NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Mexico Oil, Natural Gas Production Now Coming from 22 Companies

A total of 22 companies are now producing oil and natural gas in Mexico, with another two expected to join the list in 2020, according to local oil and gas association Amexhi.

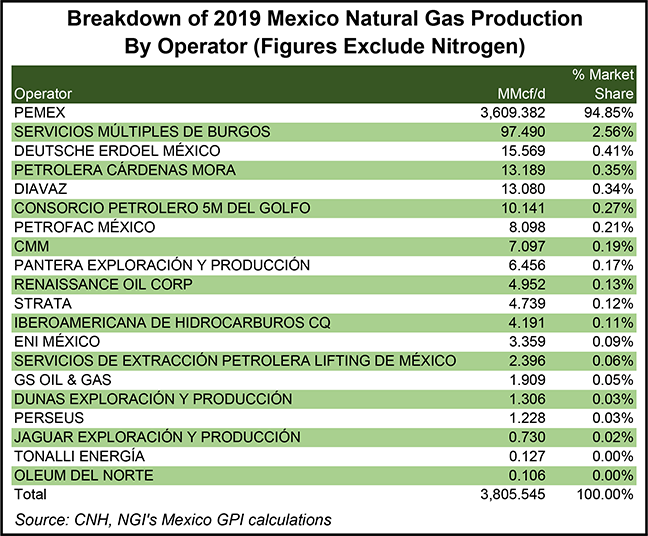

Four years after the signing of the first exploration and production (E&P) contracts under Mexico’s market-opening 2013-2014 energy reform, private sector firms are supplying 49,000 b/d of crude oil production as of January, Amexhi highlighted Friday, citing figures from upstream regulator Comisión Nacional de Hidrocarburos (CNH). Private sector natural gas output, meanwhile, averaged 228.9 MMcf/d.

Pre-reform, only state oil company Petróleos Mexicanos (Pemex) was allowed to produce oil and gas in the country.

A total of 111 E&P contracts awarded under the reform are currently in effect.

The ones currently in production comprise fields that had already been discovered at the time they were awarded via the Round 1.2 tender in 2015, as well as mature fields that were already in the production phase when they were awarded through rounds 1.3, 2.2 and 2.3, or through Pemex farmout tenders and oilfield service (OFS) contract migrations.

Bid rounds 1.4 and 2.4, which concluded in 2016 and 2018, respectively, pertain to deepwater projects, which on average take about eight years to reach the production phase, Amexhi said. The group also highlighted that deepwater exploration wells have a success rate of about 20%, “which is to say, for every five wells drilled only one will result in a discovery.”

Mexico’s president, Andrés Manuel López Obrador, has halted the awarding of further E&P contracts, opting instead to place the burden of production on Pemex, by way of OFS contracts awarded to drilling companies that do not hold working or participating interests in the acreage being developed.

CNH data show that Pemex’s oil production stood at 1.72 million b/d as of January, down from 1.9 million b/d in January 2018, the president’s first month in office.

Including Pemex’s Ek-Balam offshore project, contracts awarded under the reform were producing 109,688 b/d oil and 242.6 MMcf/d of natural gas in January, up from 71,195 b/d and 172.6 MMcf/d in the same month a year ago.

As it has asserted before, Amexhi on Friday said that its members have fulfilled 100% of their contractual commitments, “demonstrating…their commitment to the development of the country’s oil and gas industry.”

The group has periodically made its case to the government for resuming bid rounds in order to relieve the financial and operational burden on the heavily indebted Pemex.

Local paper El Economista quoted López Obrador’s chief of staff Alfonso Romo, seen as a moderate voice and a conduit to the business community, as saying in January that the administration would be unveiling a major public-private energy sector investment plan in February that could include limited oil and gas rounds and/or farmouts for stakes in Pemex-operated projects.

Romo has since said the announcement would come in March.

If and when the plan is unveiled, “in my personal opinion, I think that it will be more of the same,” Mexico City-based energy consultant Gonzalo Monroy told NGI’s Mexico GPI, meaning “service contracts and/or” engineering, procurement and construction projects, “but nothing really attractive to private investment.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |