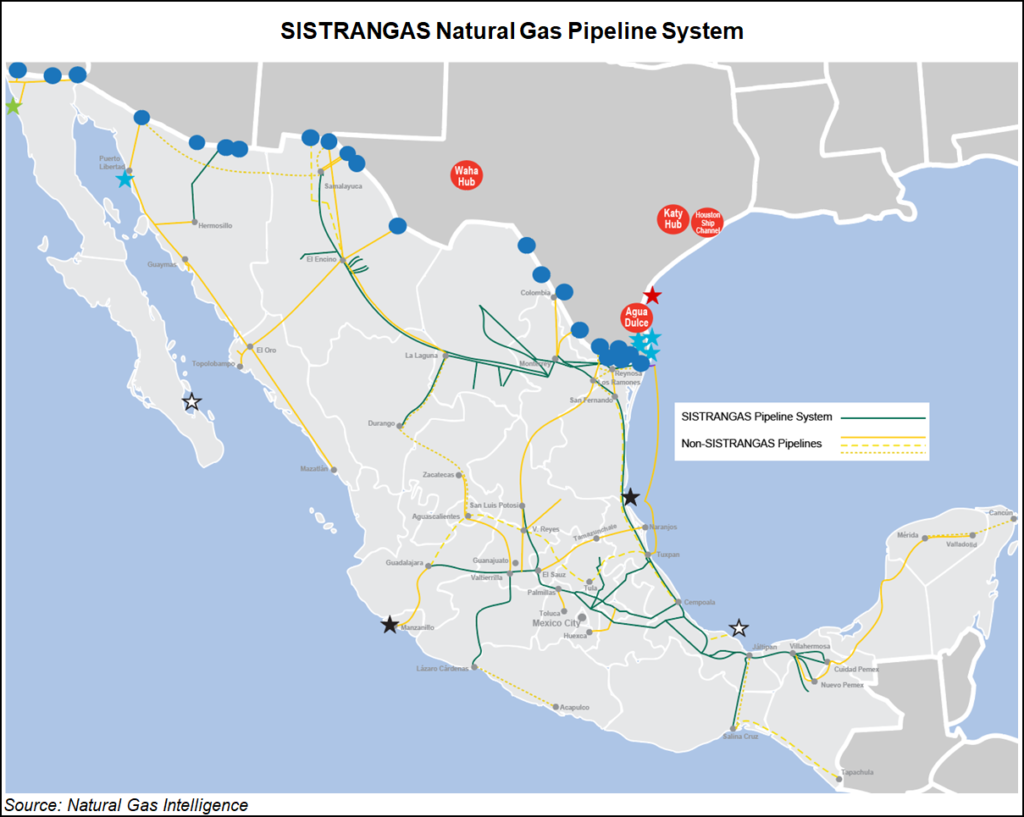

Cenagas, which operates the Sistrangas national pipeline network, plans to use the results of the consulta pública, or public consultation, to help define gas demand in the country and new projects that may need to be developed.

Gasifying the south of the country and providing economic development to the region has been a priority of the current administration.

Because of the coronavirus pandemic, the consultation is to be held virtually this year from Monday through Friday (June 15-19). To participate, follow this link. Participation is voluntary, Cenagas said. Results are to be published on Aug. 28.

The process is open to operators across the gas supply chain, including end-users, producers, transporters, distributors and marketers.

Over the consultation period, Cenagas plans to host via web regionally specific workshops and presentations outlining activities and plans. Participants would have the opportunity to comment.

Last year, 86 natural gas market agents took part in the survey, about three times what had previously been the norm.

The results suggested demand growth through 2024 in the electricity sector of about 1 Bcf/d, industrial demand of about 0.5 Bcf/d and distribution demand growth totaling 0.6 Bcf/d.

A total of 1 Bcf/d additional capacity was requested by commercial intermediaries through 2024, a reflection of the growing presence of independent marketers in the Mexican market. Before 2017, the only marketer present in the Sistrangas was state oil company Petróleos Mexicanos (Pemex).

Natural gas used in oil production, refining and the petrochemical segments is not included in the consultation, nor are the demand projections of state companies Pemex and Comisión Federal de Electricidad (CFE).

Meanwhile, cheap liquefied natural gas (LNG) available on the global market from the demand destruction caused by the coronavirus, along with sunk cost economics, could lead to LNG imports to Mexico potentially pushing out some pipeline imports from the United States, at least in the short term, according to analysts at Tudor, Pickering, Holt & Co. (TPH).

Mexico’s Altamira LNG terminal, which hasn’t seen a cargo since last October when the 2.6 Bcf/d Texas-Tuxpan marine pipeline came online, is scheduled to receive 3.2 Bcf this month, TPH said.

“The scheduled cargo is flagged as a re-export from France, with the ship under long-term contract to Total, who conveniently hold a 25% interest in the Altamira facility,” TPH said.

Additionally, with Total SA “holding offtake contracts at Cameron, Freeport, and Sabine Pass, if exports from these facilities are delivered into Europe, the Europe-Mexico price spreads provide a convenient backhaul arb.”

U.S. export flows to Mexico are currently around 5.3 Bcf/d, roughly flat to last year, TPH said.

Also this week, the senate leader of President Andrés Manul López Obrador’s Morena party, Ricardo Monreal, presented a plan to combine energy regulator Comisión Regulador de Energía (CRE), antitrust watchdog Comisión Federal de Competencia Economica (Cofece), and telecoms regulator Instituto Federal de Telecomunicaciones (IFT).

During his daily press conference on Thursday morning, López Obrador said he was unaware of the plan, but said if it meant cost savings, he was in favor of it.

Critics have suggested the move is yet another in a long line of actions that have weakened regulators in the energy sector as a means to grant more commercial power to Pemex and CFE.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |