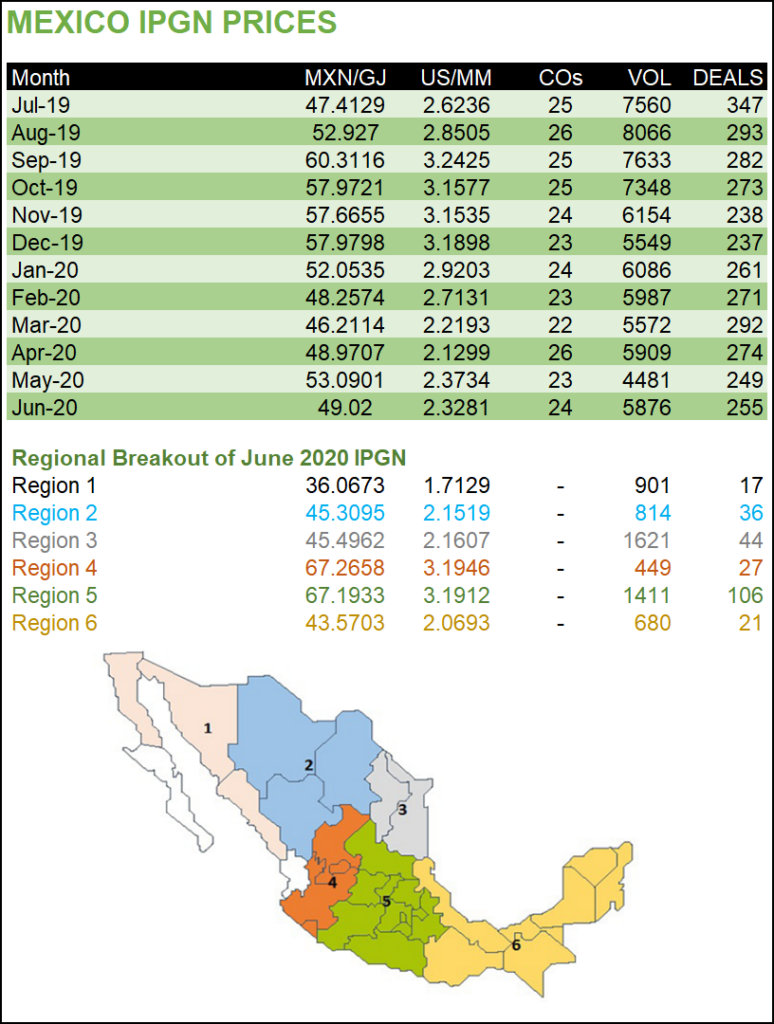

Natural gas prices in Mexico averaged $2.33/MMBtu in June, versus $2.78/MMBtu in June 2019, according to the latest IPGN monthly natural gas price index published by the Comisión Reguladora de Energía (CRE).

Marketers transacted 5.88 Bcf/d of the molecule, compared to 7.37 Bcf/d in the year-ago month, CRE data show.

CRE used 255 transactions from 24 companies to calculate this month’s index, versus 238 deals from 21 companies a year ago.

The IPGN compiles day-ahead spot sales reported to CRE by marketers.

CRE started publishing the index in July 2017 under the framework of Mexico’s 2013-2014 energy reform, which liberalized the formerly state-dominated natural gas market.