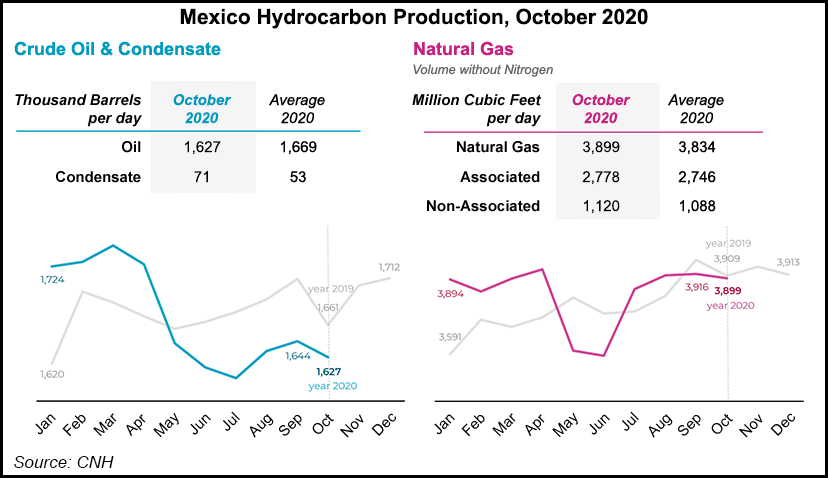

Natural gas production in Mexico was flat year/year at 3.9 Bcf/d in October, according to upstream hydrocarbons regulator Comisión Nacional de Hidrocarburos (CNH).

State oil company Petróleos Mexicanos (Pemex) accounted for 3.68 Bcf/d of the total, the same amount it produced in the year-ago month.

Dry gas production from Pemex processing centers averaged 2.18 Bcf/d, down from 2.3 Bcf/d in October 2019, according to company data.

The dry gas figure is a more precise reflection of the volumes that make it to the local market, as the figure does not include liquids, water and other impurities, nor the gas that Pemex re-injects into oil wells to increase pressure and stimulate production.

Pemex production of fractionated natural gas liquids (NGLs), meanwhile, totaled...