Strong demand on Mexico’s Pacific Coast helped prop up Waha’s May bidweek price, which jumped 31.0 cents month/month to average $2.685.

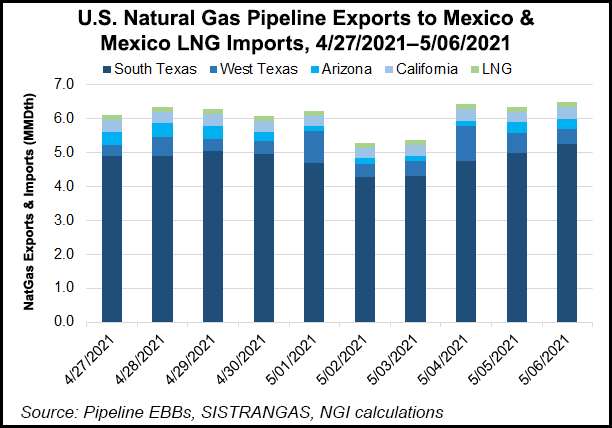

Spurred by new infrastructure and demand on the West Coast, Mexico imports via pipeline from the United States have been unseasonably strong, spiking to a record 7.1 Bcf/d in mid-April. Analysts at Energy Aspects said trade has since “tempered,” although it is still above the pre-spike baseline.

NGI calculations had Mexico imports from the United States at 6.48 Bcf on Thursday.

Recent pipeline interconnections, including Grupo Carso’s 472 MMcf/d Samalayuca-Sásabe pipeline, are allowing Waha gas to serve power plants in Empalme and Puerto Libertad, Gadex consultant Eduardo Prud’homme told NGI’s Mexico GPI.

Deliveries to the...