Imports of natural gas from the United States continue to dominate Mexico’s natural gas supply, but they have dropped slightly this month on lower demand.

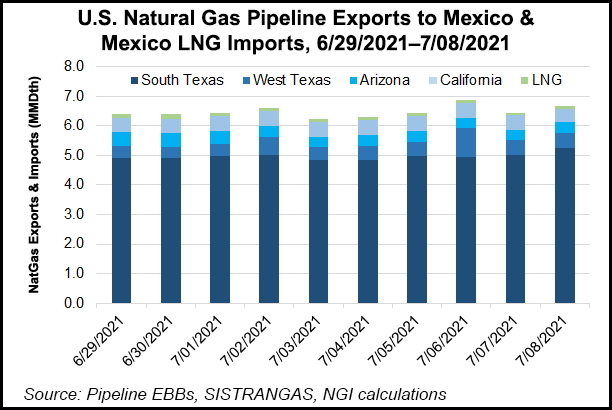

To date this month, Wood Mackenzie reported that Mexico imports from the United States were 6.7 Bcf/d, 2% lower than in June. NGI calculations had the 10-day average through Thursday at 6.48 Bcf/d.

The lower figure “reflects the impact of tropical storms, which began to intensify around mid-June, affecting Mexican demand for gas,” Wood Mackenzie analyst Ricardo Falcon told NGI’s Mexico GPI.

Mexico’s meteorological service expects a stronger-than-usual hurricane season this year, with up to 19 formations potentially reaching categories 1-5 against a 1991-2020 average of 15, Falcon said. “Wood Mackenzie believes,...