NGI The Weekly Gas Market Report | Infrastructure | NGI All News Access

Mexico Needs to Promote Benefits of Natural Gas, Increase Coverage, Says Industry

The natural gas industry in Mexico needs to work harder to get natural gas to areas that still lack access while doing a better job of promoting the benefits of the fuel, according to a series of experts who spoke last week at Industry Exchange’s 5th Mexico Infrastructure Projects Forum in Monterrey, Mexico.

“In Mexico, states with natural gas have up to 50% higher gross domestic product (GDP) than those without,” said CEO José García Sanleandro of Gas Natural México (Naturgy Mexico), the local subsidiary of Spain’s Naturgy Energy Group. “Natural gas increases investment, jobs, brings downs costs, and it contributes to improving the environment by displacing wood and fuel oil. It’s our mission as a sector to tell people this. We need to do a lot of work as a sector to educate, and also tell the new government so it understands the importance of natural gas to the country.”

Sanleandro, who is also vice president of natural gas association Asociación Mexicana de Gas Natural (AMGN), which represents more than 100 local natural gas companies, offered the example of the Bajío region in central Mexico, which includes parts of the states of Aguascalientes, Jalisco, Guanajuato, and Querétaro, as an example of this success.

During 2008-2018, GDP rose by 36% in the region as access to natural gas increased dramatically. End-users jumped from 70,000 to 210,000 in the period, and pipeline infrastructure rose from 2,500 kilometers (km) to 5,400 km.

Still, only 7% of Mexico’s homes and businesses today have access to natural gas. Moreover, many parts of the country lack access to gas altogether. Sanleandro said one of the great challenges is providing gas in the South and Southeast, while improving gas distribution networks in Mexico City.

The abundance of cheap gas available in the United States makes the case for improving gas penetration in Mexico even more compelling, according to Engie SA’s Eva Ribera, director of natural gas transportation services.

“It’s crazy that being so close to the cheapest gas in the world, distribution coverage in Mexico only is 7%,” Ribera said, adding that red tape is part of the problem. “To get a distribution permit you need to present 80 forms and it takes over a year. We all have to help out, and there are a lot of things we can improve.”

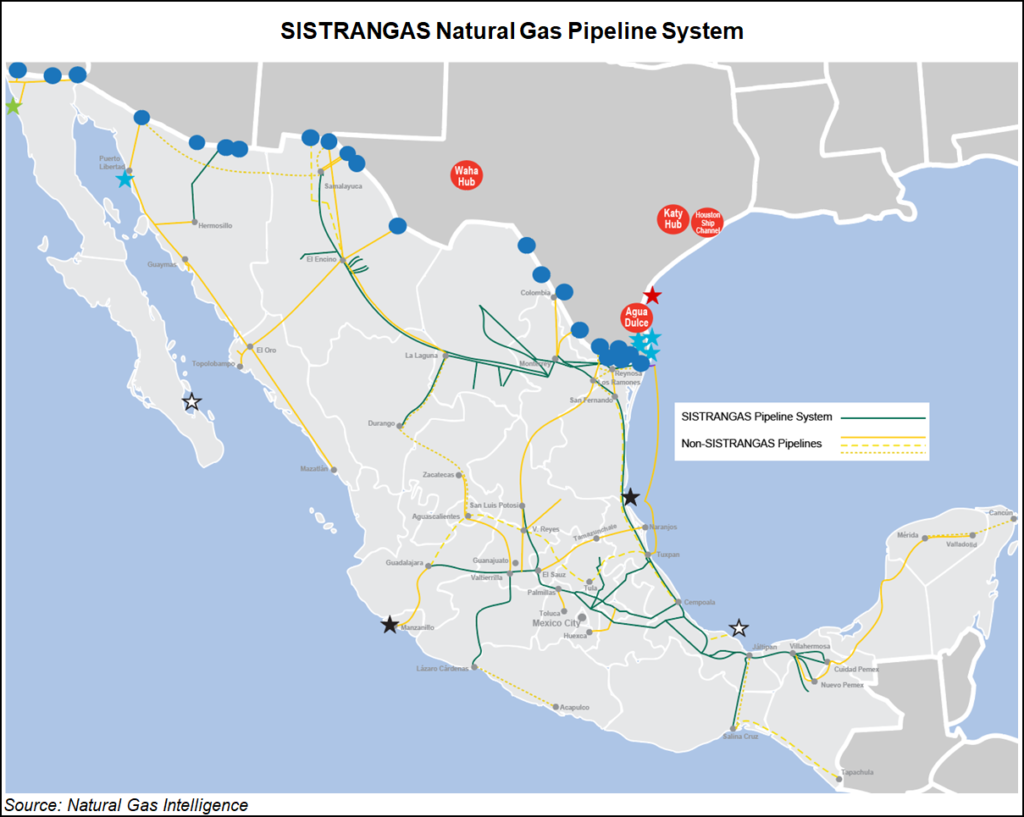

One pending issue is shoring up gas supply to the Yucatán Peninsula. Engie owns the isolated 485-mile Mayakan pipeline, which supplies gas to power plants and industry in the Yucatán Peninsula. Mayakan sources gas entirely from Nuevo Pemex, a natural gas processing center run by Mexican state oil company Petróleos Mexicanos (Pemex) that has seen natural gas production all but dry up in recent years. Plans are in place to connect the Mayakan to the national Sistrangas grid.

“We are working on this, but we also need to do a lot more to get continental gas down to the region,” Ribera said. “The gas in the south is really of a poor quality. But getting continental gas there requires rearranging the system, reversing the flow at Cempoala, or developing new import plants.

“But short and medium range we need to make the connection, and then we can start making other interconnections to get gas to Cancún and other places on the peninsula.”

The country manager for Spain’s Enagas, Nerea Chacartegui, argued that interconnects between existing pipelines were crucial to building out the nascent gas market.

“There have been great advances in infrastructure and it is now a widespread network and Mexico is connected to the basins with the cheapest gas in the world,” she said. “In general, the infrastructure has been created. But there are issues, like isolated systems in the Yucatán and Baja California, and a lack of connections between existing infrastructure. Before we build new pipelines, we need to think of connecting what already exists. And next, we need to guarantee that there is open capacity on these existing systems.

“What we need to get gas to the final user is we need lots of actors, lots of basins, and for this we need to connect the system.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |